Dow snaps 5 session skid

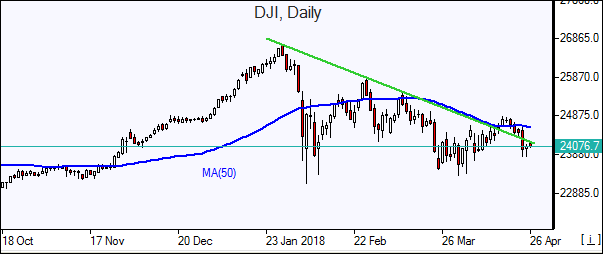

US stocks edged higher on Wednesday on positive earnings reports erasing earlier losses. The S&P 500 edged up 0.2% to 2639.39. The Dow Jones industrial rose 0.3% to 24083.83 helped by 4.2% gain in Boeing on better-than-expected earnings. The blue chip index halted five day losing streak. Nasdaq composite index however slipped less than 0.1% to 7003.74.The dollar strengthening resumed: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.5% to 91.213, though is lower currently. Stock indices futures point to mixed openings today.

Earnings season is unfolding with almost 80% of the S&P 500 companies results so far beating earnings forecasts, according to FactSet. The ICE dollar index resumed the climb as 10-year Treasury note yield rose above 3%, hitting highest since late 2013. US interest rates have been moving higher over the past week on rising inflation expectations.

No change in ECB policy expected today

European stocks extended losses on Wednesday. Both the British Pound and euro turned lower against the dollar but are rising currently. The Stoxx Europe 600 lost 0.8%. Germany’s DAX 30 ended 1% lower at 12422.30. France’s CAC 40 lost 0.6% and UK’s FTSE 100 fell 0.6% to 7379.32. Indices opened flat to 0.2% lower today.

The European Central Bank will meet today at 13:45 CET, no change in policy is expected but investors will watch for any sign euro-zone’s monetary authority is preparing a shift in stimulus plans for the June meeting.

Asian indices mixed

Asian stock indices are mixed today. Nikkei ended 0.5% higher at 22319.61 as yen edged higher against the dollar. China’s stocks are falling led by technology sector after news that US is investigating if China’s Huawei violated US sanctions on Iran: the Shanghai Composite Index is 1.5% lower and Hong Kong’s Hang Seng Index is down 0.7%. Australia’s ASX All Ordinaries is down 0.2% with Australian dollar little changed against the greenback.

Brent rising

Brent futures prices are higher today on expectations the United States will re-impose sanctions against Iran and decline in Venezuela output. Prices rose yesterday despite the US Energy Information Administration report that domestic crude supplies rose unexpectedly by 2.2 million barrels last week to 429.74 million. June Brent crude rose 0.2% to $74 a barrel on Wednesday.