Dow snaps 7-session winning streak

US stocks retreated on Thursday on tax cuts delay possibility. The dollar weakened as the Senate’s tax plan was unveiled: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.5% to 94.51. Dow Jones industrial average lost 0.4% to 23461.94, snapping seven-session win streak. The S&P 500 pulled back 0.4% to 2584.62 led by industrial stocks. The NASDAQ Composite index dropped 0.6% closing at 6750.05.

European stocks pull back on disappointing earnings updates

European stocks pulled back on Thursday on weaker than expected earnings updates. Both the euro and British Pound climbed against the dollar. The Stoxx Europe 600 index lost 1.1%. Germany’s DAX 30 fell 1.5% to 13182.56. France’s CAC 40 ended 1.2% lower and UK’s FTSE 100 retreated 0.6% to 7484.10. Indices opened mixed today.

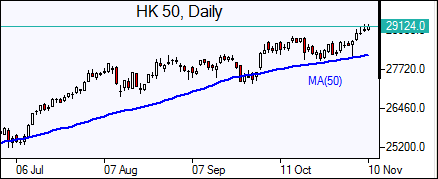

Asian markets slip

Asian stock indices are mostly lower today as market sentiment was undermined by losses on Wall Street overnight.Nikkei lost 0.8% to 22681.42 as yen advanced against the dollar. Chinese stocks are mixed: the Shanghai Composite Index is 0.2% higher while Hong Kong’s Hang Seng Index is down 0.1%. Australia’s All Ordinaries Index is down 0.3% as Australian dollar pared previous day gains against the greenback.

Oil Lower

Oil futures prices are edging lower today on rising US output concerns with increases in shale oil production on higher price incentives. Prices rose yesterday on rising geopolitical concerns after a report Saudi Arabia has urged its nationals to leave Lebanon immediately. Brent for January settlement rose 0.7% to end the session at $63.93 a barrel on Thursday.