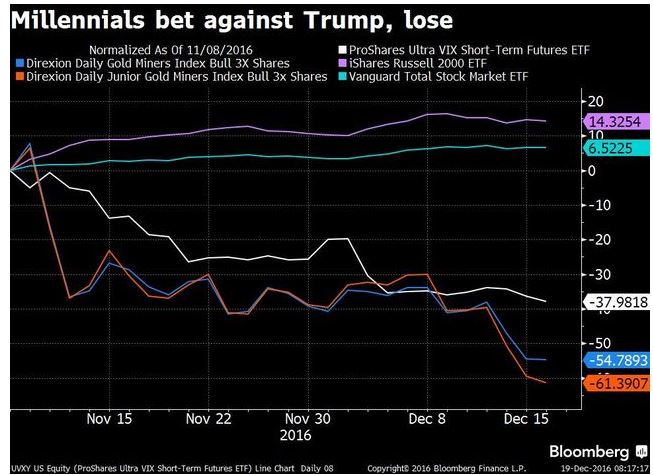

Bloomberg ran a fascinating article on millenials' investment decisions in the wake of the US Presidential election. Apparently, younger investors plowed money into highly leveraged defensive ETFs, including triple levered gold miner ETFs like NUGT and JNUG, as well double-levered short-term VIX futures, UVXY. To say that these wagers were ill-fated would be an understatement: the three ETFs highlighted have fallen an average of 51% in just six weeks.

Source: Bloomberg

Of course, this article serves as an indictment on forecasting market reactions to external shocks, a big reason why one of our mantras is to "trade what you see, not what you believe." At a more superficial level, it also shows that gold-mining stocks and, by extension, the price of gold itself, have fallen precipitously over the last several weeks.

Whenever you're examining the gold market, there are two major drivers: the value of the U.S. dollar and real interest rates.

Of course, gold is denominated in U.S. dollars on the international market, so all else equal, a decline in the value of the dollar would increase the price of gold in dollars and vice-versa. Beyond this mechanical relationship, the U.S. dollar has also become a bit of a “risk” currency given the (relative) hawkish positioning of the Federal Reserve, meaning that traders buy the dollar when they're feeling optimistic about the global economy, often selling safe-haven assets like gold or the Japanese yen to fund the purchase.

The other major fundamental driver of gold prices is real interest rates, or the interest rate on inflation-indexed bonds. Real interest rates simply represent the opportunity cost of holding gold. When real interest rates are low, investment alternatives like cash and bonds tend to provide a low or negative return, pushing investors to seek alternative ways to protect the value of their wealth.

On the other hand, when real interest rates are high, strong returns are possible in cash and bonds and the appeal of holding a yellow metal with few industrial uses diminishes. Beyond the opportunity cost of holding gold, interest rates also play a role in the cost of funds when buying gold on margin, as many traders do.

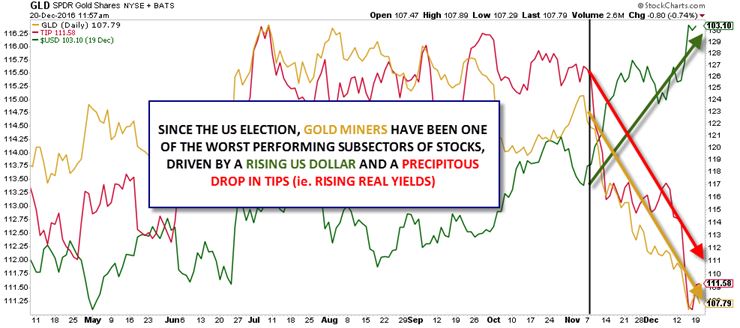

The chart below (using TIP as an inverse proxy for real yields) shows this relationship:

Source: Stockcharts.com

If these conditions (a strong U.S. dollar and rising real yields) remain intact in the coming months, gold miners could see their troubles extend into 2017. Value hunters looking to buy gold miners in 2017 may want to wait for signs of a top in the dollar and in real yields (bottom in TIPS) before trying to pick a bottom.