by Eli Wright

Stocks mostly gained yesterday with some indices including the Dow and Germany's DAX nearing benchmark levels – this despite thinning volume ahead of the Christmas holidays. Activity on the S&P and Dow was 20% lower than the 30-day average, reflected by muted swings in volatility; the VIX is down 2.22% to 11.45.

In Asia overnight, the Shanghai Composite was up 1.09% from a six-week low, climbing to 3,136.77. The Hang Seng rose 0.5% to 21,838. The Nikkei, however, fell 0.26% from its 2016 closing high, to 19,444.49 as losses in the steel, fishery and precision Instruments sectors led shares lower

In Europe this morning, the FTSE is down% to 0.17% to 7,032.30; the DAX is flat at 11,453.50, and the Stoxx 50 is down 0.43%, at 3,265.50.

On Wall Street, despite yesterday morning's bearish coil, the Dow rallied to within 13 points of the 20K benchmark, before closing up 0.46%, at a record 19,974.62. The S&P 500 rose 0.36% to close at 2,270.76, one point removed from its all-time high; the NASDAQ gained 0.49% to 5,483.94; and the Russell 2000 finished 0.73% higher, at 1,385.28.

In pre-market trading, the S&P is flat, while the NASDAQ and Dow are up 0.04% and 0.08%, respectively. Look for buyers to push their advantage at the start of today’s session. As Chris Weston, chief market strategist at IG said in a commentary describing Australia's S&P/ASX 200:

“It's a good day to be an equity bull. However, it's a slow grind higher as opposed to an explosion in demand and the moves we are seeing in many markets are fairly subdued.”

At this point, it will take just a 0.1% increase to boost the Dow to 20,000.

Bond yields dropped slightly across the board. The 2-year note is at 1.225%; 10-year yield is at 2.55%; and 30-year yield is at 3.133%.

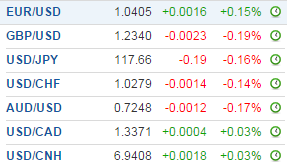

Forex

The dollar is broadly weaker this morning. The euro, which touched a 14-year low yesterday, has recovered slightly, to $1.0405; the yen and Swiss franc have bounced as well. The cable and Canadian dollar, however, remain depressed.

The Dollar Index has dropped 0.07% as of this writing, to 103.22.

Commodities

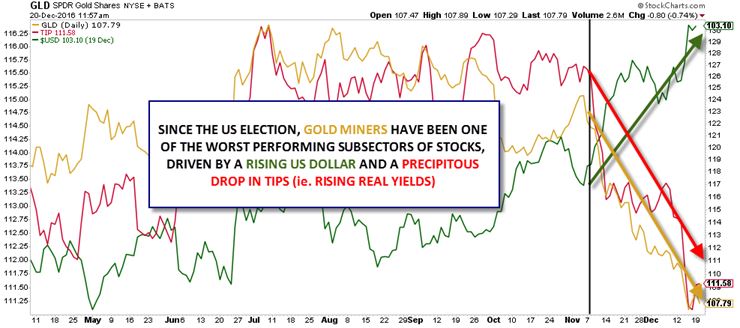

Gold settled lower yesterday, after traders regained their risk-on sentiment, but the precious metal is up 0.32% this morning, at $1,137.25. The Trump Bump, higher dollar, and increasing Treasury yields have all contributed to the yellow metal's decline. Some are wondering if the precious metals sector will ever come back

Source: Stockcharts.com

Of interest, and perhaps sadly for them, millennials—the US population segment that by and large supported Hillary Clinton over Donald Trump in the US election—never considered that Trump would actually help the stock market, and instead plowed money into gold ETFs such as the Direxion Daily Gold Miners Bull 3X Shares Fund, (NYSE:NUGT) and the Direxion Daily Junior Gold Miners Bull 3X Shares Fund (NYSE:JNUG), which in conjunction with gold, have fallen dramatically since November 9, down 54% and 61%, respectively. The lesson? Don’t put your money where your heart is; remain objective.

Silver is also up slightly today, rising 0.32% to $16.168. The white metal could go as high as $16.60. However with bears in firm long-term control, a move below $15.80 is also possible.

Oil is up 0.75%, to $53.70, as US API weekly crude supplies fell 4.15 million barrels, more than the expected 2.5 million barrel decline. Official data from the Energy Information Administration will be released later today. It's also expected to show a 2.5 million decrease in oil supplies. Also contributing to the rise in oil prices: yesterday President Obama banned new oil and gas drilling in Federal waters in the Atlantic and off of the coast of Alaska. Should Trump want to repeal this action, he will have to fight it in court. Brent is up 0.89%, to $55.84.

Stocks

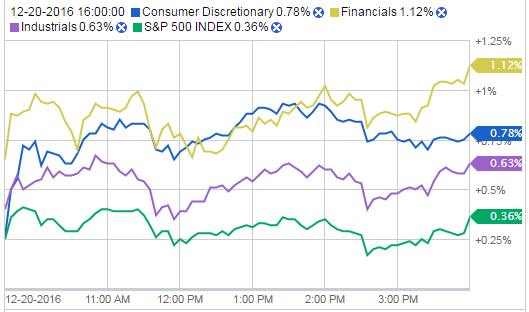

The Financial, Consumer Discretionary, and Industrial indices all outperformed the overall S&P yesterday.

Source: Fidelity.com

The 1.12% gain in financial stocks was led by Charles Schwab (NYSE:SCHW), which rose 3.61%, and BlackRock (NYSE:BLK), which ended 2.23% higher. Citizens (NYSE:CFG), PNC (NYSE:PNC), and Citigroup (NYSE:C) each gained approximately 2%. Goldman Sachs (NYSE:GS) was up 1.68%.

Consumer Discretionary gains were led by travel stocks: TripAdvisor (NASDAQ:TRIP) gained 5.04%; Royal Caribbean Cruises (NYSE:RCL) increased 3.45%, and Carnival (NYSE:CCL) rose 2.28% following a better than expected Q4 earnings report, though the company warned that increased fuel prices going forward could have an impact on 2017 earnings.

Major bricks-and-mortar retailers, including Kohl’s (NYSE:KSS), Macy’s (NYSE:M), Nordstrom (NYSE:JWN) were all up, as were home improvement giants Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD). Electronics retailer Best Buy (NYSE:BBY) was up as well. Toy makers Hasbro (NASDAQ:HAS) and Mattel (NASDAQ:MAT) both pushed higher.

Nike (NYSE:NKE) reported Q2 2017 earnings yesterday, coming in below analyst forecasts, but shares nevertheless rose 1.85%. Gains were driven on increased US and China demand.

The big Industrials performers yesterday were Emerson (NYSE:EMR), Caterpillar (NYSE:CAT), and Deere (NYSE:DE).

Transports—airlines in particular—did well too. United Continental (NYSE:UAL) added 2.11%; Alaska Air (NYSE:ALK) was up 1.36% and American Airlines (NASDAQ:AAL) gained 1.32%.

Twitter Inc (NYSE:TWTR) was yesterday's big Tech sector loser, falling 1.75%, as both Adam Messinger, the company's chief technology officer and Josh McFarland, a vice president of product, both announced they were leaving the social media company.

Year-to-date, Twitter has fallen approximately 23%. It soared in late September and early October—up 20% at one point to $25.25—on takeover rumors, but when no actual acquirer materialized, the share price collapsed. Twitter closed yesterday at $17.92 – and it could fall to the $16.60 area next.

The average analyst consensus for Twitter's 12-month price target is $16.95, but the low estimate is severe...a depressing $10.