- Global equities fall

- US dollar strengthens

- End of QE spurs bond selloff

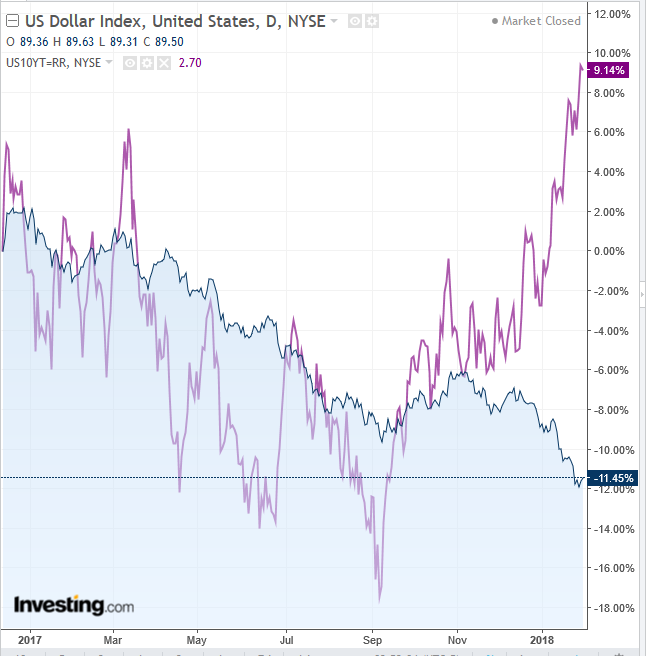

- Dollar-yield decouples

- Fed policy makers gather Wednesday for Chair Janet Yellen’s final meeting on interest rates before her term ends.

- US President Donald Trump delivers his first State of the Union address.

- Earnings season gets into high gear this week as tech giants such as Microsoft (NASDAQ:MSFT), Facebook (NASDAQ:FB), Alibaba (NYSE:BABA) Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) report. We believe these five earnings calls are worth watching.

- Economists are forecasting that US employers probably added more jobs in January than a month earlier; Friday's nonfarm payrolls report will confirm or alter this assessment.

- Bank of England Governor Mark Carney speaks before the U.K. Parliament’s Economic Affairs Committee in London Tuesday.

- Chinese manufacturing and services PMIs are due Wednesday.

- On Wednesday, the core euro-zone inflation report may show an uptick from a year ago to 1 percent this month.

- Australia’s S&P/ASX 200 declined 0.86 percent

- Japan’s TOPIX fell 1.18 percent, falling below its uptrend since September 6.

- The Shanghai Composite retreated 0.95 percent while shares on Hong Kong’s Hang Seng plunged 1.07 percent.

- The MSCI Asia Pacific Index sank 1.2 percent on the largest tumble in almost eight weeks.

- The MSCI Emerging Markets Index dropped 1.3 percent, its largest tumble in almost eight weeks.

- The Stoxx Europe 600 dipped 0.4 percent as of 8:22 London time (3:22 EST), the lowest in almost two weeks.

- The UK’s FTSE 100 fell 0.3 percent.

- S&P 500 Futures decreased 0.4 percent to the lowest in a week.

- The Dollar Index is down 0.2 percent after yesterday’s 0.32 percent rebound to the highest in a week.

- The euro fell 0.3 percent to $1.2346, the weakest in a week.

- The British pound sank 0.5 percent to $1.3998, the weakest in more than a week.

- The Japanese yen advanced 0.2 percent to 108.74 per dollar.

- South Africa’s rand declined 0.9 percent to 12.0471 per dollar, the weakest level for the currency in more than a week, its biggest slide in more than a month.

- The MSCI Emerging Market Currency Index sank 0.3 percent, the largest decrease in two months.

- The yield on 10-year Treasuries increased two basis points to 2.71 percent, the highest in almost four years.

- Germany’s 10-year yield declined one basis point to 0.68 percent, the first retreat in a week.

- Britain’s 10-year yield declined one basis point to 1.447 percent and the biggest fall in two weeks.

- West Texas Intermediate crude decreased 1.1 percent to $64.87 a barrel on the largest dip in almost seven weeks.

- Gold fell 0.3 percent to $1,336.16 an ounce, the weakest in more than a week.

Key Events

US equity indices all fell yesterday, tumbling the most since the start of 2018. At the same time US Treasuries sold off, pushing yields to their highest levels since April 2014, as the dollar strengthened against all major currencies.

The S&P 500 underperformed all major US indices, falling 0.67 percent, the most since September. The Dow Jones Industrial Average dropped 0.66 percent, the most since August. The NASDAQ Composite declined 0.51 percent, 'outperforming' the other major US indices. As well, the Russell 2000 lost 0.59 percent of its value, retreating from its all-time high, posted last Wednesday, double the distance down versus its sister US indices.

This morning, global stocks—from Japan’s TOPIX to Hong Kong’s Hang Seng and mainland China’s Shanghai Composite, to Australia’s S&P/ASX 200, to Europe’s STOXX 600—took their cue from their US counterparts. All sold off.

Greenback: Central Cog of the Market's Structure

German bonds fell yesterday, for a fourth straight day, pushing the 5-year yield into positive territory, as it broke above zero percent for the first time since April 2014, hitting its highest level in more than two years. Investors sharply increased supply and reduced demand after Klaas Knot, the current President of the Dutch central bank and a member of the ECB's Governing Council, said Sunday that quantitative easing has accomplished all it can and therefore should no longer be continued.

Bond investors have been worried since last June of a dotcom-like crash in the bond market, when the Federal Reserve announced it would gradually begin selling off some of its gargantuan bond portfolio, flooding the market. At the same time it indicated it would begin raising rates, another bond downer, as investors sell their bond holdings in order to buy higher yielding bonds.

While a stock decline generally leads to a Treasury rally, as investors rotated capital out of growth assets into safe havens, bonds have fallen in tandem with stocks. Klaas' comments added to expectations that central banks worldwide will reduce stimulus as the global economic outlook improves.

Moreover, despite the worst stock slide in four (SPX) to five (Dow) months, safe haven assets fell too, along with all major currencies. The yen fell 0.20 percent while gold slid 0.64 percent.

The highest 10-year yields since April 2014 have attracted a lot of international investors, whose asset purchasing has included buying the dollar. However, the dollar-bounce only serves to help bears slam it further and harder. After six straight weekly declines the buck is on track to close the month 3 percent lower as most investors are long euro-short dollar.

The dollar is the central cog in the complex market structure. Last week, stocks advanced while the greenback continued to retreat. Yesterday, the USD rose while stocks slipped. Treasuries share a negative correlation with the dollar, as the higher yield increases dollar demand, structuring a dollar-yield positive correlation.

That positive correlation has broken down since November, however, when the dollar entered its recent decline and Treasury yields started moving higher. The disconnect may be attributed to a steeper rally in stocks, which sucked up demand, pulling it away from Treasuries which are on the edge of a cliff as QE winds down and higher rates become palpable.

The retreat of Treasuries took benchmark yields above 2.7 percent, but European government bonds edged higher as traders await growth data.

The question investors now struggle with is whether the highest yields since 2014 could turn the capital rotation back out of equities—which are already at record-setting highs—and into bonds. Their decline might provide a buying opportunity at the same time that buy-and-hold yield investors may boost Treasuries.

An additional example of the dollar's importance to inter-market commerce and interconnectivity is the price of oil. When the dollar was falling, oil was rising. Yesterday, however, when the greenback rebounded, crude's price fell.

The yen climbed this morning, trading within a potential bearish pennant, the second one since mid-January. Sterling slumped for a second day, its third day decline in four trading days.

Bitcoin dropped below $11,000, resuming its bearish pennant pattern. It's not the only cryptocurrency currently in focus for many investors. A brewing Tether scandal has generated headlines too.

Up Ahead

Market Moves

Stocks

Currencies

Bonds

Commodities