Monday January 23: Five things the markets are talking about

The ‘mighty’ U.S. dollar remains under pressure across the board, since Trump’s inauguration speech on Friday still did not provide investors with clarity on his tax reform and fiscal spending plans – the speech reiterated protectionism, a word that global investors fear.

President Trump has begun work aiming to place American interests at the forefront of his agenda, a winning campaign promise that’s helped since November to support U.S equities, the dollar and bond yields.

With the market requiring more clarity, investors continue to unwind many of their “Trump trades” believing that the asset moves had pushed prices too far, too fast.

Note: Last week saw precious metal funds biggest inflow in five months, while bond funds notched a fourth consecutive gain. However, if Trump focuses on fiscal stimulus, the dollar should find support, if he talks trade restrictions and penalties, expect much more volatility with much deeper pullbacks for the ‘mighty’ buck.

On the data front, it’s a relatively tame week. There are no central bank meetings this week. Flash PMI data will provide a window to January data. In China, the lunar New Year celebrations begin for the year of the rooster.

1. Global equities showing mixed results to Trump’s speech

In Asia, stocks saw mixed results overnight on widespread investor caution about getting overly bullish on the Trump reflation trade.

On the weekend, President Trump declared his intentions to withdraw from TPP, a 12-nation trade pact that Japan and Australia also have signed up for. The Nikkei closed -1.3% lower, with exporters reacting to the yen’s rise (¥113.52), while the Aussie’s ASX 200 dropped -0.8% to notch a sixth decline in eight sessions.

In China, the Shanghai Composite rose +0.4% and the Shenzhen Composite climbed +0.9% as the People’s Bank of China (PBoC) added temporary liquidity to the system ahead of the Lunar New Year.

In Europe, equity indices are trading lower across the board as market participants digest Trump’s inauguration speech. Financial stocks are trading notably lower, with the major banks leading the losses in the Eurostoxx and FTSE 100, while commodity and mining stocks are providing the support in the FTSE 100.

U.S futures are set to open in the red (-0.2%).

Indices: Stoxx50 -0.4% at 3,825, FTSE -0.6% at 7,155, DAX -0.3% at 11,590, CAC-40 -0.4% at 4,833, IBEX -35 -0.6% at 9,326, FTSE MIB -0.1% at 19,461, SMI -0.5% at 8,231, S&P 500 Futures -0.2%

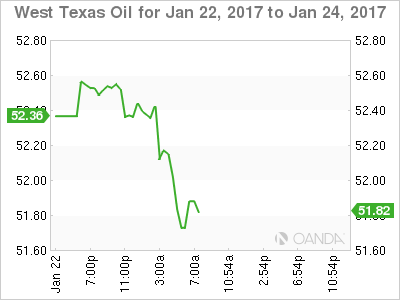

2. Energy prices start the week on the back foot

Oil prices have ticked lower ahead of the U.S open, falling for the first time in three sessions on fears that rising U.S. production will weigh on the market – U.S. oil production has risen more than +6% since mid-2016.

Note: U.S. energy companies last week added the most rigs drilling for new production in almost four-years. Baker Hughes report saw an uptick of +29 rigs in the week of Jan. 20, bringing the total count up to 551.

Brent crude futures are trading at +$55.42 per barrel, down -7c from Friday’s close, while U.S. West Texas Intermediate (WTI) crude futures are -11c lower at +$53.11 a barrel.

Production cuts by oil producers and a weaker dollar is preventing the market from dropping much further into the red.

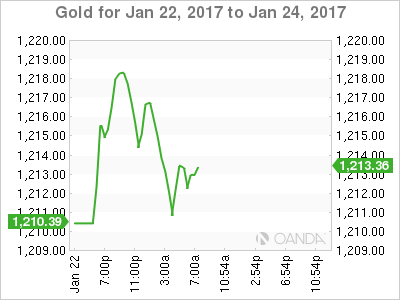

Gold prices (+$1,214.043) are on the rise, supported by a weaker dollar and safe haven buying on uncertainties over U.S. policy.

The yellow metals continues to shrug off better-than-expected U.S data that reinforces the view that the U.S. economy is sufficiently robust to warrant Fed rate hikes.

3. Sovereign yields are on the move

With U.S. corporate bonds having outperformed their European counterparts since November, has managed to narrow the gap between the dollar and euro yields.

Fixed income dealers now expect this trade to begin to lose steam, as the dollar corporate bonds cannot rely on the Fed’s support that their euro counterparts benefit from the ECB at the moment.

Ahead of the U.S. open, the 10-Year Treasury yield has fallen to +2.435%, after having risen briefly on Friday to +2.513%, its highest print this year. It’s equivalent 10-Year German Bund yield is little changed at +0.333%.

The U.S. 2-Year yield (the most sensitive to the Fed’s policy outlook) has dropped sharply to +1.18% from Thursday’s three-week high of +1.25%, giving back much of gains made after last week’s upbeat comments from Fed Chair Janet Yellen.

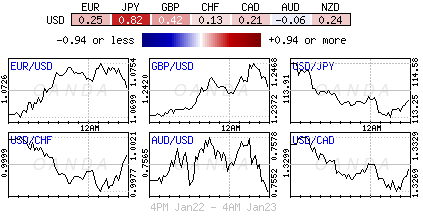

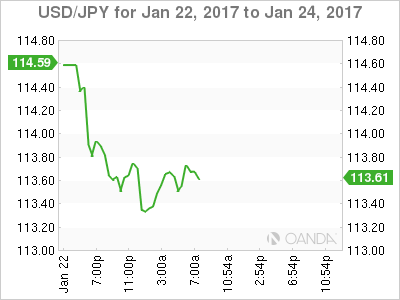

4. Trump's Protection Bias Damages Dollar

The first trading day after inauguration has the “mighty” buck seeing red due to Trump’s greater focus on protectionism than on economic stimulus.

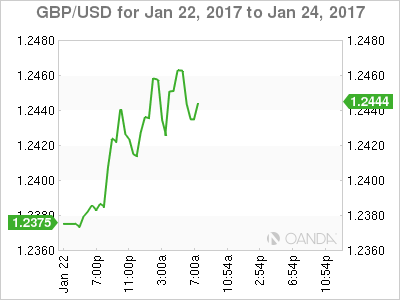

The EUR/USD has rallied +0.4% to a two-month high of €1.0757, while USD/JPY has lost around -1% to print an intraday low atop of ¥113.17, edging near last week’s low of ¥112.57. Even sterling has found some traction, rising +0.7% to a five-week high of £1.2473 before the U.K. Supreme Court ruling tomorrow (see below).

Emerging market currencies are finding support. The South African rand (ZAR) has gained +0.8%, the Mexican peso (MXN), which has weakened the most on Trump’s protectionist and anti-immigration stance, rose +0.8% to a two-week high of $21.415.

5. UK’s PM Theresa May waits for E.U. court ruling

Tomorrow’s U.K. Supreme Court ruling is widely expected to say that PM Theresa May “must” consult lawmakers before triggering Article 50 to leave the E.U. For investors, if the ruling goes in the PM’s favour it’s expected to be “very negative” for the pound (£1.2452).

Despite whatever the outcome, market consensus continues to see sterling underperforming ahead of Article 50 being triggered at the end of Q1.

Also, PM May is said to be the first foreign leader to meet U.S President Trump. On Friday January 27, the two leaders are expected to discuss future trading relationships, NATO and defeating terrorism. The U.S is said to be considering a “passport deal” that would allow British and American firms to set up and trade in each other’s countries with minimum regulatory hurdles.