September 21: Five things the markets are talking about

The Fed’s decision to leave the benchmark interest rate unchanged was entirely anticipated yesterday, but their ‘hawkish’ forecast for where rates will be at the end of the year caught some of the market by surprise.

As expected, the Fed announced its balance sheet runoff plan would start next month, while keeping its options open on a potential December rate hike. After the announcement the U.S Treasury curve flattened as short-end backed up faster than long rates.

Note: With the Fed biting the bullet over quantitative easing (QE), investors are now expected to turn their attention to several appearances by ECB officials for clues on the future of Europe’s stimulus.

Elsewhere, the Bank of Japan (BoJ) also left policy unchanged, as expected. The one dissenter, by new BOJ policy board member Goushi Kataoka, said that the “yield curve control is not enough to meet inflation target,” and “sees low chance of consumer prices increasing from 2018 on.”

In the U.K, Brexit strategy continues to top the agenda as PM Theresa May prepares to outline her revised approach tomorrow, while in Germany campaigning continues before Sunday’s (Sept. 24) general election. Down-under, New Zealand prepares to go to the polls Saturday.

1. Stocks mixed results

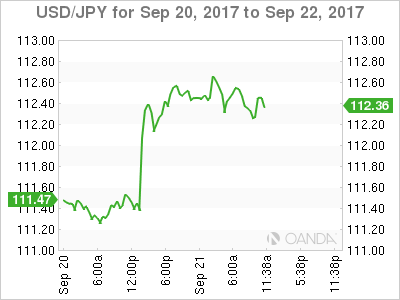

In Japan, the Nikkei share average edged up overnight (+0.2%), helped by gains on Wall Street and a weaker yen (¥112.40) after the Fed signaled it still expects to raise interest rates one more time this year. The BoJ kept monetary policy steady, while maintaining its upbeat view of the economy. The broader Topix index rallied less than +0.05% to its highest print in two-years, before giving up some of its gains after the BoJ’s decision.

Note: Investors remain weary of headlines related to a snap Japanese election that is rumoured to be called by PM Abe as early as next Monday.

In Hong Kong, shares ended little changed, as strength in financial and consumer stocks offset a slump in the resources sector triggered by a stronger dollar. The Hang Seng index fell -0.1%, while the China Enterprises Index rose +0.2%.

In China, the major indexes slipped, as developers and the materials sector weakened, offsetting gains in financial firms buoyed by the potential of another Fed rate increase. The blue-chip Shanghai Shenzhen CSI 300 index fell -0.1%, while the Shanghai Composite Index lost -0.2%.

In Europe, regional indices trade mostly higher across the board with the weaker EUR (€1.1916) helping push indices higher following the Fed and BoJ rate decision.

U.S stocks are set to open in the ‘red’ (-0.1%).

Indices: Stoxx600 +0.2% at 382.7, FTSE flat 7271.5, DAX +0.2% at 12598, CAC 40 +0.5% at 5267, IBEX 35 +0.2% at 10311, FTSE MIB +0.5% at 22470, SMI +0.4% at 9133, S&P 500 Futures -0.1%

2. Oil prices steady ahead of key OPEC meeting, gold lower

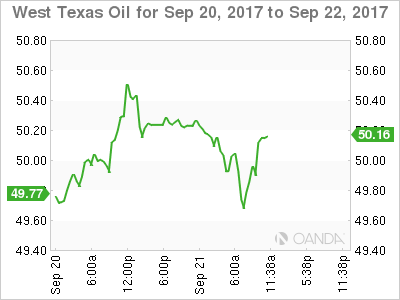

Oil prices were steady overnight, holding most of this week’s gains ahead of today’s OPEC meeting in Vienna that could extend production limits aimed at clearing a glut that has depressed the market for more than three years.

In January, OPEC and its allies agreed to reduce output by about -1.8m bpd until March 2018 in an attempt to empty inventories. The market is now anticipating an extension to that deal, possibly to the end of next year.

Brent crude oil is down -5c at +$56.24 a barrel, while U.S light crude is -15c lower at +$50.54.

Note: Both contracts have risen more than +15% over the last three-months as global oil supply has tightened.

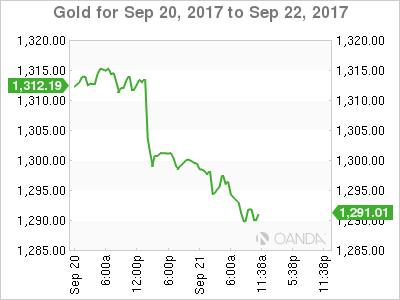

Ahead of the U.S open, gold prices have slipped to its lowest print in over three-weeks overnight. A stronger U.S dollar and increasing prospects of a December Fed rate hike is curbing appetite for the ‘yellow’ metal. Spot gold is down -0.2% at +$1,298.06 an ounce.

3. Sovereign yields on the rise

With the Fed considered a tad more ‘hawkish’ after yesterday’s Federal Open Market Committee (FOMC) meeting – suggesting it is open to one more rate hike in 2017, data depended and three hikes next year – took the market by surprise.

FI dealers scrambled to price in a Dec. hike, pushing front-end U.S yields much higher (U.S 2s backed up to +1.43% for the first time since 2008) and flattening the curve.

According to the CME, Fed fund future odds moved from pre-meet +50% to +73% possibility for a Dec. Fed rate hike.

Market fears that the Fed will continue to raise rates despite lackluster inflation could keep pressure on the bond market in the near term. Also, the Fed indicated yesterday that it reduced its longer-term projection for its federal-funds rate. Officials now see a rate target of +2.8%, rather than +3%.

The yield on U.S 10-year rallied less than +1 bps to +2.27%, reaching its highest yield print in more than seven-weeks on its fifth consecutive advance. In Germany, the 10-year Bund yield climbed +3 bps to +0.47%, the highest in more than six-weeks.

4. Dollar still holding tough for now

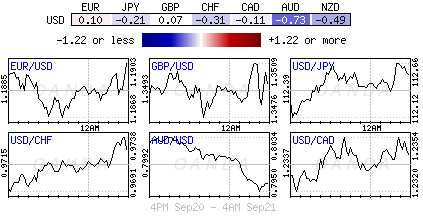

The U.S dollar has posted a powerful rebound in the past 24-hours as the market was caught off guard by the Fed’s projection of one more rate hike within the year.

In yesterday’s session, the EUR slumped -0.8% to €1.1860 intraday, giving back most of its gains made in the prior four-sessions. USD/JPY has managed to surge up to ¥112.52, its highest intraday level in nearly two-months, extending its winning streak to a fourth-session.

USD/CHF is up for a fourth day as it gains +0.2% to $0.9724, and USD/CAD has regained the psychological C$1.2300 level by rising +0.3% to C$1.2324. The pound swung up to £1.3656 Wednesday, its highest intraday level since the Brexit vote, before retreating to trade atop of £1.3492.

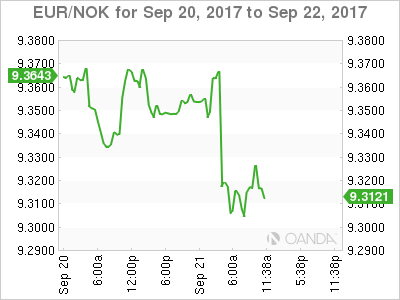

Elsewhere, NOK ($7.8066) has rallied against the U.S dollar after Norges Bank suggested rates might rise sooner than anticipated, even as it left its key policy rate at a record low of +0.5% earlier this morning. EUR/NOK has dropped to its lowest level in a week and a half at around €9.3057.

5. S&P cuts China’s credit rating

S&P Global Ratings cut China’s sovereign credit rating for the first time in 18 years earlier this morning, citing the risks from soaring debt, and revised its outlook to stable from negative.

The sovereign rating was cut by one step, to A+ from AA-.

“China’s prolonged period of strong credit growth has increased its economic and financial risks,” S&P said. “Although this credit growth had contributed to strong real GDP growth and higher asset prices, we believe it has also diminished financial stability to some extent.”

Note: Moody’s Investors Service cut China’s rating last May to A1 from Aa3, citing similar concerns over economy-wide debt and effects on state finances.