by Eli Wright

The US dollar is markedly lower against a basket of currencies, which has helped lift gold by 0.6% so far this morning. US equities were up yesterday on growth in the auto sector, but the retail sector is weighing on US indices today because of negative after-the-close reports yesterday from several bricks-and-mortar retailers. Right now, global indices are mixed.

In Asia overnight, the Nikkei fell 0.37% to 19,520.69. However, the Shanghai Composite inched 0.18% higher, to 3,164.60 and the Hang Seng gained 1.46% to close at 22,456.69.

In Europe this morning the FTSE is up 0.09% to 7,196.40 and the Stoxx 50 is 0.05% higher, at 3,315. The DAX, however, is down 0.15%, to 11,567.

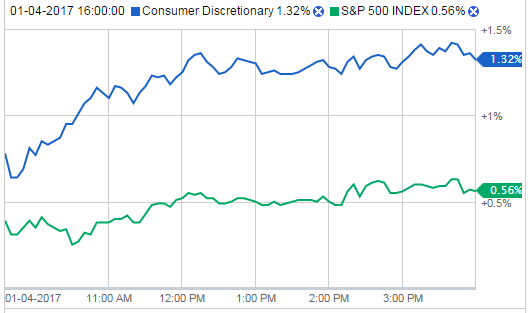

On Wall Street yesterday, the Dow rose 19,942.16; the S&P 500 gained 0.56% at 2,270.75; and the NASDAQ closed 0.88% higher, at 5,477. Small-caps saw the largest increases, as the Russell 2000 jumped 1.69% on the day, to finish at 1,389.12, five points off its record high.

In pre-market trading, however, things aren't so rosy; the Dow is down 0.03%; the S&P is down 0.07%; and the NASDAQ is down 0.13%.

US Treasury yields are lower across the board: the 2-year yield is at 1.222%; the 10-year yield is at 2.434%; and the 30-year yield is at 3.034%.

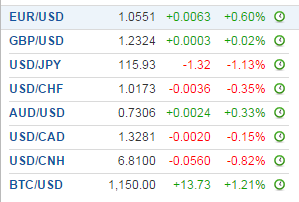

Forex

The Fed’s December meeting minutes were released yesterday, revealing a less hawkish tone than previously thought.

“Members agreed that there was heightened uncertainty about possible changes in fiscal and other economic policies as well as their effects,” the minutes of the Dec. 13-14 meeting said. “About half of the participants incorporated an assumption of more expansionary fiscal policy in their forecasts.” However, they “agreed that it was too early to know what changes in these policies would be implemented and how such changes might alter the economic outlook.”

The US Dollar Index has fallen approximately 1.2% since yesterday; as of this writing it’s at 101.95, breaking below its consolidation levels from the past three weeks.

The Fed may be more cautious than initially assumed, especially in light of how the incoming administration’s fiscal policies might affect the US economy; the next rate hike isn’t expected until June-July, 2017. Despite this upside risk, there is little doubt that the direction for US monetary policy is divergent from most other major central banks, since the Fed looks to be the only central bank raising rates in the near future.

Today’s ADP report, initial jobless claims, and ISM non-manufacturing PMI might influence the dollar’s trajectory. However, the big driver, at least in the short term, will be tomorrow’s nonfarm payrolls report.

The dollar is currently down against the euro, cable, and yen among others. Commodity currencies, including the Australian and Canadian dollars, have also advanced as oil prices remain elevated and gold bounced higher.

Commodities

Not much has changed for oil. Brent and crude are both holding steady, at $56.33 and $53.20 respectively. As has been said here earlier this week, where prices go from now will largely depend on how strictly the OPEC production cuts deal is adhered to by participants. Later today, the EIA releases weekly crude oil inventories information, which is expected to decrease by 2.152M.

A frigid December in the US drove natural gas prices up to $3.93 at the end of the month. However, updated weather forecasts now point to higher-than-normal temperatures across large swathes of the country until at least mid-January. As a result, the price of gas has fallen 17% in the past week – down to $3.265.

Even though demand may decrease in January, total natural gas in storage currently stands at 3.360 trillion cubic feet, nearly 11.0% lower than levels at this time a year ago and 2.3% below the five-year average for this time of year. With supply levels lower—and we’ll know even more once natural gas inventory figures are released later this morning—prices could stay elevated.

Gold is in the midst of a four-day rally, up 2.3% over that time period, to $1,177.95. There is now some room for bullish optimism on the depressed commodity.

If dollar weakness persists, the yellow metal could extend to $1,215, back above the $1,200 level that represented strong support from February-November, 2016, up until after the election. Downside risk could see gold fall to $1,140.

Silver also continues to rally; the white metal is 0.72% higher this morning, trading at $16.672.

Stocks

As mentioned above, the S&P rose 0.56% yesterday, but the biggest gains were seen in the Consumer Discretionary Index, which added 1.32%.

Source: Fidelity.com

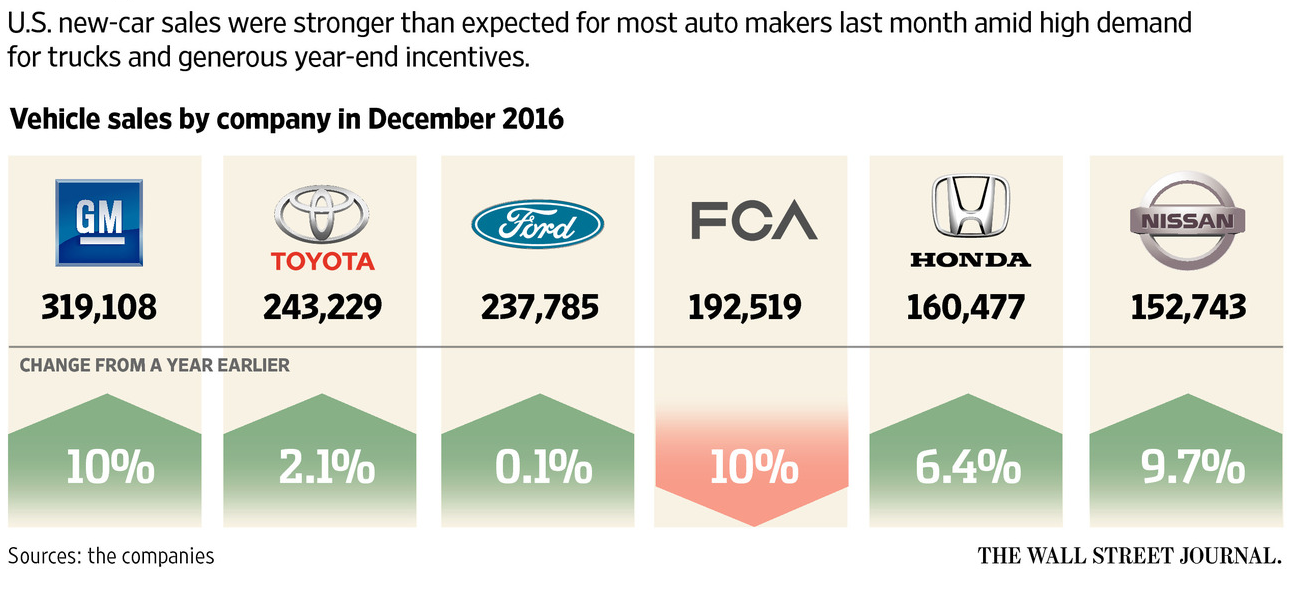

On the heels of a second straight annual auto sales record, the top gainers in the Consumer Discretionary sector were General Motors (NYSE:GM) and Ford (NYSE:F), which rose 5.52% and 4.61%, respectively.

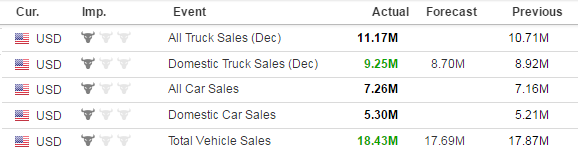

Source: Investing.com

Stronger than expected truck and auto sales also helped AutoNation (NYSE:AN), the largest automotive retailer in the United States, which gained 3.94%; auto parts manufacturer Delphi Automotive (NYSE:DLPH), rose 3.7%; and CarMax (NYSE:KMX), the largest used-car retailer in the US, climbed 3%. Goodyear Tire (NASDAQ:GT) rose 2.6%, as well.

Non U.S. car-makers, boosted by strong December sales, gained as well. Toyota (NYSE:TM) sales grew 2.1%, sending the stock 2.23% higher. Honda (NYSE:HMC) sales increased 6.4% and shares rose 3.55% as a result. Nissan (OTC:NSANF) vehicle sales jumped 9.7%, boosting the company's US shares by 1.85%.

Fiat Chrysler (NYSE:FCAU) was one of the few laggards; sales actually declined 10% for the automaker. FCA shares rose 1.36 yesterday, but are down 1.07% in pre-market trading.

Switching gears from automobiles to bricks-and mortar retail, Macy’s (NYSE:M) and Kohl’s (NYSE:KSS) both reported weak holiday sales, with 2.1% declines for each retailer in November and December YoY. Macy’s also said it planned to close 68 stores in 2017 and slash more than 10,000 jobs.

Kohl’s stock was up 4.22% yesterday and Macy’s shares were 1.73% higher, both contributing to the gains on the Consumer Discretionary Index. However, Kohl’s stock nose-dived 15.09% after the closing bell, while Macy’s shares plunged 10.85%.

The news had a spillover effect on other retailers as well. Nordstrom (NYSE:JWN) and JC Penney (NYSE:JCP) both lost more than 5% in after-hours trading.