Friday June 23: Five things the markets are talking about

Global equities are trading mixed now that this weeks Fed speakers have done little to alter market projections for the path of interest rates. crude oil is poised for its fifth straight week of declines.

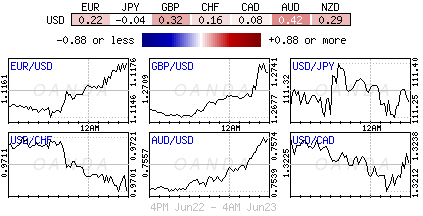

The ‘mighty’ USD peaked at a one-month high on Tuesday after the Fed did the expected, hiked interest rates last week and left the door ajar for further monetary tightening later in the year.

However, with fed fund futures odds of that happening straddling atop of +41%, the greenback has been stuck in a tight range ever since, pending fresh catalysts.

Nonetheless, the market is waiting on U.S data due next week – which include the June consumer confidence indicator, pending home sales, crude oil inventories, revised Q1 GDP and the PCE price index – for direction.

Yet, for a stronger conviction, what really matters for the dollar are wages and inflation-related data, which occurs in a fortnight with nonfarm payrolls (NFP).

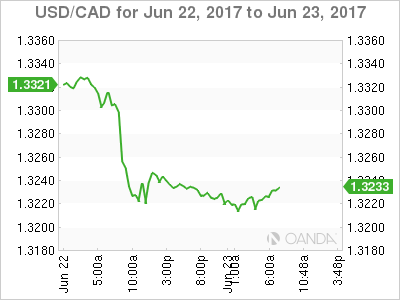

This market snooze fest, aside from the commodity currency moves this week – CAD in particular – investors have to be patient and pick their moments now that central banks again have a stranglehold on currency markets.

Note: Today, the Fed’s Bullard, Mester and Powell cap a busy week for speeches from U.S policy makers.

1. Global stocks keep their head above water

Global equities, helped by a rebound in tech shares in particular, remain resilient despite investor concerns about a policy misstep from the Fed – inflation is lagging – and a rout in the oil market that extended for a fifth-week.

In Japan, the Nikkei share average finished this week little changed as dollar-yen levels steadied (¥111.28). The broader Topix added less than +0.1%, while down-under, Australia’s S&P/ASX 200 Index gained +0.2%.

In Hong Kong, the Hang Seng China Enterprises Index added +0.3%, while the Hang Seng Index rose less than +0.1%.

In China, blue chips stocks ended at an 18-month high, buoyed by MSCI inclusion of mainland shares in its key index. The blue-chip CSI 300 index settled up +0.9%, while the Shanghai Composite Index added +0.3%.

In Europe, indices are trading modestly lower across the board with continued weaker oil prices weighing.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: STOXX 600 -0.1% at 388, FTSE -0.3% at 7416, DAX -0.3% at 12757, CAC 40 -0.2% at 5271, IBEX 35 -0.5% at 10656, FTSE MIB -0.3% at 20862, SMI -0.2% at 9034, S&P 500 Futures +0.1%

2. Oil edges up, but still set for biggest H1 fall in 20-years, gold shines

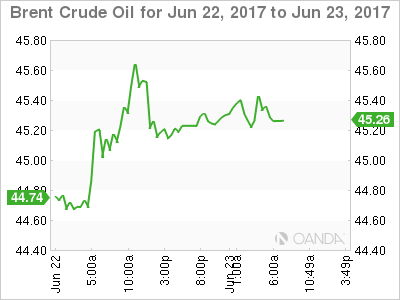

Overnight, oil prices have edged a tad higher, but remains on course for its worst first-half decline in almost two decades as production cuts have failed to sufficiently reduce oversupply.

Brent crude futures are up +28c at +$45.50 a barrel, while West Texas Intermediate (WTI) crude futures are trading at +$43.04 a barrel, up +30c from yesterday’s close.

Since peaking in late February, crude has dropped around -20% in the wake of the initial OPEC-led production cut.

Note: OPEC and non-OPEC oil producers’ compliance with the output deal reached 106 percent in May. However, a number of producers – notably Iraq, Saudi Arabia and Russia – aggressively ramped up output in the run-up to the deal, while U.S producers, Libya and Nigeria are exempt from the cuts.

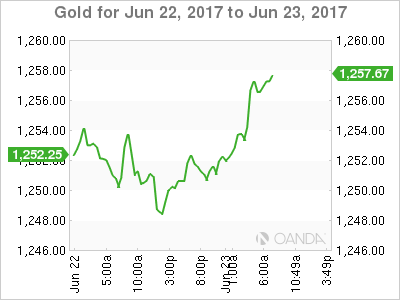

Ahead of the U.S open, gold prices (+0.6% at +$1,257.1 an ounce) have climbed to a weekly high, supported by a lower dollar and economic and political uncertainty around the world. However, the prospect of further interest rate hikes by the Fed is expected to limit gains.

3. German Yield Spreads Poised to Reach Pre-Trump Levels

The Treasury/Bund 10-year gap currently stands at +191.3 bps, down from +233.38 bps in late December.

Some dealers believe that the risk that the Fed may be moving ahead of the curve in its interest rate-rise path, given declining inflation rates and a shift in political risk from Europe into the U.S, argues for a tighter yield spread between the two bonds (U.S 10s to outperform German debt product). For many, the technical target is around +165 bps, a level last seen before Trumps U.S presidential win.

Overnight, the yield on 10-year Treasuries has backed up +1 bps to +2.16%. In the U.K 10-year yields have added +3 bps to +1.05%, while French OAT’s and German Bund yields are little changed.

Note: The Fed has raised interest rates four times since late 2015, and three times since the U.S election last November. U.S Treasury yields have fallen around -50 bps since the March rate hike.

4. The ‘Big’ dollar under pressure

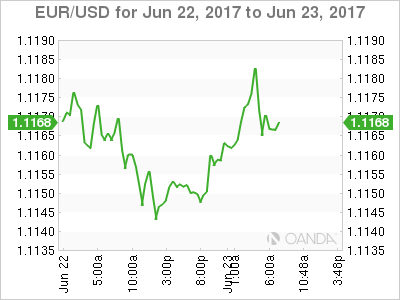

Overnight, the U.S dollar has traded mostly on the back foot. The EUR (€1.1174) has found support following better-than-expected manufacturing data in the eurozone (see below).

Sterling (£1.2727) rises after outgoing BoE member Kristin Forbes said in a speech yesterday that there were “compelling” reasons why a U.K interest rate rise should not be delayed. Ms. Forbes leaves the MPC next week, but the comment carries weight, as she is not a lone voice, with three out of eight members voting to raise rates at this month’s BoE meeting. The pound ‘bear’ expect gains to be limited due to political and Brexit uncertainty.

Note: It’s exactly a year today since Britain voted to leave the E.U – in the past 12-months the pound has fallen more than -15% outright, and almost -13% versus the EUR.

Commodity-linked currencies continue to hold onto their significant gains made yesterday following a rebound in crude oil prices from 10-month lows – CAD in particular is trading flat (C$1.3232).

5. Eurozone economy slows, but

Data this morning showed that the eurozone’s economy slowed slightly this month, but it still had its strongest quarter in more than six years, according to a survey of activity in the manufacturing and services sectors.

The composite PMI fell to 55.7 from 56.8 in May, a five-month low. The market was expecting it to fall to 56.6; however, it still leaves the eurozone economy growing at its fastest rate since the start of 2011.