Tuesday May 2: Five things the markets are talking about

With May Day over, capital markets are back in full swing and despite some weaker than expected economic data in the U.S of late, investors are returning to risky assets.

Global stocks are heading for a fresh high as investors focus on stronger corporate earnings. The yen has extended it losses while Treasury prices maintain its price declines.

Dealers will be focusing on the Fed and the U.S yield curve with the FOMC beginning its two-day policy meet today.

Yesterday, the VIX closed at its lowest level in a decade, which suggests that investor fears are easing, despite North Korea’s saber rattling.

1. Global equities trade atop record highs

In Asian overnight, shares rose to near two-year highs as growing optimism over tech industry earnings and easing concerns over North Korea offset softer-than-expected factory readings in China and the U.S.

In Japan, the Nikkei climbed (+0.7%) to a six-week high on earnings optimism, while the broader Topix index rose +0.6% to the highest since March 21.

Note: Japanese markets will be closed for holidays over the next three-days.

In South Korea, the KOSPI index advanced +0.7% to trade atop of its six-year high. In Singapore, the KospiStraits Times Index added +0.9%, while in China the Shanghai Composite Index declined -0.4%, following four straight days of gains.

Down-under, the Aussie S&P/ASX 200 Index slipped -0.1%, breaking a seven-day rally, as banks declined.

In Europe, indices are trading higher on generally positive PMI data out of Eurozone. Elsewhere, stronger earning from BP (LON:BP) is helping the FTSE to slightly outperform.

U.S stocks are to open little changed (-0.1%).

Indices: Stoxx50 0.1% at 3564, FTSE 100 +0.4% at 7232, DAX 0.1% at 12447, CAC 40 0.3% at 5280, IBEX 35 0.6% at 10776, FTSE MIB 0.5% at 20710, SMI 0.4% at 8852, S&P 500 Futures -0.1%

2. Oil prices rise, gold falls

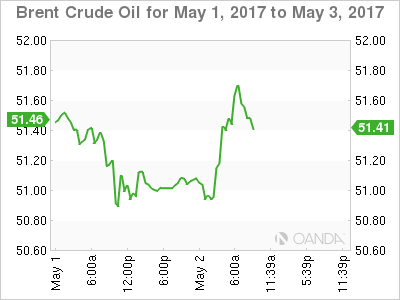

Crude ‘bulls’ are getting the better of the “bears” rising production concerns in the U.S, Canada and Libya as oil prices are on the rise ahead of the U.S open, supported by market expectations that OPEC will extend last November’s output cut quotas into H2. OPEC is to meet on May 25.

Brent crude oil futures are up +30c at +$51.82 a barrel – the contract hit a one-month low of +$50.45 last week after the restart of two Libyan oilfields – while U.S light crude (WTI) is up +20c at +$49.04 a barrel.

Note: Libya’s National Oil Company said yesterday that production had risen above the +760k bpd to its highest in three-years, with plans to keep boosting production. Offsetting some of the market prices losses is data from Russia showing that oil output fell slightly to +11m bpd in April from +11.05m in March.

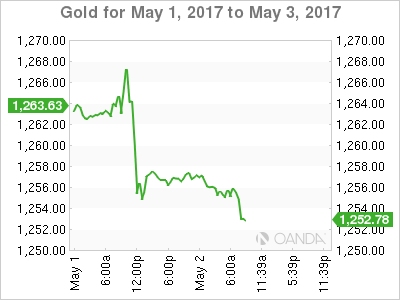

Gold trades near its three-week lows on surging equities and on the dollar’s strength. Bullion prices dropped -1% yesterday to +$1,253.66 an ounce, its weakest since April 11.

3. Global yields back up

A number of factors are boosting demand for U.S treasuries on price pullbacks -investors are sceptical over Trump’s capability to push through his fiscal agenda anytime soon and a number of economic releases over the past month have been disappointing.

U.S 10’s have backed up +1 bps to +2.33% overnight on market belief that the Treasury department may raise the size of its longer-dated bond issuance from its quarterly refunding release tomorrow – 10-year and 30-year bonds to increase by perhaps +$2B apiece.

The Fed is to start its two-day policy meeting today, and is widely expected to hold short-term interest rates steady tomorrow after a rate increase in March. Some Fed officials have signaled in recent weeks that the door remains open for the Fed to raise rates again in June. Fed fund futures see a +66% chance for a hike next month.

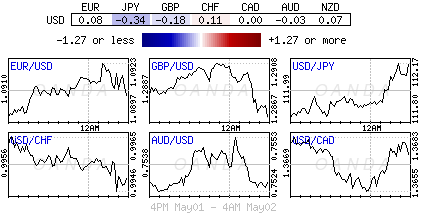

4. Dollar majors trade in narrow range

The dollar majors are trading in a narrow range. The EUR (€1.0910) continues to find support on pullback outright, helped by expectations that Macron will beat far-right candidate Marine Le Pen in this weekend’s French presidential elections. Euro GDP data out tomorrow is expected to show the economy picking up.

Sterling falls, with GBP down -0.1% at £1.2877 as U.S Congress reached a deal to avoid a government shutdown helps the dollar. It’s off its overnight lows after the U.K manufacturing PMI data beat consensus – 57.3 in April, bouncing from March’s four-month low of 54.2.

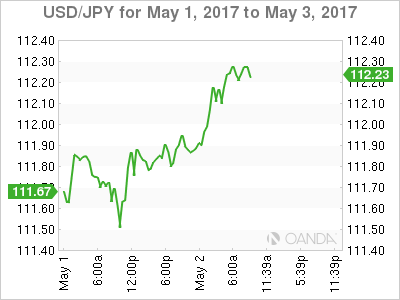

USD/JPY (¥112.21) is now trading atop its one-month highs, with yen ‘bears’ looking for further extensions for the dollar.

Note: The yen remains vulnerable to rising political tensions over North Korea as it is as safe-haven.

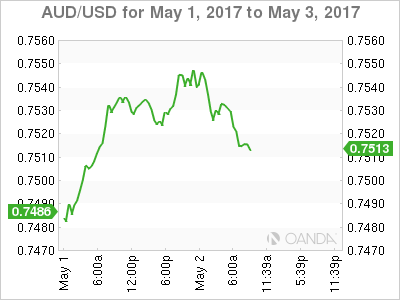

The AUD/USD (A$0.7531) was most volatile overnight, sliding after a disappointing China Caixin Manufacturing PMI (see below), before lifting to its overnight highs after an upbeat RBA policy statement.

Emerging markets FX gains are being supported by optimism that the Fed will ‘not’ raise interest rates this week, and that there wont not be any negative surprises from this weekends second round French Presidential election.

5. RBA holds steady, China data disappoints

Overnight, RBA held rates steady at +1.50% as expected, but the policy statement was definitely more upbeat after last month’s grim assessment of employment.

Aussie policy makers noted improvement in global growth boosting demand for exports, noted employment was now a bit stronger and forecasted growth reaching +3% over the next few years. As to be expected, they are also anticipating further increase to underlying inflation.

In China, the Caixin Manufacturing PMI came in below estimates at 50.3 vs. 51.3E, which is also its seven-month low.

Analysts noted that slower increases in output and new orders endorsed the decline, along with softer growth in new-orders that forced companies to cut jobs at the fastest pace in four-months. Slowing growth was also felt in the prices components.