All three main indices log fresh records

US major stock indices ended at record highs on Tuesday on positive corporate reports. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.1% to 93.98. The S&P 500 rose 0.7% to record 2599.03 led by technology stocks. Dow Jones industrial average climbed 0.7% to all-time high 23590.83 supported by 1.9% gain in Apple (NASDAQ:AAPL). The Nasdaq composite index jumped 1.1% to fresh record high 6862.48.

European markets rise as Germany concerns subside

European stocks added to gains on Tuesday on easing political uncertainty concerns spurred by the collapse of German coalition government talks. The euro ended little changed while British Pound continued advancing. The Stoxx Europe 600 rose 0.4%. German DAX 30 jumped 0.8% closing at 13167.54. France’s CAC 40 closed 0.5% higher and UK’s FTSE 100 added 0.3% to 7411.34. Markets opened mixed today.

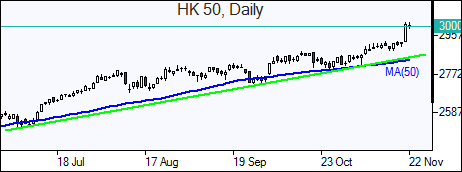

Hang Seng leads Asian indices higher

Asian stock indices are rising today as strong global growth buoys investor confidence. Nikkei rose 0.6% to 22549.00 despite accelerated yen strengthening against the dollar. Chinese stocks are advancing: the Shanghai Composite Index is up 0.6% and Hong Kong’s Hang Seng Index is 0.8% higher. Australia’s ASX All Ordinaries added 0.4% with Australian dollar little changed against the greenback.

Oil higher on expected US crude draw

Oil futures prices are rising today after TransCanada corporation said it will cut crude pipeline deliveries from Alberta’s oil sands to US by at least 85% through to the end of November. Prices rose yesterday supported by the American Petroleum Institute industry group report US crude stocks fell by 6.4 million barrels last week. January Brent rose 0.6% to $62.57 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.