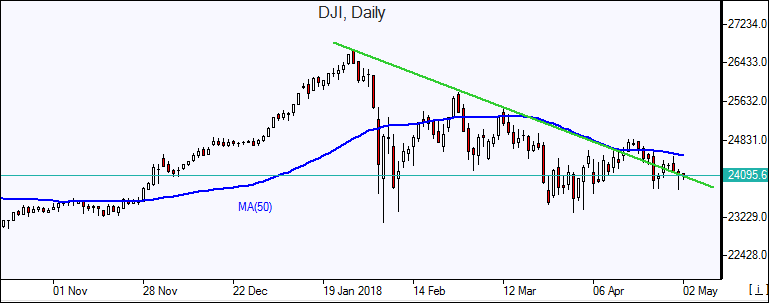

Dow falls third session in a row

US stocks recovered part of previous session losses Tuesday buoyed by technology shares rally. The S&P 500 added 0.3% to 2654.8. Six of 11 main sectors ended lower however. Dow Jones industrial average slid 0.3% to 24099.05, posting the third straight decline. The NASDAQ Composite rose 0.9% to 7130.70. The dollar strengthening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.7% to 90.755. Stock indices futures point to mixed openings today.

Technology shares rally was led by Apple (NASDAQ:AAPL), up 2.3%. Federal Reserve interest rate decision is expected today at 20:00 CET. The central bank is expected to keep the Fed funds rate in 1.5%-1.75% range. Investors will be looking for any sign policy makers may be considering a change to a tightening path to three more rate increases in 2018 instead of two. Data the previous day showed the personal consumption expenditure index, the Federal Reserve’s preferred inflation gauge, rose to 2% year over year in March from a 1.7% in February, hitting the central bank’s 2.0% target for the first time in a year. Higher rates act as a brake on economy as higher borrowing costs slow down business investment.

European stocks pull back

European stocks pulled back Tuesday with many markets closed for Labor Day. Both the euro and British pound decline against the dollar accelerated. The STOXX Europe 600 slipped 0.1%. UK’s FTSE 100 rose 0.2% to 75240.36. Markets opened mixed today.

Asian indices mostly lower

Asian stock indices are mostly lower today as investors await new developments in US-China tariff confrontation. China’s Vice Premier Liu He will meet a top-level US trade delegation in Beijing this week, according to Chinese state media. Commerce Secretary Ross said yesterday Trump was prepared to levy tariffs on China if the delegation did not reach a negotiated settlement to reduce trade imbalances. Nikkei lost 0.2% to 22472.78 with yen little changed against the dollar. Chinese stocks are falling despite the Caixin report indicating activity in China's factories expanded at a slightly faster rate in April: the Shanghai Composite Index is down 0.2% and Hong Kong’s Hang Seng Index is 0.3% lower. Australia’s ASX All Ordinaries is up 0.6% despite Australian dollar turning higher against the greenback.

Brent rebounding

Brent futures prices are edging higher today ahead of US inventory report as traders expect US inventories rose last week. The American Petroleum Institute late Tuesday report indicated US crude inventories rose by 3.4 million barrels last week. Prices ended lower yesterday as US Energy Information Administration reported domestic oil output rose to a record 10.264 million barrels a day in February. July Brent lost 2.1% to $73.13 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.