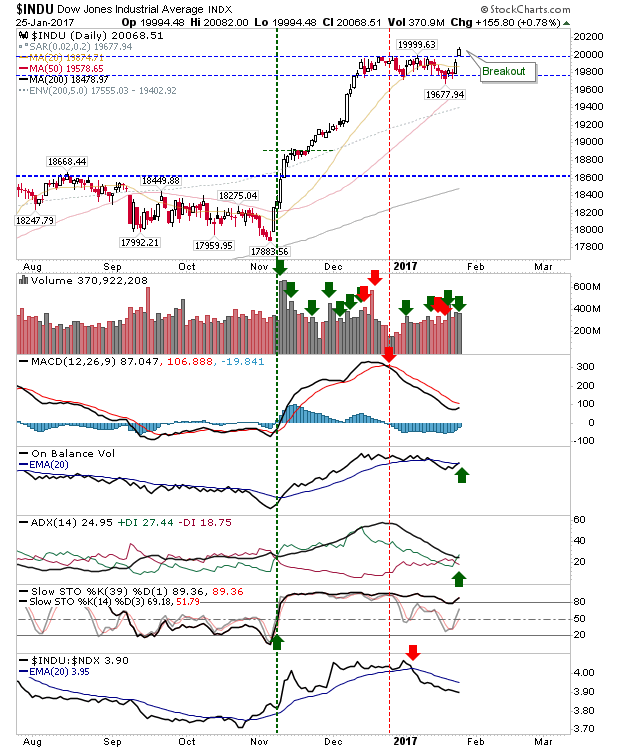

Another good day for indices yesterday as the Dow broke resistance to follow the lead set by the S&P and NASDAQ on Tuesday. The Dow also delivered a MACD trigger 'buy' and +DI/-DI crossover on higher volume accumulation.

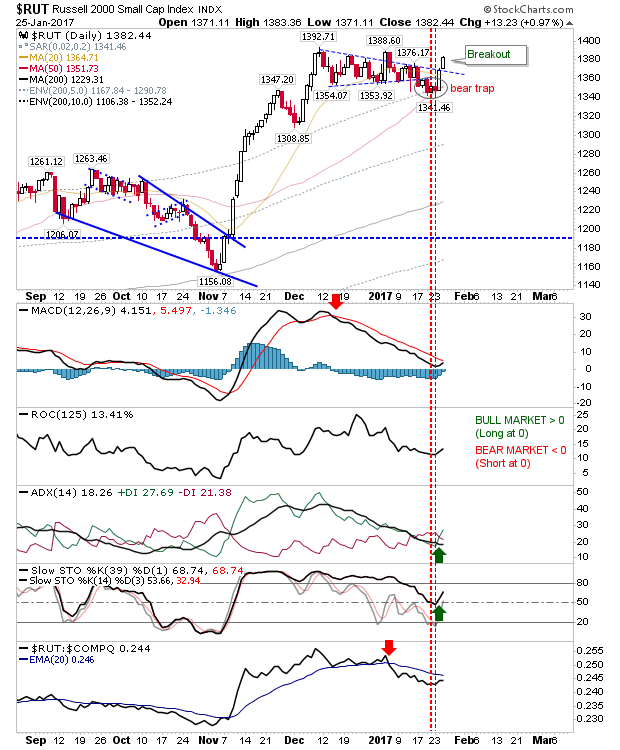

The Russell 2000 also pushed on to confirm a new 'bear trap'. The original 'bull trap' at 1,388 hasn't been negated yet, but this could happen today as could the MACD trigger 'buy'.

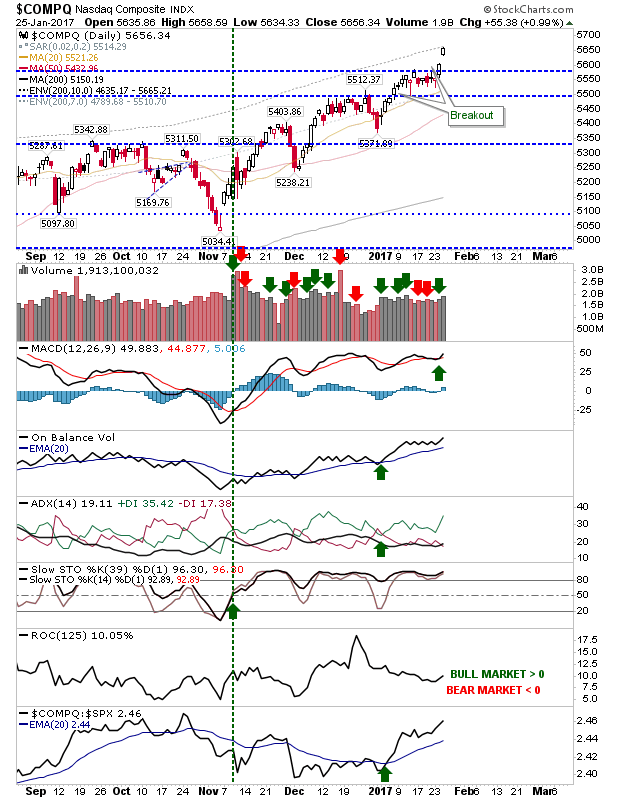

The NASDAQ added nearly 1% as it posted an accumulation day, building on the initial breakout from Tuesday. It offered the clearest state of intent from bulls.

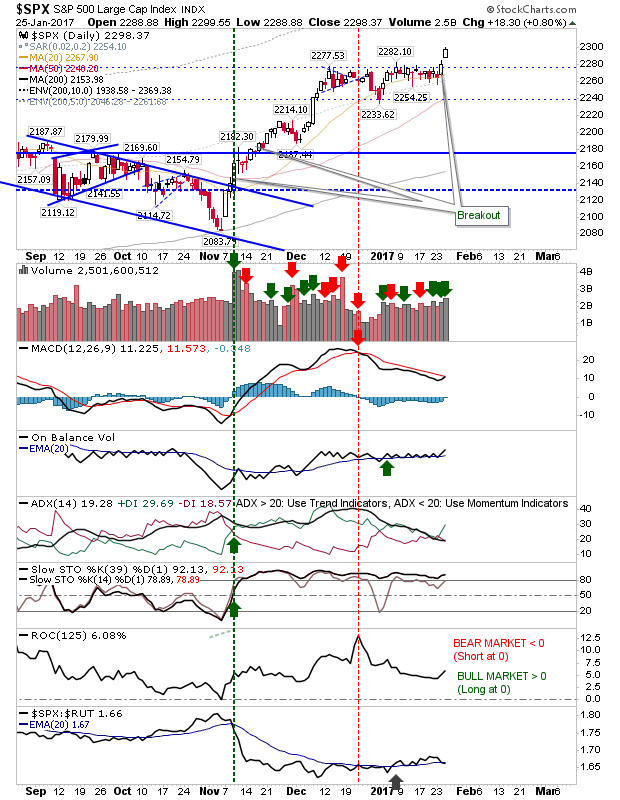

The S&P was not to be left behind as it enjoyed a second day in a row of accumulation. However, it did experience a drop in relative performance against the Russell 2000.

For today, indices are well placed to continue their advance. Shorts have little to work with while indices post new highs. It would take a two-bar reversal to offer the potential for a top and this doesn't look likely given how these indices have emerged from consolidations.