by Pinchas Cohen

Key Events

- Investors are fearful of market highs, despite release of good earnings reports and no expectation of Fed rate changes.

- President Donald Trump’s problems deepen with widening Russia probe. Still, equities rise to a record $78 trillion value.

- OPEC has no reduction in sight, but it doesn’t mean they aren't trying to spin investor outlook.

Global Affairs

The global market opened negatively with Asia Pacific shares falling, though they closed mixed, while the yen advanced for a fifth day. The MSCI Asia Pacific has fallen for the first time in 11 days, but has since stabilized. Investors are demonstrating caution ahead of a week bursting with earnings releases and a Fed interest rate decision.

European shares were sold off on Germany’s top automakers coming under investigation for collusion on prices and the design of diesel emissions treatment systems. Among the companies in question are BMW (DE:BMWG), Volkswagen (DE:VOWG_p), Audi (DE:NSUG) and Porsche (DE:PSHG_p).

Volkswagen gapped down 2.85 percent and rebounded 0.40 percent. The plunge crossed below the uptrend line since February 2016, after managing to climb back above it. Should it fall below its initial downside breakout, the June low of 134.90, it would suggest a downtrend.

So far, of the US companies that have already reported earnings, 20 percent beat expectations with earnings near 10 percent. So, why are investors turning cautious? There are no expectations of an interest rate change later this week, and the Fed already slowed its path of hikes. So, why have investors put the brakes on last week’s rallies? What are they scared of?

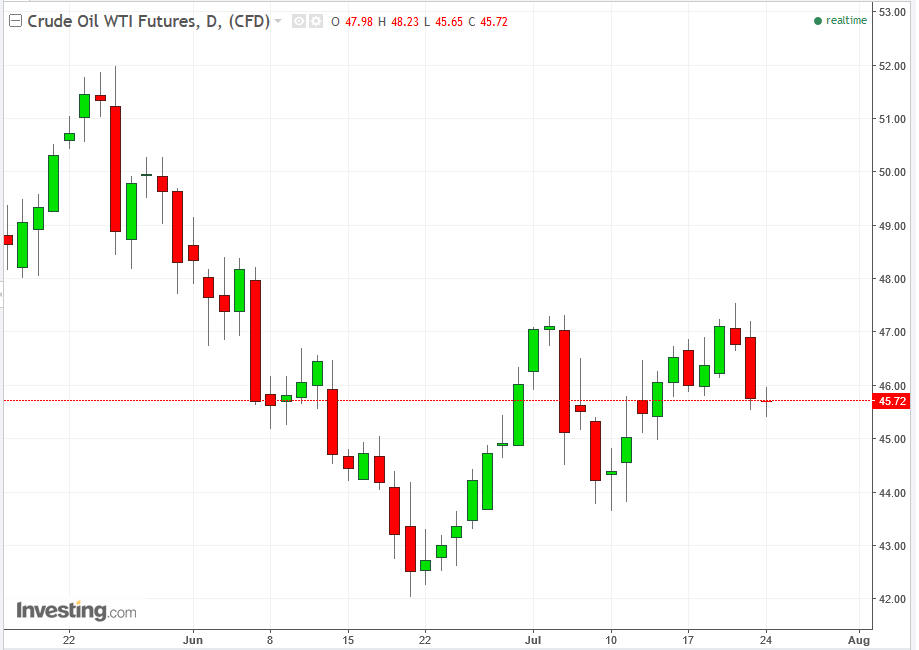

Oil was suppressed below $46 a barrel, and plunged a quarter-percent between in early morning trade, ahead of an OPEC meeting, whose headline excludes curbing Libyan and Nigerian production. Unidentified sources claim the two African members are willing to cap output if they can maintain 1.8 million barrels a day for Nigeria, and 1.28 million barrels a day for Libya. Both countries have boosted their output— Nigeria from 1.5 to 1.75 million barrels a day and Libya from 630,000 to 840,000 barrels a day.

However, OPEC Secretary-General Mohammad Barkindo told reporters on Sunday in St. Petersburg, that while:

“The re-balancing process may be going on a slower pace than we earlier projected, but it is on course, and it’s bound to accelerate in the second half.”

It will go faster in the second half of the year, as demand will rise and the oil market will need even more Libyan and Nigerian crude. This is spinning taken to a masterful level, particularly at a time when oil's price has plunged because of global glut. Oil pared its losses as of 4:42 EDT and is flat with yesterday’s close.

Investors will be following this week’s earnings from industry leaders, beginning today with Alphabet (NASDAQ:GOOGL), and will continue through Thursday with Amazon (NASDAQ:AMZN). Traders hope these earnings will demonstrate that this bull market, valued at $78 trillion, is still charging ahead.

Optimism continues, even as President Trump, upon whom so much faith was placed to restart the economy, is struggling to keep his administration functioning as the Russia probe increases in magnitude and after two senior spokesmen from his inner White House circle have resigned.

Up Ahead

- 9:45: US - Manufacturing PMI (July, flash): expected to rise to 52.3 from 52. Markets to watch: Dow Jones, S&P 500, NASDAQ Composite, USD crosses.

- 10:00: US - Existing Home Sales (June): forecast to rise to an annual rate of 5.64 million from 5.62 million. Markets to watch: S&P 500, USD crosses—especially against the JPY.

- Martin Marietta Materials (NYSE:MLM), listed on the S&P 500, could see its stock move on this week's existing home sales announcement. It's a leading supplier of building materials. On June 26, it crossed below its uptrend line since the beginning of the year. Should it decline below its $201.77 March low it will have completed a double-top.

Earnings

Alphabet is scheduled to report earnings after market close, for the fiscal quarter ending June 2017. Consensus EPS for the internet giant forecast for the quarter is $8.2 vs $7 YoY.

On Thursday, the stock got stuck under the resistance of the June 26 peak. On Friday it climbed back toward its high of the day, but failed to surpass it. This invites an attractive risk-reward ratio for a short, unless earnings won’t blow the stock past its June 6 peak, which would provide an implication for a top.

Mobileye (NYSE:MBLY), the company recently acquired by Intel (NASDAQ:INTC) which develops systems for autonomous driving is scheduled to report earnings. Consensus EPS forecast for the quarter is $0.18, vs $0.11 YoY.

IBM (NYSE:IBM), the US's biggest manufacturer, had its stock drop after posting 21 consecutive revenue declines, ending a return move to its broken uptrend line since June.

Global Indices

- The Stoxx Europe 600 fell 0.2 percent as of 8:33 a.m. in London (3:33 EDT), after dropping 1 percent on Friday. Automakers dropped 2.2 percent.

- The MSCI Asia Pacific Index was flat after rallying over the past two weeks to its highest level in more than 10 years.

- Japan’s TOPIX slid 0.5 percent, after falling as much as 1 percent earlier in the day.

- Australia’s S&P/ASX 200 Index lost 0.6 percent.

- China's Shanghai Composite advanced 0.4 percent while Hong Kong’s Hang Seng was 0.5 percent higher.

- India’s Sensex climbed 0.6 percent to a record high.

- S&P 500 futures fell 0.2 percent. The underlying gauge closed flat on Thursday and Friday last week.

Currencies

- The yen climbed 0.3 percent to 110.78 per dollar, its highest level since June 19.

- The Dollar Spot Index retreated less than 0.1 percent, after dropping for two straight weeks.

- The euro fell 0.1 percent to $1.1648.

- The British pound added 0.1 percent.

- The Australian dollar rose 0.5 percent, trading above 79 U.S. cents ahead of a speech by Reserve Bank of Australia Governor Philip Lowe on Wednesday. Guy Debelle, the central bank’s No. 2, appeared to tone down the RBA’s more hawkish tone last week.

Commodities

- WTI crude fell 0.3 percent to $45.63 a barrel. Limiting oil output from Nigeria and Libya won’t be on the agenda when OPEC meets on Monday. Both African nations are saying they’ll need to keep pumping at a higher level before they can join a global effort to stem a supply glut, according to two people familiar with the planned talks.

- Gold slipped less than 0.1 percent to $1,254.48 an ounce, after climbing for the past two weeks.

Bonds

- The yield on the 10-year Treasury note was flat at 2.24 percent.

- Australian benchmark yields fell two basis points to 2.68 percent.

- French and German 10-year yields were little changed, while UK gilts rose one basis point to 1.18 percent.