Key Points:

- Key 1200 support level has been broken.

- Technical bias remains firmly bearish moving ahead.

- The Fed and Trump should keep the metal depressed in the medium to long-term.

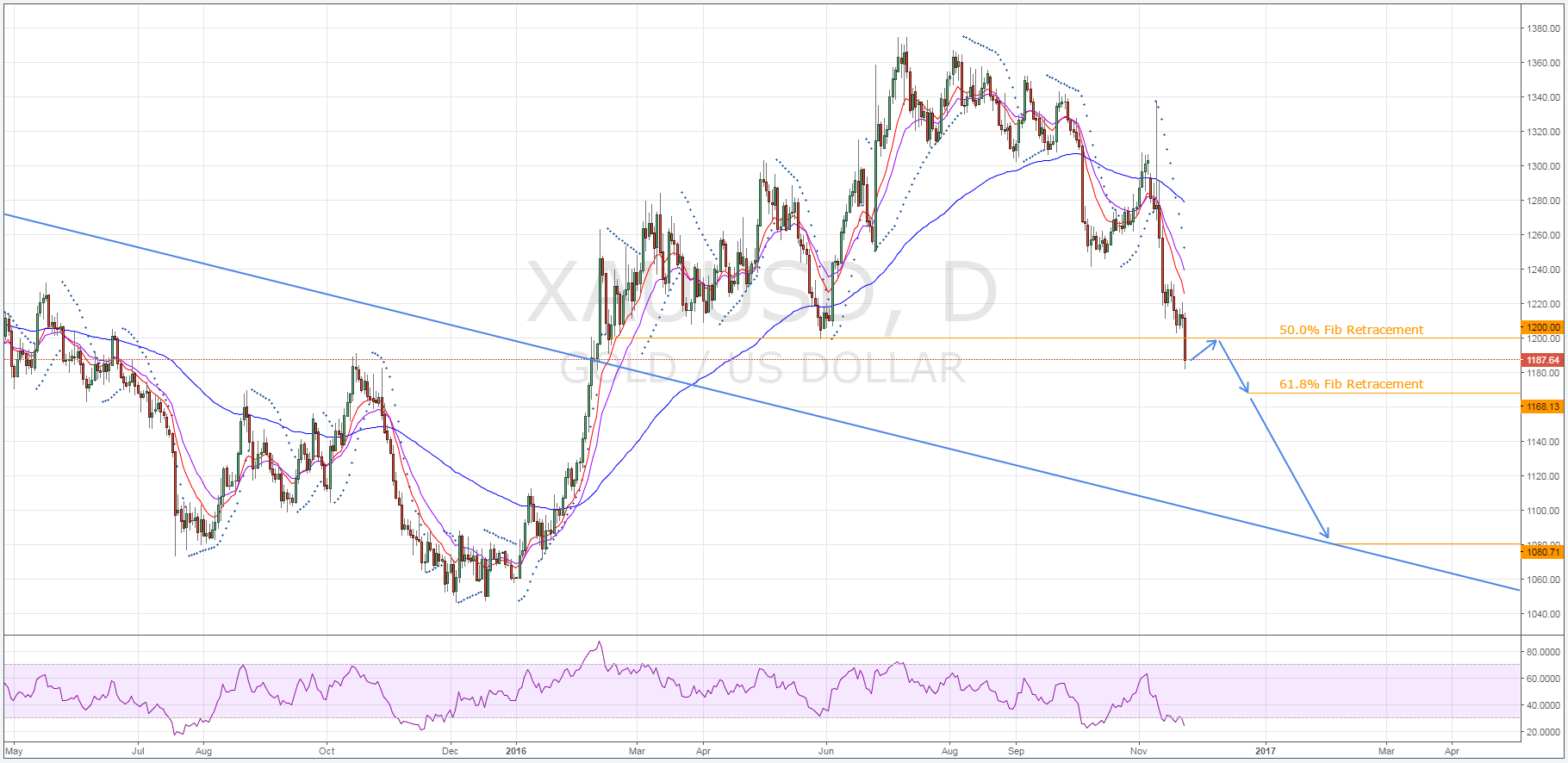

Gold plunged through the key psychological zone of support around the 1200 handle during Wednesday’s session which opens the pair up to a whole new world of downside risk. From both a technical and fundamental perspective, gold prices could now come under siege which will likely see the metal travel as low as 1168.13 and beyond in the coming weeks.

Firstly, a look at the technicals shows us a number of key things to keep in mind moving forward. Specifically, whilst both the EMA activity and the Parabolic SAR readings are highly bearish, strong oversold RSI and stochastics readings should mean that gold recovers in the near-term. After moving back to the 1200 handle to relieve the oscillators however, the full force of the EMA bias and similarly bearish Parabolic SAR readings should come back into play and send the metal seeking support.

In the medium-term, gold should find its first major zone of support around the 61.8% Fibonacci level. This price does coincide with a historical zone of support so we should see the bears lose some momentum as they begin to push the metal lower. However, in the long-term, there remains significant scope to see gold test last year’s lows before being propped up by the old long-term trend line.

From a fundamental perspective, the outlook for gold prices is just as damning. Most of the selling pressure will, of course, be generated by the markets continued pricing in of what are perceived to be pro-growth policies from Trump. Specifically, the trillion odd dollars which the president-elect has earmarked for infrastructure development has been meet with broad approval by the markets and this is likely to be felt for some time. In fact, the VIX remains near a yearly low which has been taken by some as a sign that the Trump effect could be more than a mere knee-jerk reaction and that he could be a more stabilising influence than originally thought.

In addition to the gold-depressing effects of Trump’s fiscal policy, the Fed’s monetary policy is also going to be impacting gold prices substantially moving forward. In the near-term, the all but assured 25 bps rate hike has already been making itself felt across the market. However, more recently, the Fed has intimated that in the likely event that Trump does put his foot on the gas for the US economy, it will respond by further increasing rates. The shift away from the slow and steady approach could certainly prove to be the spark needed to start a long-term decline for the metal.

Ultimately, we will have to wait and see if the market’s response to Trump’s fiscal policy is well founded or whether another upset is on the horizon. Regardless, the technical bias currently seems to suggest that we are at least going to see some near-term bearishness, even if the plunge back to December’s lows fails to materialise. However, keep an eye on the usual economic news as it will be instrumental in ensuring that the metal stays below the 1200 handle as we move ahead.