by Eli Wright

US markets closed yesterday on a celebratory note, perhaps in anticipation of today's Thanksgiving holiday, but more likely on the continued strength of the US dollar and US equities. The Russell 2000 was up for the 14th straight day, the Dow reached a new record high and the S&P 500 continues to flirt with additional highs after Tuesday's record breaker. Gold continues its slide lower.

Equity Markets

Wall Street's post-election exuberance continued, as indices hovered at near-record highs. The Dow closed 0.31% higher, at 19,083.18 while the S&P 500 ticked up 0.08% to 2,204.72. The NASDAQ's upward momentum barely flagged, dropping 0.1%, to 5,380.68.

The U.S. market’s belief in President-elect Trump’s pledge to “make America great again” continues to drive upward momentum. That's been particularly true for small caps; just one additional up day for the Russell 2000 will break its twenty-year record for consecutive gains. It’s currently up 0.57%, at 1,343.51.

This morning, the Shanghai Composite closed flat, at 3,241.50, as the Hang Seng felt the impact of the dollar’s bull run, slipping 0.36%, to 22,596. The Nikkei managed to swim against the tide, rising 0.94% on a weakened yen, to 18,333.41.

As of this writing, European markets are flat: the DAX is up 0.05% to 10,668; the Euro Stoxx 50 is up 0.01% at 3,036. The UK's FTSE, on the other hand, is down 0.20% to 6,804.30.

Forex

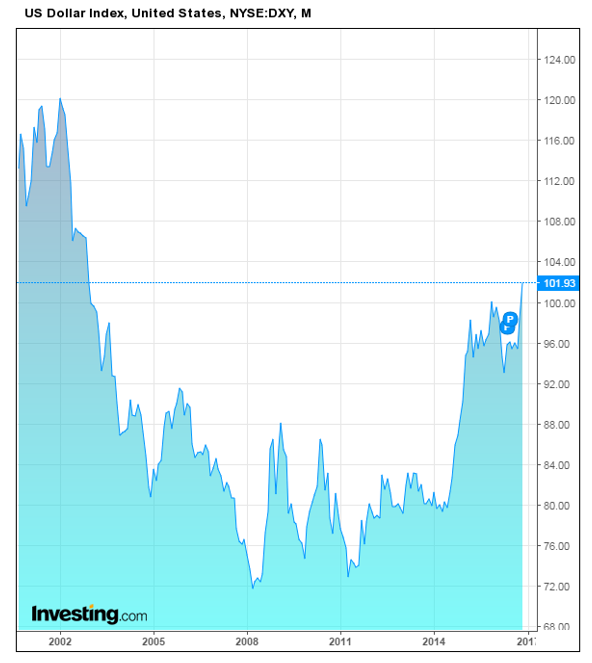

Inflation expectations based on a combination of positive US economic data, president-elect Trump’s promises, and the over 90% chance of a Fed rate hike in December, have been a boon to the Dollar Index, which on the monthly chart, below, is currently hovering at fourteen-year highs at 101.96, the highest it has been since 2002. With dollar bulls still in control, look for the USD to continue higher.

Sterling remains one of the few major currencies holding its own versus the greenback. The Japanese yen and Swiss franc are both at their lowest monthly levels since February, 2016. USD/JPY has already passed 113.25 resistance, while USD/CHF is approaching the 1.02 target.

The euro is perhaps the most dovish of the majors, as diverging monetary policy drives it in the opposite direction from the USD. Should the euro fall below its current position, $1.046 would be its next significant level, after which we could perhaps see parity with the dollar.

The dollar's ongoing strength continues to hammer emerging markets, in particular Asian currencies beyond the yen, including the Indian rupee, the Philippine peso and the thai baht. The South African rand recovered slightly, as did the Brazilian real.

Oil

Oil prices have been boosted by increased optimism that OPEC—and Russia—would agree to a deal to reduce output. However, Russia has backtracked off earlier remarks regarding its willingness to freeze production. Uncertainty regarding an agreement has returned to the marketplace. OPEC's next meeting will take place on November 30, in Vienna. Traders are hoping for additional clarity at the time, but that could mean there remains a handful of days during which tight sideways oil prices might prevail. If an agreement fails to materialize, prices could return to the $44 level or even lower. Should a production freeze deal actually become reality oil could push above $50.50. Brent is currently trading at $49.08; Crude is at $48.12.

Gold

With risk-on appetite once again in play, combined with the rising USD, gold broke below $1,200. Bears could lose the upper hand at this psychologically significant break if buyers decide to reenter the market on lowered prices, especially when trading volume resumes after the holiday. However, with charts continuing to show a strong downside bias, gold could potentially fall to $1,150.

Bonds

The rising dollar and rate hike expectations are having an impact on bond markets. Short term Treasuries in particular are affected as investors find better opportunities in equity markets. The U.S. 2-year Treasury yield is 1.131%, near six-year highs. The 10-year yield is 2.355%, a sixteen-month high; and the 30-year yield is close to ten-month highs, at 3.024%.

In Europe, quantitative easing programs and ECB monetary policy have had the opposite effect. The German 2-year bund yield is up slightly from its record low, now at -0.727%, France's 2-year sovereign bond yield is at -0.6%, and the UK 2-year gilt is at 0.139%.