Friday May 26: Five things the markets are talking about

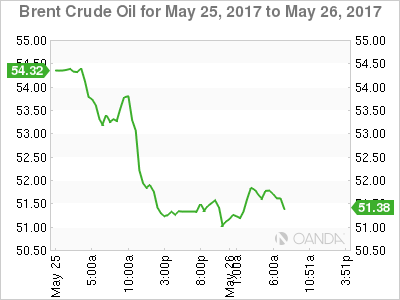

Battered Brent Crude Oil prices have stopped the bleeding for now as the market seems to be looking past the disappointment that yesterday’s OPEC meeting did not expand on production cuts, instead of extending.

Global equities too are under pressure following crude oil’s -5% loss yesterday; the loss seems to have undermined sentiment towards risk assets in general.

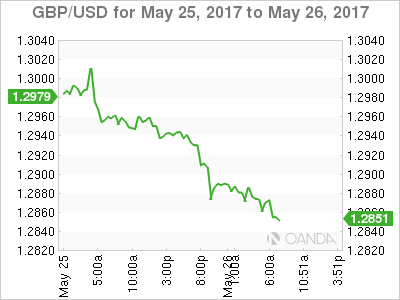

The pound has slid on a poll showing PM Theresa May’s Conservatives’ lead shrinking, two weeks before an election. According to the latest YouGov/Times poll, the Conservatives lead Labour by +43% to +38% ahead of June 8 election.

Comments from the St. Louis Fed President Bullard (dove) in Tokyo this morning are weighing on the ‘mighty’ dollar as he noted “prices are deviating noticeably from the Fed’s +2% inflation path” and called market expectations of “two more rate hikes this year as too aggressive.”

1. Stocks lose some appeal on risk attitude

In Asian overnight, regional bourses traded mostly mixed despite the continued bullish momentum stateside, where the sixth consecutive positive session Thursday took U.S indices to new record highs.

In Japan, the Nikkei share average extended its losses (-0.6%) as the yen’s gains (¥111.03) outright accelerated – the benchmark index still managed to cap off a winning week (+0.5%). The broader Topix fell -0.6%.

In Hong Kong, stocks broke a five-day winning streak, as gains in air carriers were offset by weakness in energy shares. The Hang Seng index was unchanged, while the China Enterprises Index gained +0.1%. For the week, both Hang Seng and HSCE gained +1.8%.

In China, stocks have ended the week higher with state-led buying offsetting the midweek Moody’s downgrade. The blue-chip CSI 300 index fell -0.2%, while the Shanghai Composite Index added +0.1%. For the week, CSI300 advanced +2.3%, while the SSEC gained +0.6%.

In Europe, regional indices trading mostly lower led by the FTSE MIB and French CAC, with the FTSE100 outperforming having traded new all time highs, mostly supported by a weaker pound (£1.2860).

U.S stocks are set to open in the red (-0.1%).

Indices: Stoxx50 -0.7% at 3559, FTSE +0.1% at 7524, DAX -0.4% at 12568, CAC 40 -0.7% at 5298, IBEX 35 -1.0% at 10831, FTSE MIB -1.0% at 21083, SMI -0.2% at 9019, S&P 500 Futures -0.1%

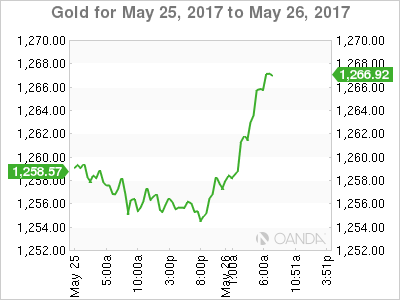

2. Oil stops the bleed for now, gold shines

Oil prices have edged higher ahead of the U.S open, but remain on the back foot after plummeting -5% in yesterday’s session when OPEC and some non-OPEC producers agreed to extend a pledge to cut around -1.8m bpd until the end of the Q1 2018. The market was pricing in “longer or larger curbs.”

Brent crude futures are at +$51.80 per barrel, up +0.66% from Thursday’s close. They are still set to end today’s session with a weekly loss of more than -3%. U.S West Texas Intermediate (WTI) crude futures continues to trade below the psychological +$50 handle, at +$49.15, though still up +16c from yesterdays close.

A weaker dollar coupled with a pullback in investor risk appetite is supporting gold. In the overnight session, spot gold has rallied +0.5% to +$1,261 an ounce, and is poised for a +0.5% gain for the week.

3. Global yields fall on risk attitude

It’s not just a calm tone in equities, the bond market’s volatility index has fallen to its lowest level in nearly three years this week as the Fed minutes further reduce risk of a big rise in yields.

Note: A lower reading suggests that investors expect smaller price swings or a relatively tight trading band for yields.

Currently, fixed income dealers expect the U.S 10-year Treasury yield to continue to trade between +2.20% and +2.50% in the near-term. Ahead of the open stateside, U.S 10s have backed up +1 bps to +2.24%.

In Europe, the bond market is being supported by muted expectations of a rapid turnaround in the ECB’s policy. French (OAT’s) 10-year yields are little changed, while German Bunds have dropped -1 bps to +0.36%.

In Japan, 10-year JGB yield declined -0.01 bps to +0.035% on disappointing CPI data overnight (see below).

4. ‘Big’ dollar remains under pressure

The pound has been one of the big movers with sterling falling to a new two-month low against EUR at €0.8724 after a YouGov opinion poll showed the lead for PM Theresa May’s Conservative Party falling by -5 points ahead of the June 8 election. Outright, GBP/USD has dropped -0.5% to a two-week low of £1.2861, easily extending Thursday’s fall after data revealed an unexpected downward revision to U.K Q1 GDP.

The EUR/USD (€1.1227) continues to hover atop of the psychological €1.12 handle. Many expect the ‘single’ unit pullbacks to be brief and shallow. The ‘bulls’ believe the EUR is in the process of going higher – the prospect of the ECB announcing a path to more tapering of its asset-purchase program at the June ECB meeting, improving eurozone economic activity, and rising eurozone capital inflows is expected to support the currency towards €1.1275 -1.13.

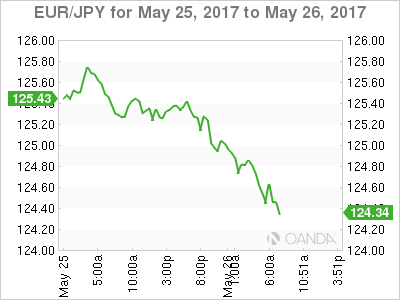

JPY (¥110.98) currency is firmer in the aftermath of Japan’s April CPI data.

5. Japan’s inflation recovers

Rising energy prices in April are finally making a dent in ‘disinflationary’ forces in Japan, as headline CPI hit a three-month high while Core-CPI (ex-food) hit a two-year high.

Japan National CPI rose for the fourth consecutive month – y/y +0.4% vs. +0.4%e; Core-CPI +0.3% vs. +0.4%e.

Overall, despite the uptick, the data remains well below the BoJ’s target. However, the consensus continues to expect higher inflation in Japan in coming months due to a tightening labor market and a recovery in energy prices.