Thursday March 30: Five things the markets are talking about

UK’s divorce proceeding with the E.U have officially begun, and like most separations, expect the “children,” in this case the electorate, who will be the most affected when things get emotional and messy.

In this circumstance, a two-year timeline to complete and signoff on the exit seems very tight, and the cost will be like building a house, more than the initial proposed budget.

Over the coming months, and years, it’s not going to be an easy ride for either sterling, Governor Carney or PM Theresa May, let alone the UK electorate or mainland Europe. It will however keep capital markets very busy.

This divorce will redefine the country’s relationship with its largest trading partner and end decades of deepening political integration on the continent.

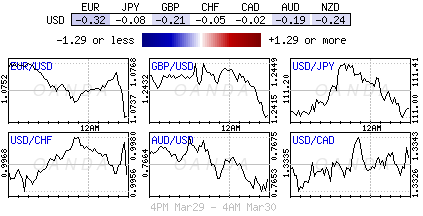

Elsewhere, the U.S. dollar has got a lift from ‘hawkish’ Fed officials, while crude gains on lower inventory numbers. The U.S. reports its third estimate for Q4 GDP this morning, while tomorrow’s data include data on personal spending and incomes.

1. Stock slip on Q1 close

Global equities are under pressure as investors approach the end of the best quarter for stocks in four years.

Japan’s Topix fell -0.9%. The index is up +0.6% for the quarter, despite the yen’s (¥111.23) strengthening this year. Down-under, the Aussie’s S&P/ASX 200 index climbed +0.4%, gaining for a third day to the highest since April 2015 as energy shares jumped.

In Hong Kong, the Hang Seng fell -0.3% while the Hang Seng China Enterprise (CEI) lost -0.7%.

In China, the Shanghai Composite (-1%) was one of the worst performers, as investors ponder the People’s Bank of China’s (PBoC) support after the central bank skipped its reverse repo operation injection for the fifth consecutive day.

In Europe, equity indices are trading mixed, but generally higher as market participants digest the formal start of Brexit. Banking stocks are generally lower in the Eurostoxx, while commodity and energy trade notably higher in the FTSE 100.

U.S. stocks are set to open in the red (-0.1%).

Indices: Stoxx50 -0.1% at 3,470, FTSE +0.1% at 7,378, DAX +0.1% at 12,215, CAC 40 flat at 5,070, IBEX 35 flat at 10,370, FTSE MIB +0.1% at 20,289, SMI +0.1% at 8,666, S&P 500 Futures -0.1%

2. Oil prices steady after two days of gains, gold slips

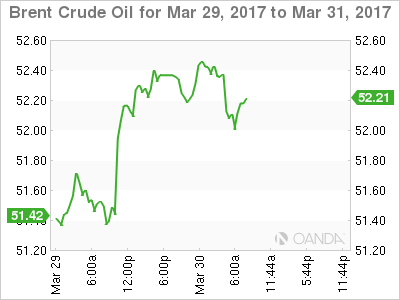

Crude oil prices are little changed ahead of the U.S. open after two-days of increases as bloated U.S. inventories limited the impact of supply disruptions in Libya and lower supply from other OPEC exporters.

Brent crude oil is unchanged at +$52.42 a barrel, while U.S light crude oil (WTI) is down -5c at +$49.56. Both benchmarks rose more than +$1 a barrel yesterday to their highest levels for two-weeks, rallying back from a four-month low.

Note: Oil production in Libya has fallen more than -250k bpd this week as armed protesters have blocked oilfields of Sharara and Wafa.

A Reuters survey released yesterday showed that OPEC members have complied with +95% of their commitments under last Nov.’s deal cut. Nevertheless, members are still finding it difficult to tighten the oil market because inventories in many parts of the world are at, or near, record highs.

Note: This week’s U.S EIA report showed that U.S. crude stocks rose +867k barrels to a record of nearly +534m barrels last week.

Investors are waiting to see if OPEC and non-OPEC members decide to extend its production curbs into H2.

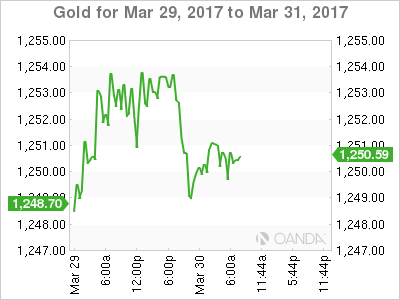

Gold prices have dipped overnight (down -0.1% at +$1,250.66 an ounce) as the dollar strengthened, but economic uncertainty around the UK’s departure from the E.U and the approaching French elections has capped those losses.

3. Rate divergence the “name of the game”

In Europe, yields on 10-year German Bunds (-2 bps to +0.29%) are under pressure in the secondary market after a series of inflation releases on a state level show consumer prices are rising at a slower pace. The reports appear to fall in line with the recent ECB view that the pick up in inflation was “temporary.” This reinforces the view that the ECB is not anywhere near the exit of its QE.

Elsewhere, ten-year Italian BTP’s have rallied more than +10 bps against Bunds this month, and with the ECB trying to eliminate the hike/tapering discussion; investors should be expecting more spread tightening in the short-term.

Ahead of the U.S. open, yields on U.S 10’s are little changed at +2.38%. The yield fell -4 bps yesterday after backing up the same amount on Tuesday. Aussie 10-Year yields fell -3 bps to +2.69%.

4. Dollar finds much needed Fed support

The ‘mighty’ dollar is better bid overnight after Fed officials yesterday suggested that some policymaker’s (Rosengren) favor raising interest rates more than twice this year.

Note: Fed fund futures show a +20% chance that rates will end the year above +1.5%. Bank of Cleveland President Loretta Mester, Bank of Dallas President Robert Kaplan and New York Fed President William Dudley are all due to speak later today.

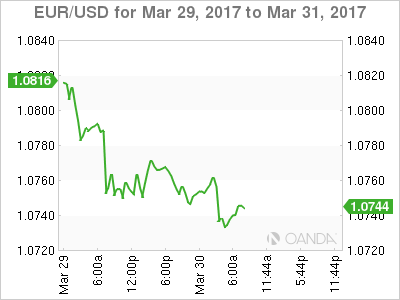

The EUR/USD (-0.3% to a new week low at €1.0731) has come under selling pressure since a report Wednesday said that the ECB thought the March meeting was “over interpreted” as too hawkish. Expect speeches by ECB policymakers to be closely watched today.

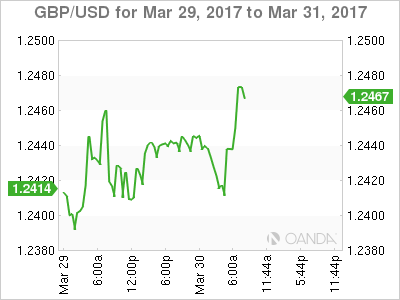

Sterling (-0.25% at £1.2406) is withstanding the formal start to Brexit. Investors now have to gauge how much of a “hard” divorce is already priced in?

5. March inflation data eases for both Germany and Spain

This morning’s euro inflation data releases for March appear to fall in line with recent ECB view that the pick up in inflation was “transitory.”

Consumer-price growth in Spain (+2.1%) weakened for the first time in almost a year, while Germany’s Saxony date also shows a drop (+1.8% vs. +2.4%).

Note: German regional inflation numbers are being released throughout the morning.

The market expects the euro-zone flash inflation number due Friday to show a drop to +1.8%.

These weaker headline prints should reinforces view that the ECB is not anywhere near the exit of its expansionary monetary strategy and would maintain its forward guidance that rates to stay low or lower in the forecast horizon.