Wednesday December 13: Five things the markets are talking about

Global equities have struggled a tad overnight as investors wait for monetary policy decisions by G10 central banks.

Note: The ECB, BoE and SNB will set monetary policy at their respective meetings on Thursday.

Later this afternoon, the Fed is widely expected to announce its third +25 bps rate increase of 2017 following today’s conclusion of its two-day meeting (2 pm ETD). Expect the market to be paying close attention to the central bank’s outlook for 2018.

Note: The Fed has penciled in another possible three hikes for next year and two more for 2019 before topping out near +2.75%.

To date, U.S dollar bulls have been ‘paying’ all year for the error of focusing on steadily rising U.S rates and mostly ignoring where the Fed’s tightening path stops. “It’s not where yields are, but where they end up that counts.”

Overnight, the ‘big’ dollar has managed to halt its longest winning streak in nearly two-years after the Democratic candidate, Doug Jones, won the Alabama Senate race, cutting the Republican majority in the U.S senate in half.

Note: Ahead of the FOMC decision, investors will be focusing on U.S consumer inflation data (08:30 am EDT)

1. Stocks struggle ahead of Fed meeting

In Japan, the Nikkei share average ended lower overnight after tech stocks lost ground as they tracked their weaker U.S counterparts. The Nikkei 225 Index fell -0.5%, while the broader Topix shed -0.2%.

Down-under, Aussie stocks overcame some mid-afternoon weakness to finish slightly higher on a takeover deal. The S&P/ASX 200 finished up +0.1%, a fresh one-month closing high and a fifth-straight gain. It’s the longest winning streak since October. In S. Korea, the Kospi index rallied +0.8% as reports of S. Korea and the U.S considering delaying joint military drills until after the Winter Olympics in February helped tourist-reliant companies.

In Hong Kong, stocks rebounded overnight, supported by services and financial firms. At the close of trade, the Hang Seng index was up +1.49%, while the Hang Seng China Enterprises index rose +1.83%.

In China, stocks ended higher, aided by gains in consumer and transport firms. The Shanghai Composite index was up +0.7%, while the blue-chip CSI 300 was up +0.86%.

In Europe, regional indices trade mixed this morning ahead of the U.S open. U.S futures did see some early weakness after Democrat Doug Jones won the Alabama Senate race before paring the losses.

U.S stocks are expected to open little changed.

Indices: Stoxx600 -0.1% at at 391.4, FTSE +0.1% at 7504, DAX -0.1% at 13165, CAC 40 -0.1% at 5421, IBEX 35 +0.3% at 10318, FTSE MIB -0.4% at 22635, SMI -0.1% at 9351, S&P 500 Futures flat

2. Oil prices recover on big U.S. stock drawdown, gold trades at their lows

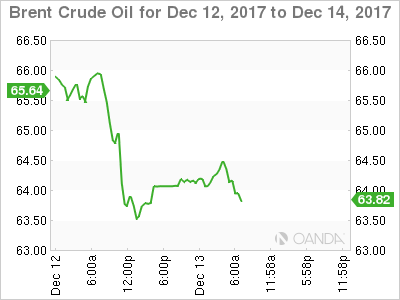

Oil prices remain better bid ahead of the U.S open as industry data yesterday revealed a larger-than-expected drawdown in U.S crude stockpiles. Also aiding prices is the markets expectation for an extended shutdown of a major North Sea crude pipeline.

Brent crude is up +69c, or +1.1% at +$64.03 a barrel. It had settled down -$1.35, or -2.1% yesterday on a wave of profit-taking after news of a key North Sea pipeline shutdown helped send the global benchmark above $65 for the first time since mid-2015. U.S light crude (WTI) is up +45c, or +0.8%.

U.S API data yesterday indicated that domestic crude stocks fell by -7.4m barrels last week. That is almost twice the decline of market expectations for a drop of -3.8m barrels.

Also providing support was the news that Britain’s biggest pipeline from its North Sea oil and gas fields is likely to be shut for several weeks for repairs.

Investors to take their cues from today's U.S government’s EIA report release (10:30 am EDT).

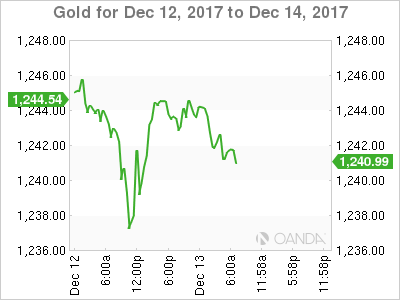

Ahead of the U.S open, gold trades atop its weakest level in almost five-months amid expectations the Fed will hike interest rates later today. The Fed has increased rates twice in 2017 and is still expected to push through three more hikes next year. Spot gold is down -0.1% at +$1,242.18 an ounce. That is not far above yesterday’s intraday low of +$1,235.92, which is the lowest print since July 20.

3. Sovereign yield curves

Central banks top the list of risk events with the FOMC, BoE, ECB, SNB, Norges Bank and Turkey’s central bank.

The Bank of England (BoE) is not expected to raise interest rates again until after the U.K has officially exited from the E.U, which is scheduled for March 2019. However, this is assuming that domestic inflation starts to slow in the medium-term, after the annual CPI rose by +3.1% in November earlier this week. Tomorrow, the BoE is expected to keep interest rates on hold at +0.5%, after a +25 bps rise last month.

General consensus expects Turkey’s central bank (TCMB) to hike interest rates at its policy meeting tomorrow (07:00 am EDT). It is expected to raise the late liquidity lending rate between +25 bps and +225 bps from +12.25%, the first rate increase since April.

Questions around the ECB’s thinking about tapering should start to feature in the Q&A session of Draghi’s press conference (08:30 am EDT). However, Draghi will almost certainly not engage in this discussion. The ECB has said it will buy assets at a reduced rate from January until at least September. There is no advantage for Euro policy makers to make any decision around ending QE any sooner than is necessary – the ECB is likely to decide its next steps in middle of next year.

4. Dollar awaits Fed announcement

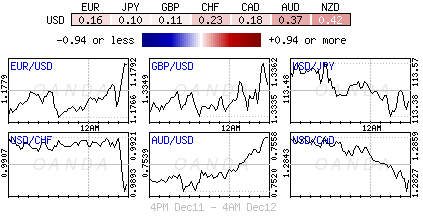

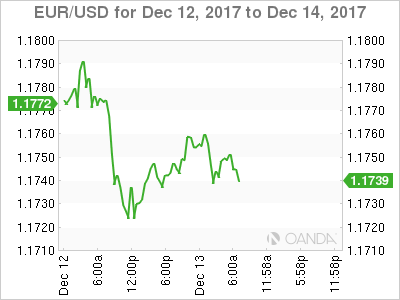

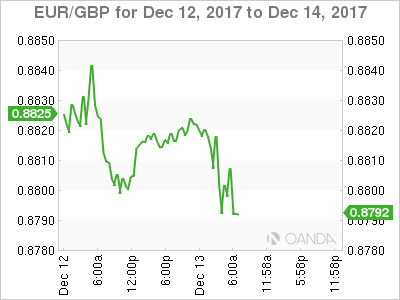

The softer USD (€1.1746, £1.3346, ¥113.37) exhibited during Asia session has somewhat disappeared in the Euro session. Alabama election results apparently have been moved aside for the time being ahead of the Fed’s rate announcement.

Note: Yesterday’s Alabama Senate result was a loss for congressional Republicans because it trims their Senate advantage to 51-49 as they enter some tough negotiations on spending with Democrats next year. However, it probably will not affect the expected vote on Trump’s supposed business-friendly tax cuts, as the winner will not be certified until late December and sworn in in January. Republicans have been hoping to get a bill passed through both sides of Congress before Christmas.

Expect sterling (£1.3346) to remain on tenterhooks as PM Theresa May is facing another painful Brexit dilemma as her own Tory lawmakers are lining up a vote for an amendment to her bill that paves the way for the U.K’s exit from the E.U. The PM’s dilemma, she either caves into theses rebels who want the power to veto the final Brexit deal, or face a potentially damaging defeat.

In Italy, as expected, President Mattarella is to dissolve Parliament on Dec 28th or 29th to clear the way for elections.

5. Eurozone industrial output stronger than expected

Data this morning showed that industrial production in the eurozone was stronger than expected in October, rising by +0.2% from September and +3.7% y/y. This beat the consensus forecast of a -0.3% drop on the month and a +3.5% rise on the year.

Digging deeper, data for September were also revised slightly higher.

Net result, the E.U economic picture is consistent with the eurozone economy having a better end to the year, and firmer starts to 2018, than had been expected.

Other Euro data showed that the number of people in work rose by +0.4% during Q3, and is now at a record high. Hence, do not be surprised if the ECB raises its growth forecasts tomorrow.