Thursday July 6: Five things the markets are talking about

Yesterday’s Fed minutes has done little to aid dealers in mapping out their U.S yield cure. It’s tomorrow’s U.S jobs report (08:30 am EST), including a wage inflation reading, which is the key data point for capital markets this week to effect market expectations on the Fed’s policy outlook.

At their meeting last month, Fed officials debated when to start shrinking the central bank’s balance sheet, according to meeting minutes released yesterday, with some favoring starting “within a couple of months” and others suggesting it would be better to wait. The main sticking point was uncertainty over whether the recent drop in inflation is temporary, or a real problem.

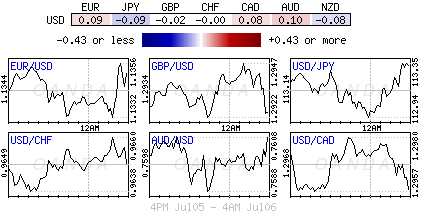

The Fed’s lack of consensus has global equities trading mixed, yen giving up some of its recent gains and ‘big’ dollar little changed.

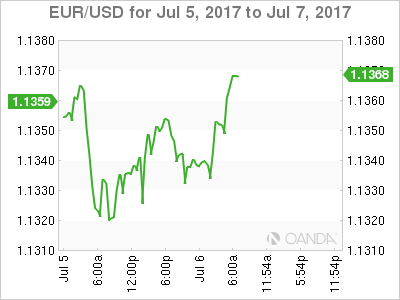

Similarly, the European Central Bank’s (ECB) account of their June 8 monetary policy meeting (07:30 am EST) will be watched for any discussion on the decision to drop the reference to future interest rate cuts – by removing the words “or lower” from their introductory statement. Dealers will also be looking for clues on “tapering.”

To date, many expect the ECB to make some kind of announcement regarding tapering of bond buying at the September or October monetary policy meeting, with a reduction in monthly purchases starting in January.

Note: Friday’s non-farm payroll (NFP) report is expected to add around +175k workers last month and wage growth probably strengthened.

1. Stocks show a mixed reaction to FOMC minutes

In Japan, the Nikkei (-0.4%) dropped to three-week lows overnight as ongoing tensions around North Korea continued to sap risk appetite. The broader Topix dropped -0.2%.

In Singapore, the Straits Times Index declined -0.5% while Indonesia’s benchmark gauge climbed +0.3% and India’s BSE Sensex 30 advanced +0.5%.

In Hong Kong, the Hang Seng Index fell -0.2%, while the Hang Seng China Enterprises Index retreated -0.4%.

In China, the Shanghai Composite Index increased +0.2%.

In Europe, regional bourses had opened mixed, but are now drifting lower. With crude oil moving higher it’s providing some support to energy stocks on the FTSE 100, while materials stocks are under pressure following drop in precious metals. Markets attention has switched to the ECB minutes and tomorrow’s non-farm payroll (NFP) report.

Indices: Stoxx50 -0.5% at 3,462, FTSE -0.5% at 7,358, DAX -0.3% at 12,418, CAC 40 -0.5% at 5,154, IBEX 35 -0.7% at 10,453, FTSE MIB -0.5% at 21,042, SMI -0.5% at 8,913, S&P futures -0.1%

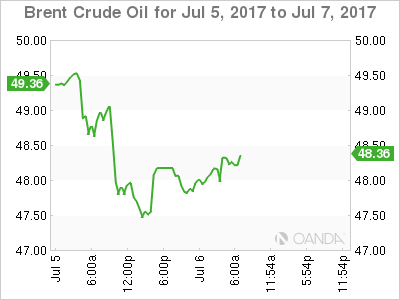

2. Oil rallies after U.S inventory drop, gold prices steady

Ahead of the U.S open, crude oil is trading better bid, recovering some ground after a surprisingly upbeat picture of U.S demand.

However, the prospect of oversupply in 2018 continues to provide a headwind, which is causing many analysts to cut next year’s price forecasts.

Brent crude futures are up +71c at +$48.50 a barrel. The price fell as much as -4.6% intraday yesterday, before closing down -3.7%, its biggest one-day drop in a month. U.S West Texas Intermediate (WTI) crude futures are also up +71c, at +$45.84 a barrel.

Yesterday after the close, API data showed U.S. crude inventories fell more sharply than expected, down -5.8m barrels in the week to June 30, against expectations for a draw of -2.3m barrels.

Note: OECD total oil inventories are still above +3B barrels and the recovery in Libyan and Nigerian supplies, coupled with a return of U.S shale, is expected to prevent steep stock draws ahead.

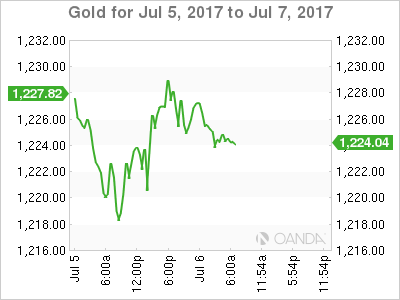

For now, rising geopolitical risks is providing some support for gold. The precious metal is little changed (-0.1% to +$1,223.97 an ounce) overnight as tensions on the Korean peninsula stoked safe-haven demand for the metal. Nevertheless, the dollars strength is expected to provide weight for some metal prices.

3. European Bond auctions back up yield

Heavy government bond supply from the U.K, Spain and France is putting some downward price pressure on the bond prices ahead of the U.S open.

Note: Today’s supply is tilted to the long- end of both the Spanish and French yield curves. Spain is offering €5B in 2022-, 2040- and 2046-dated, while France auctions €8.5B May 2027-, October 2027- and May 2048-dated OATs. While in the U.K, £2.5B 10-Gilts is on offer (+1.25% 2027).

The collective Euro supply has U.S. 10-Year’s backing up +3 bps to +2.35%, after falling -3 bps points yesterday and Gilts, OAT’s and Bunds climbing +2 bps.

Elsewhere, down-under, Australia’s benchmark yield has gained +1 bps to +2.64%. The Reserve Bank of Australia’s (RBA) Harper said that Aussie policy makers are “comfortable holding interest rates for now and see no reason to scare the horses at the moment” by signaling coming interest rate increases.

4. Dollar’s mixed fortunes

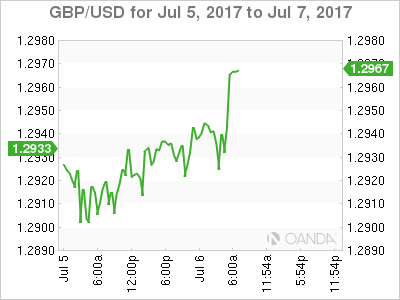

Sterling is marginally higher outright (£1.2935), but continues to trade in “no man’s land.”

Some of the pounds gains in the past weeks have been on the back of expectations that the BoE may raise interest rates given higher-than-expected inflation. Sterling bears are hoping that the “lower highs and lower lows” is putting the currency pair at risk of a steeper decline towards £1.28 again.

Note: GBP/USD rallied well above £1.30 after Carney spoke last week, but has since failed to hold above this key level.

The EUR (€1.1362) is steady outright after booking gains in the week on upward revisions to German manufacturing and service sector activity, similar changes to the broader eurozone purchasing managers’ indices, and a rebound in retail sales (see below). Market is waiting for the ECB minutes for conviction on the single units next move.

Note: The reduction in the ECB’s bond-buying program is not fully priced in yet by the markets.

5. Eurozone sales rise to greatest extent in almost two years

Data this morning showed that Eurozone retailers recorded an uptick in sales during June (53.2 vs. 52 m/m).

Growth was driven by sharp expansions in France (74-month high) and Germany, although another decline in Italy continued weigh on overall growth.

Digging deeper, there was a broad-based drop in ‘gross margins’ for retails, which suggests a continued challenging business climate, while a strong increase in employment provides stronger evidence of a recovery in the eurozone retail sector.