by Eli Wright

Despite Trump’s remarks that the U.S. would quit the Trans-Pacific Partnership (TPP) deal on his first day in office, Asian markets were barely affected in overnight trading. The Hang Seng closed at the same level as yesterday at 22,676.69. Trump has also insisted he would raise import taxes on China. However, the Shanghai Composite barely flinched, dropping a mere 0.24%, to 3,240.51. Equity markets in Japan are closed today for a holiday.

In Europe the FTSE is trading 0.4% higher at 6,846; the DAX and Euro Stoxx 50 are both down 0.6%, at 10,650 and 3,026 respectively.

Wall Street continued to break records yesterday, as blue-chips, large companies, technology shares, and small cap stocks all scaled higher. The Dow reached an important milestone, moving higher by 0.35% and crossing 19,000 for the first time in its history; the NASDAQ climbed 0.33%, to close at 5,386.35; the S&P passed the 2,200 threshold, rising 0.22%; and the Russell 2000 closed 1% higher at 1,335.91.

In pre-market trading the S&P, NASDAQ and Dow are all down approximately 0.05%. The Russell 2000 has fallen off its high by 0.13% to 1,332.7.

Bond yields are holding steady: US 10-Year Treasuries are at 2.314%; 30-Year yield is 3%.

Forex

The dollar remains bolstered by rate hike expectations and positive economic data. Further manufacturing and housing data comes out today: Core Durable Goods Orders at 8:30 AM ET and U.S. New Home Sales figures at 10:00 AM ET. The Dollar Index currently stands at 101.10.

The Japanese yen continues to struggle; even with moderately optimistic reports, the pound seems unable to push past $1.267; and the euro zone’s widening interest rate differentials versus the dollar is pushing the euro closer to parity than to the next resistance level at $1.07.

Donald Trump’s stated protectionist and nationalist trade policies are suppressing emerging markets – and currencies. The Brazilian real, Indian rupee, Chinese yuan, and Mexican peso are all struggling due to Trump’s trade rhetoric. There is however hope in Russia, where a good Trump-Putin relationship could help end sanctions.

Commodities

Gold was expected to test the $1,200 support levels, but now it seems to be creeping upwards. Has the precious metal already priced in a rising dollar and the expected interest rate hike next month? If it hasn’t, $1,200 remains the breaking point, after which a steeper fall is possible. However, if this is as low as it gets, this could be a nice entry point for safe haven investors.

Silver is currently trading at $16.627. If buyer sentiment returns, it could bounce to $17.10 in the near term. However, if the strong nearly six-year downward trend persists, it could just as easily revert to a flat $16.

Copper keeps trying to climb, and is currently at $2.533, near sixteen-month highs. At this point, let’s see if it can bounce to $2.62. Other industrial metals, such as iron, zinc, nickel, and aluminum, are also seeing increased demand.

Oil continues to rise on increasing optimism over an OPEC deal to limit output. However, several key members are seeking exemptions. Therefore, unless a deal is actually reached, we remain skeptical. Additionally, Trump’s plans to make the United States energy-independent will at least bolster U.S. stockpiles. Crude is currently priced at $48.30. Brent is trading at $49.39.

Weekly U.S. Crude Oil Inventories figures will be released at 10:30 AM ET.

Stocks

Thanksgiving is upon us, which means Black Friday and the official start of the holiday shopping season. The market will be closed all day tomorrow, and close early on Friday (at 1 PM ET). However, it can’t be overstated just how vital this time of year is for many retailers, since 30% of annual sales and 40% of profits occur in this fourth quarter.

The National Retail Federation (NFR) is predicting a 3.6% increase in retail spending in November and December – “significantly higher than the 10-year average of 2.5 percent and above the seven-year average of 3.4 percent since recovery began in 2009.”

ComScore foresees a 12% YoY jump in Cyber Monday online spending, to $3.5 billion. That forecast would indicate a strong start to the holiday shopping season. Predictions estimate that online sales over the complete holiday season could increase by as much as 19%.

E-tail and bricks-and-mortar alike have raised sales forecasts for the quarter, and Amazon (NASDAQ:AMZN), Wal-Mart (NYSE:WMT), Target Corporation (NYSE:TGT), Macy’s Inc (NYSE:M), Kohl’s Corporation (NYSE:KSS), and eBay Inc (NASDAQ:EBAY) are all optimistic.

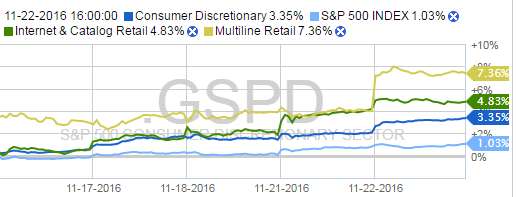

Over the past five days, the S&P Consumer Discretionary Index (the third-largest sector in the S&P, with a $4.43 trillion market cap) outperformed the broader S&P, with Multiline Retail (which includes department store operators and stores offering diversified general merchandise) especially seeing a sizeable 7.36% increase.

Source: Fidelity.com

Investors looking to act on the rising retail and online sales expectations can take a look at ETFs, including VanEck Vectors Retail (NYSE:RTH), SPDR S&P Retail (NYSE:XRT), PowerShares Dynamic Retail (NYSE:PMR), and Direxion Daily Retail Bull 3X Shares (NYSE:RETL).