Market Brief

It’s done. Greece became the first developed country to default on an IMF loan after having missed the €1.5bn payment to the IMF. The cash-strapped nation is officially in arrears and cannot expect further IMF financing before having paid its tab. Meanwhile in Athens, the financial crisis is going full swing after the government imposed capital control and closed local banks. Greek people are queuing in front of ATMs and can withdraw €60 at maximum. The euro remained surprisingly resilient and moved within a 20pips range against the dollar in the Asian session. EUR/USD sits on the 1.1128 support level implied by the 50% Fibonacci retracement on May-June rally.

Yesterday in the US, economic data were mixed as the Chicago purchasing manager index rose to 49.4 in June from 46.2 the previous month, while analysts were looking for a print above the 50 threshold. The Conference Board’s consumer confidence index printed above expectation at 101.4 in June versus 97.4 consensus, as respondents feel confident about perspectives in the job market. As a result, the S&P 500 rose 0.27% in New York yesterday, while the Nasdaq gained 0.57% and the Dow Jones 0.13%.

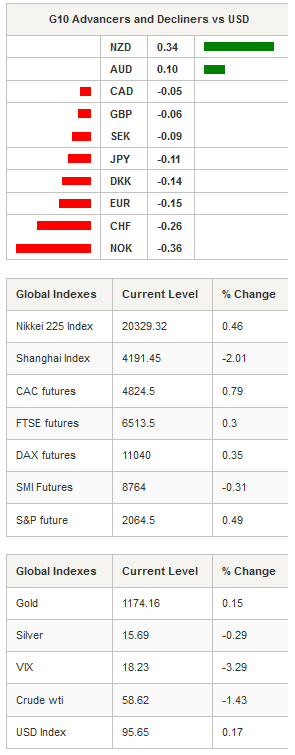

In Asia, regional equity markets are broadly higher, except Chinese stocks, with Shenzhen down -1.50, Kospi up 1.14%, Sensex up 0.71%. In Japan, the BoJ’s Tankan report shows that large manufacturing index is gaining momentum and prints at 15, beating consensus and prior reading of 12. Outlook is also encouraging and rose to 16 versus 14 expected and 10 prior reading. According to the survey, the Japanese economy is on a firmer footing, and growth in the first quarter will likely be validated in the second one. In addition, it reduces the odds of further monetary easing moves from the BoJ. The only element missing is 2% inflation. However, the BoJ is confident that the acceleration in growth will start translating into higher wages, driving up inflation. The Nikkei added 0.46%, while USD/JPY moved higher in Tokyo, back around 122.70.

In Australia, the equity market is up 1.04%, as building approvals surprised to the upside and grew 2.4%m/m in May versus 1.2% median forecast. Residential property prices rebounded in June, with the CoreLogic RP index up 2.1%m/m versus -0.9% prior reading. AUD/USD is trading right in the middle of its 1-month range. Next resistance lies at 0.7808 (Fib 38.2% on May-June debasement), while closest support can be found at 0.7587 (low of June 29th).

In Europe, equity futures are blinking green on the green, despite Greece’s missed payment. Euro Stoxx 50 adds +0.35%, Xetra Dax +0.35%, Cac 40 +0.79%, while Swiss shares are paring losses, down -0.31%. In UK, the Footsie is up 0.30%, while GBP/USD is treading water around 1.57. EUR/GBP traded with a very low volatility in the Asian session, like most EUR crosses.

Today traders will be watching Swiss PMI manufacturing; UK Markit manufacturing PMI and BoE’s Carney semi-annual financial stability report; ADP unemployment report, Markit manufacturing PMI, construction spending and ISM manufacturing from the US; Markit manufacturing PMI from Brazil.

Currency Tech

EUR/USD

R 2: 1.1679

R 1: 1.1459

CURRENT: 1.1122

S 1: 1.0868

S 2: 1.0820

GBP/USD

R 2: 1.5930

R 1: 1.5755

CURRENT: 1.5702

S 1: 1.5647

S 2: 1.5473

USD/JPY

R 2: 125.86

R 1: 124.68

CURRENT: 122.67

S 1: 122.64

S 2: 118.33

USD/CHF

R 2: 0.9503

R 1: 0.9408

CURRENT: 0.9389

S 1: 0.9285

S 2: 0.9151