Monday October 16: Five things the markets are talking about

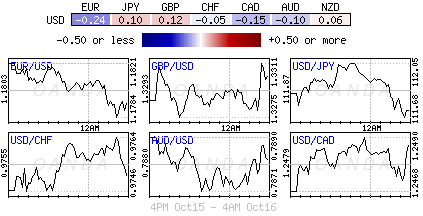

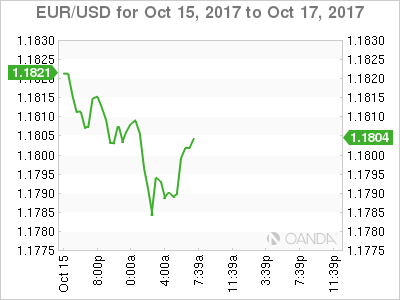

The EUR has slipped in early Monday trading after posting its biggest weekly gain in four-weeks as political uncertainty in the form of an approaching deadline over Catalonia’s bid for independence and Austria’s Sunday election outcome has convinced many to book some profits.

Later this morning, Catalan leader Carles Puigdemont is expected to clarify whether he is calling for the region’s independence from Spain, with Madrid threatening a return to direct rule if his stance remains ambiguous.

In Austria, the young conservative leader Sebastian Kurz is on track to become the country’s next leader after Sunday’s election – He will likely seek a coalition with the resurgent far right as his party is well short of a majority.

However, the euro’s losses have been somewhat limited due to a muted U.S dollar as subdued inflation data again raises market expectations that the Fed may not convey a ‘hawkish’ tone at next weeks policy meeting. Friday’s U.S inflation data suggested that the U.S’s underlying inflation remains muted.

There are no central bank meetings this week, but the Fed will publish its Beige book Thursday (Oct 18).

In the U.K, it is a big data week with both the consumer and producer price indexes (Oct 17), retail sales and claim data (Oct 19) due to be released.

This week is also a big one for China with the release of last nights September consumer and producer prices along with its Q3 GDP report (Oct 19) and last month’s industrial production and retail sales data (Oct 18).

Note: China’s 19th party congress begins on Wednesday Oct. 18 in China. Next Sunday (Oct. 22), Japan will hold an election for the lower house of the Diet.

1. Stocks are give the green light

In Japan, equities continue to find no reason to fall, with the Nikkei (+0.5%) printing its first ten-session win streak in over two years overnight. The prospects of an Abe election win later this month continues to attract buyers. The broader Topix gained +0.9%.

In Hong Kong, stocks rallied to a ten-year high overnight, joining a regional stock rally, which have been boosted by a surprisingly rosy growth forecast for China. The Hang Seng index rose +0.8%, while the Hang Seng China Enterprise (CEI) gained +0.7%.

In contrast, Chinas share indexes fell as a surprisingly strong People’s Bank of China (PBoC) economic growth projection failed to support the market. Governor Zhou indicated that China was expected to grow +7%in Q2 and defy widespread expectations for a slowdown. The blue-chip CSI300 index fell -0.2%, while the Shanghai Composite Index lost -0.4%.

In Europe, regional bourses are trading mostly higher with the exception of the Spanish IBEX, which continues to be weighed down on uncertainty over Catalonia independence.

U.S stocks are set to open unchanged.

Indices: STOXX 600 +0.20% at 392.2, FTSE +0.2% at 7546, DAX +0.20% at 13018, CAC 40 +0.3% at 5366, IBEX 35 -0.5% at 10203, FTSE MIB +0.1% at 22436, SMI -0.1% at 9305, S&P 500 Futures flat.

2. Oil rises as fighting escalates in Iraq, gold higher

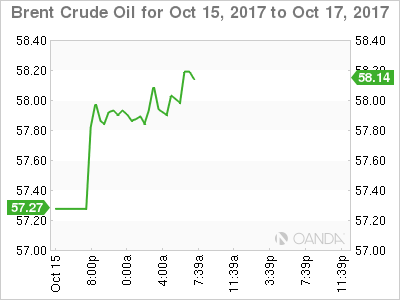

Oil markets are well supported this morning as Iraqi forces entered the oil city of Kirkuk, taking territory from Kurdish fighters and raising concerns over exports from OPEC’s second-largest producer.

Iraq launched the operation in the region yesterday as the crisis between Baghdad and the Kurdish Regional Government (KRG) escalated. Tensions have been building since the KRG voted for independence in late September.

Brent crude futures are at +$57.75 per barrel, up +58c from Friday’s close, while U.S. WTI crude is at +$51.95 per barrel, up +50c.

Note: Kirkuk accounts for +200k bpd of the some +600k bpd of oil produced in the KRG region.

Prices are also being supported by market worries over renewed U.S sanctions against Iran.

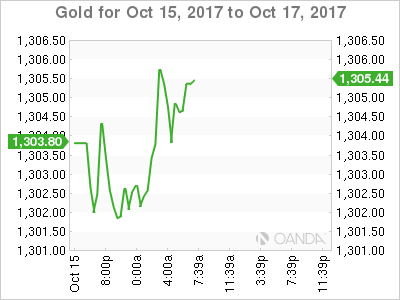

Gold is trading atop of the psychological +$1,307 an ounce, buoyed by worries geopolitical risks, including the ongoing tensions over Iran and North Korea. Friday’s weaker-than-expected U.S. inflation print helped push U.S Treasury yields lower, giving a boost to gold to trade above +$1,300.

3. Yields tug of war

Fixed income traders are stuck between Fed rhetoric and global growth on one hand and the ECB’s expected action and subdued inflation on the other. Growth and the Fed point to higher yields, while inflation and the ECB should at least keep yields at current levels.

The Fed is expected to raise rates in December (Fed funds are pricing in odds of +90%), while ECB members contemplate a softer-than-expected reduction in asset purchases. The latest estimate is to reduce monthly bond purchases to+€40B per month and carry that out for six-months, to maintain maximum flexibility. The possibility of a longer-than-expected extension of +12-months for the ECB’s QE program caused yields to tumble Friday. German 10-year Bund yields are trading at +0.4% – their lowest level since late September.

The bond market is growing to the idea that the ECB will start withdrawing asset purchases, most likely in January and expect the ECB to announce some details next week (Oct 26).

Elsewhere, the yield on 10-year Treasuries gained +2 bps to +2.29%, while the U.K’s 10-year gilt increased +1 bps to +0.41%.

4. Dollar finds a foothold

Ahead of the U.S open, the EUR (€1.1788) trades under pressure after yesterday’s Austrian elections, which are likely to result in a coalition led by the People’s Party, which wants tougher rules on immigration, and the far-right Freedom Party. EUR/GBP has fallen -0.3% to €0.8866. There are also concerns about Catalonia after President Puigdemont has yet to clarify whether he declared the region independent, raising the prospect of reprisals from Madrid. Market focus will also be looking ahead to next week ECB decision see if Euro policy makers will announce the bulk of its decisions on QE tapering.

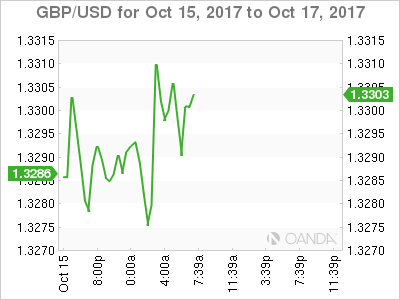

Sterling (£1.3297) is a tad higher on reports that PM May is planning to meet with E.U officials in Brussels in the hope of ending the Brexit stalemate. EUR/GBP is at €0.8867.

5. Euro-area exports jump

Data this morning showed that Eurozone exports rose +2.5% in August from July, leading to a widening of the seasonally adjusted trade surplus to+€21.6B vs. +€17.9B.

This strong print is go some ways to reassure ECB policy makers that the EUR’s appreciation this year has not been capable to pressure the region’s economic recovery, which should provide further ammunition to decide to scale back their bond purchases at next week’s ECB meeting (Oct. 26).