Trend Model signal summary

Trend Model signal: Risk-on

Trading model: Bullish

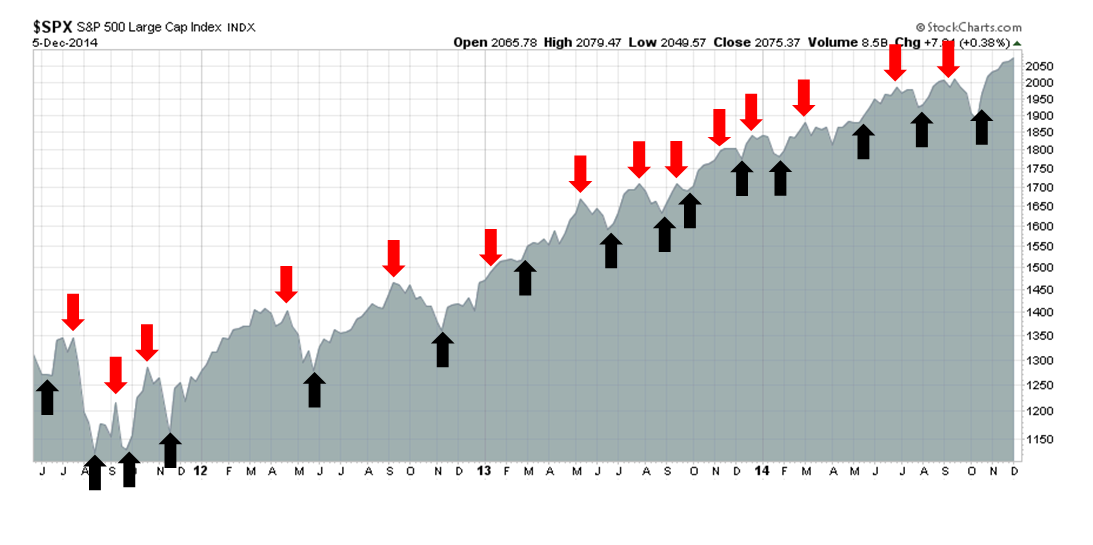

The Trend Model is an asset allocation model used by my inner investor. The trading component of the Trend Model keys on changes in direction in the Trend Model - and it is used by my inner trader. The actual historical (not back-tested) buy and sell signals of the trading component of the Trend Model are shown in the chart below:

Update schedule: I generally update Trend Model readings on weekends and tweet any changes during the week at @humblestudent. In addition, I have been trading an account based on the signals of the Trend Model. The last report card of that account can be found here.

My inner trader takes the stage

As the year draws to a close, I thought that I would do something a little different and allow my inner trader to outline his trading plan for December. Next week, my inner investor will have his chance to address his views for 2015.

You may recall that last week (see Trust (the bull), but verify (the trend)), even though the trend remained bullish, I had "called an audible" and gone to cash because I was unsure of the market reaction to the drop in oil prices. The OPEC decision had occurred over the US Thanksgiving holiday and, while the US markets were open Friday, many major market participants had gone away and volume was light. By Wednesday, I was sure enough about the trend that I dipped my toe back on the long side:

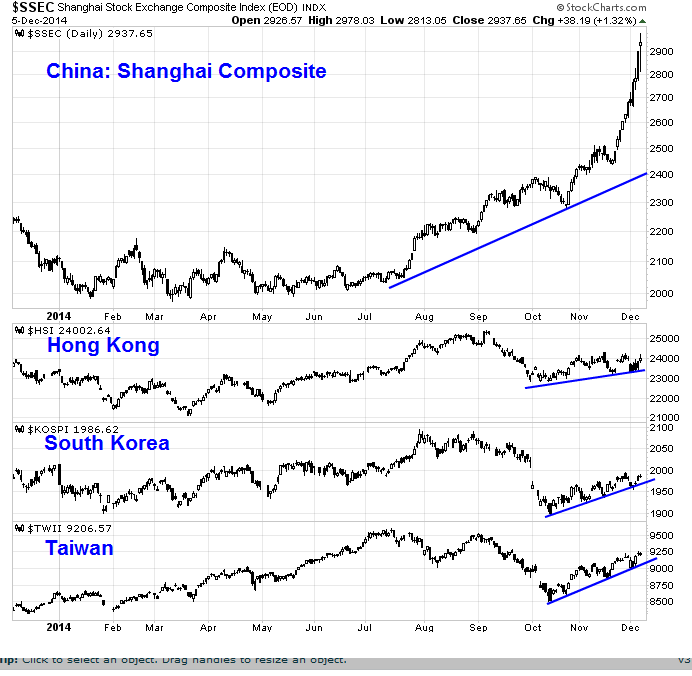

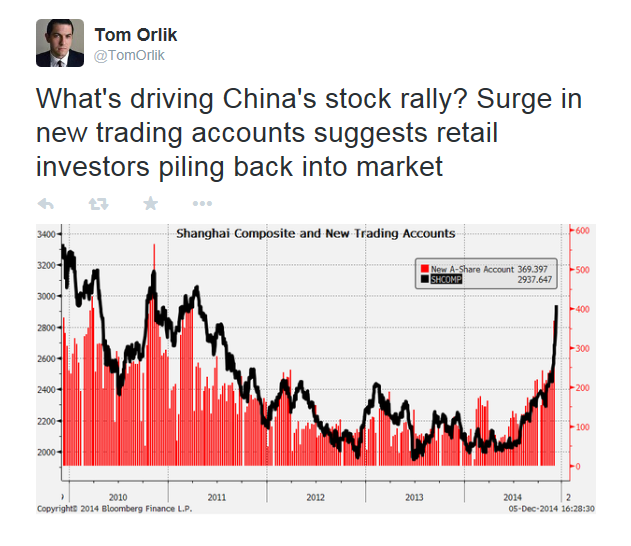

As my inner trader surveys the landscape, he continues to see a global uptrend in equities. The Chinese stock market has gone parabolic.

Even though that kind of advance is unlikely to be sustainable at the current pace (see tweet below from Tom Orlik), the other Greater China markets, namely Hong Kong, South KoreaI and Taiwan, are also in solid uptrends.

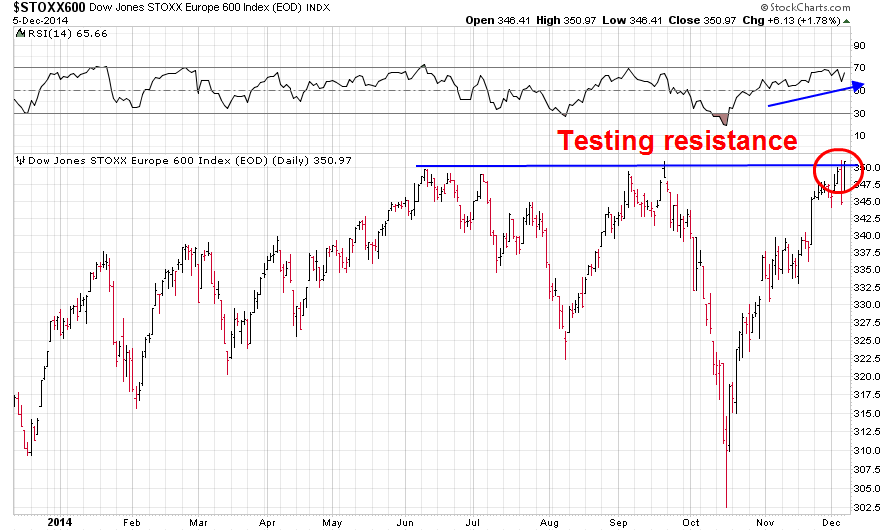

The picture also looks bullish in Europe. Despite Mario Draghi's hemming and hawing last week about whether the ECB is ready to proceed with QE, European markets have been rising and the STOXX 600 is now testing an important resistance level. The advance is supported by confirmation from the 14-day RSI. The German DAX (not shown) staged an upside breakout from resistance last week, which is another positive sign for European stocks.

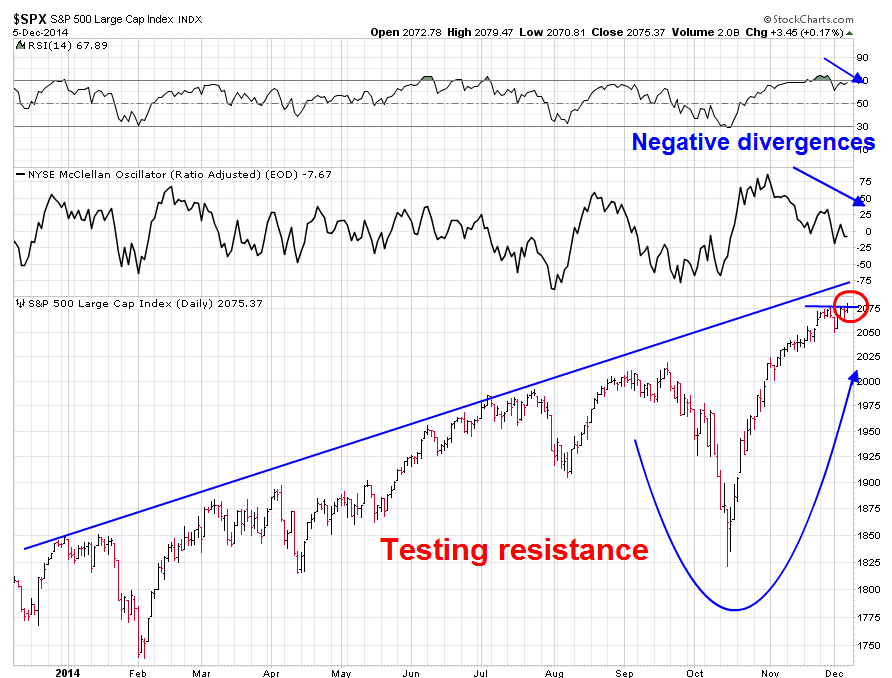

In the US, the S&P 500 tested an intra-day all-time-high on Friday and pulled back from resistance. Unlike the STOXX 600, this index is seeing a negative divergence from RSI-14. Longer term, however, the advance appears to be healthy in the context of a continued uptrend and a recovery from a V-shaped bottom.

Despite the negative divergence seen in the SPX, I would not be too quick to get overly bearish. The Dow broke out to an all-time-high on Friday with confirmation from its RSI-14.

Reasons to be cautious

On a more cautionary note, the chart below shows the Rydex Bear-Bull asset ratio (middle panel), as well as the Bear-Bull flow ratio (bottom panel). Both ratios are important indicators of investor sentiment. The asset ratio is a barometer of how much bullish and bearish investors have committed to their directional bets, but it could be misleading if viewed in isolation. Imagine that investors committed $X to the bull side and $Y to the bear side; there were no cash flows and the stock market went up by 10% during this period. The bear-bull asset ratio would fall to reflect the increase in stock prices but an observer might see misinterpret this as contrarian bearish because it had fallen 20% (+10% for bulls and -10% for bears). That`s why it`s important to view this in the context of the bear-bull cash flow ratio as well.

In the chart, I marked with vertical lines instances the dual conditions where 1) the asset ratio has reached a new low and 2) the flow ratio has also reached a low, indicating possible excessive bullish sentiment among Rydex investors. I further color coded the lines where the blue lines indicate that the stock market continued to advance and the red lines indicated future declines.

As the chart shows, we got a signal recently where both the asset and flow ratio reached a crowded long extreme. However, the track record of this indicator shows that it is not perfect and it can have relatively long lags before a decline can begin - this seems to be a characteristic of many sentiment indicators.

A hawkish Fed?

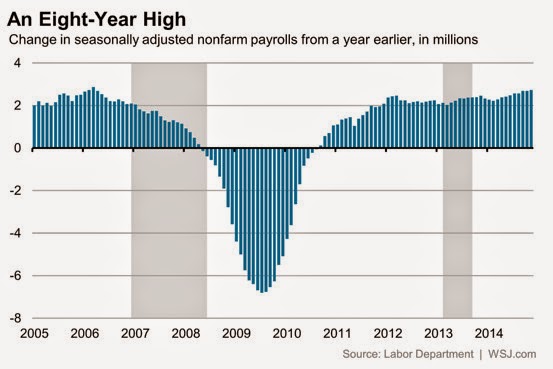

Another reason for caution is the possibility of some market turbulence ahead from the FOMC meeting due on December 17. Notwithstanding the blowout surprise from the November Jobs Report, that report made the trend very clear - the economy continues to recover in a manner consistent with Fed expectations.

Unless we see significant signs of economic weakness in the months to come, the Fed should start to raise rates in June. In a recent speech, New York Fed Governor William Dudley confirmed that timing:

Market expectations that lift-off will occur around mid-2015 seem reasonable to me. Although that could change depending on how the economy evolves, my views on “when” do not differ appreciably from the most recent primary dealer and buy-side surveys undertaken by the New York Fed prior to the October FOMC meeting.

As to what happens next, Dudley had an answer to that (emphasis added):

With respect to “how fast” the normalization process will proceed, that depends on two factors—how the economy evolves, and how financial market conditions respond to movements in the federal funds rate target. Financial market conditions mainly include, but are not necessarily limited to, the level of short- and long-term interest rates, credit spreads and availability, equity prices and the foreign exchange value of the dollar. When the FOMC adjusts its short-term federal funds rate target, this does not directly influence the economy since little economic activity is linked to the federal funds rate. Instead, monetary policy affects the economy as the current change in short-term interest rates and expectations about future monetary policy changes influence financial market conditions more broadly.

In other words, they want to watch how stock and bond markets react:

First, when lift-off occurs, the pace of monetary policy normalization will depend, in part, on how financial market conditions react to the initial and subsequent tightening moves. If the reaction is relatively large—think of the response of financial market conditions during the so-called “taper tantrum” during the spring and summer of 2013—then this would likely prompt a slower and more cautious approach. In contrast, if the reaction were relatively small or even in the wrong direction, with financial market conditions easing—think of the response of long-term bond yields and the equity market as the asset purchase program was gradually phased out over the past year—then this would imply a more aggressive approach. The key point is this: We will pursue the monetary policy stance that best generates the set of financial market conditions most consistent with achievement of the FOMC’s dual mandate objectives. This depends both on how financial market conditions respond to the Fed’s policy actions and on how the real economy responds to the changes in financial conditions.

In my opinion, the Fed would not be fazed by the market reaction to November Jobs Report. Bond yields rose in anticipation of Fed tightness, while stock prices were up modestly in response to better growth outlook. In addition, Dudley warned that the markets should not expect a stock market put from the Fed:

Let me be clear, there is no Fed equity market put. To put it another way, we do not care about the level of equity prices, or bond yields or credit spreads per se. Instead, we focus on how financial market conditions influence the transmission of monetary policy to the real economy. At times, a large decline in equity prices will not be problematic for achieving our goals. For example, economic conditions may warrant a tightening of financial market conditions. If this happens mainly via the channel of equity price weakness—that is not a problem, as it does not conflict with our objectives. In contrast, when we want financial market conditions to be extremely accommodative—as has been the case in recent years when we have been far away from our employment and inflation objectives—then we will take into consideration a broad set of developments with respect to interest rates, the stock market and other measures of financial conditions in choosing the appropriate stance for monetary policy.

Dudley, along with vice-chair Stanley Fischer and chair Janet Yellen, represent the inner circle of Federal Reserve decision making. This was an extraordinarily hawkish speech by a member of that group. At the very least, expect the "considerable time" phrase to be replaced by a statement that the market consider to be hawkish in tone and therefore stock market bearish. I would expect that stock market bulls may not find the December FOMC statement too friendly.

Weakish early December, strong late

My inner trader interprets current market conditions as a possible pause in a market uptrend. The global uptrend in equities cannot be ignored and he is giving the bull case the benefit of the doubt. On the other hand, the combination of negative divergences and sentiment models do indicate that caution may be warranted. As well, traders should also remember that investors often engage in tax loss selling this time of year.

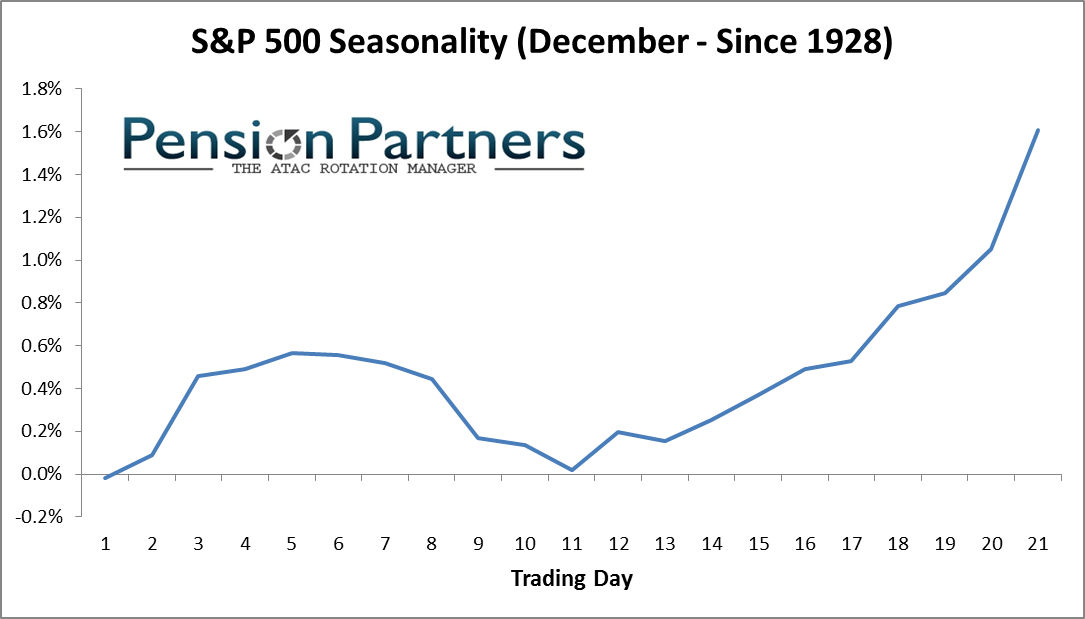

My base case scenario therefore calls for either a slow grind up in stock prices or a sideways consolidation for the first half of December, with a seasonal rally to begin in the latter half of the month. Charlie Bilello at Pension Partners created a chart that described this pattern well and it seems to be a reasonable road map to use.

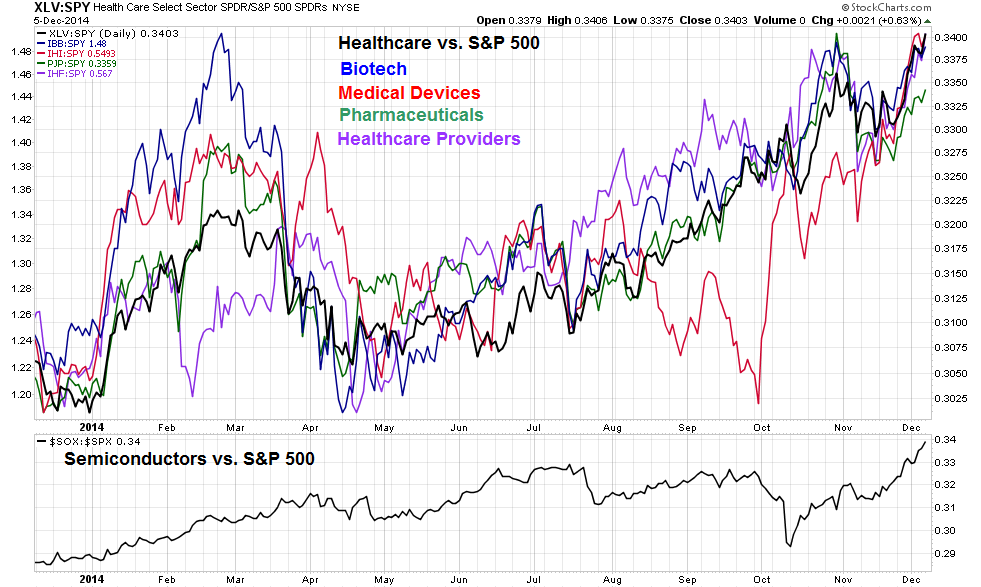

Tactically, current conditions suggest approaching the market as a market of stocks, rather than a monolithic stock market. It suggests either remaining modestly long, or using a long-short strategy of emphasizing market leaders, which reflect the optimism of a growing economy, on the long side while either avoiding or shorting laggards, which could be vulnerable to tax-loss selling.

The chart below shows the relative performance of a number of market leaders relative to the SPX (via SPDR S&P 500 (ARCA:SPY)). The top panel shows the Healthcare sector (via SPDR - Health Care (ARCA:XLV)) and its component industries (IBB, IHI, PJP, IHF) which have all outperformed the market for much of the year, and the semiconductor stocks (via the SOX Semiconductor index) on the bottom panel.

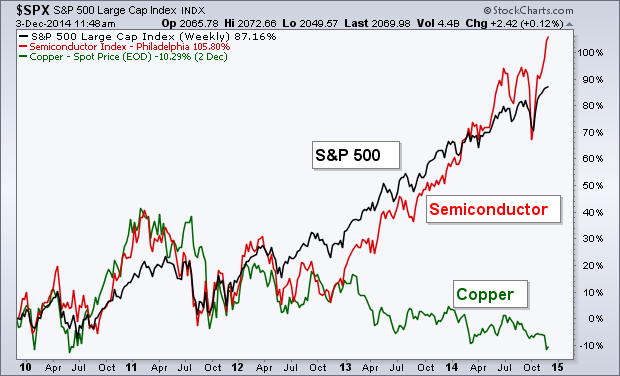

Speaking of semiconductors, I would also like to mention the post from Andrew Thrasher who believes that semiconductors have replaced Dr. Copper as a leading barometer of the global economy. In that context, the emergence of semiconductor stocks as a leadership group should be regarded as intermediate term bullish.

As for the laggards, small cap stocks have been roughly flat for the entire year and underperformed the SPX more or less all year. This pattern is suggestive of continued small cap underperformance for the next couple of weeks, followed by a typical seasonal small stock rally into January.

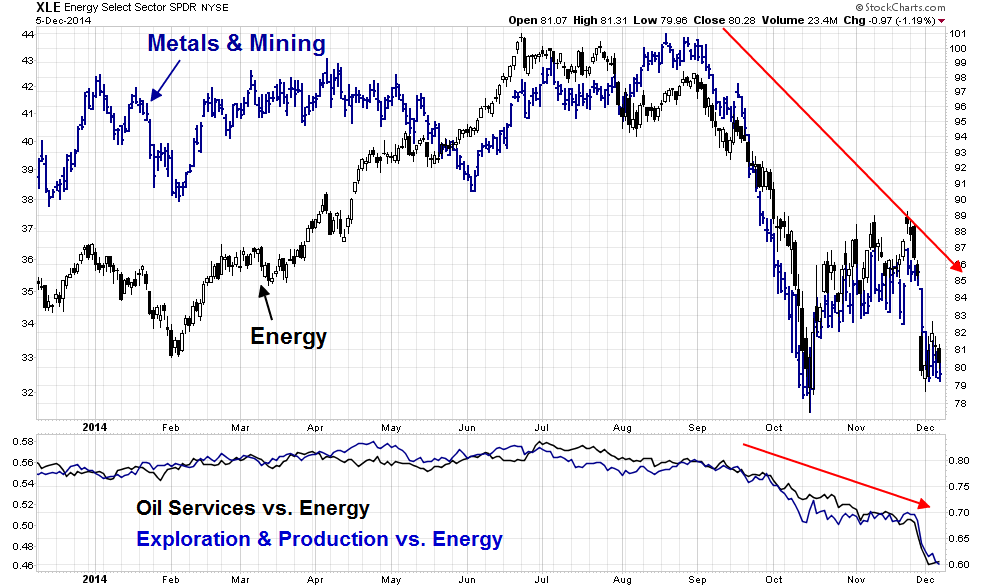

Resource stocks are also the most likely candidates for tax-loss selling in December. The top panel of the chart below shows the absolute performance of the Energy sector as well as the Metals and Mining stocks. The bottom panel shows the relative performance of the oil service and exploration and production groups relative to the already disappointing Energy sector. The Energy sector averages are dominated by the integrated oils like Exxon Mobil Corporation (NYSE:XOM) and Chevron Corporation (NYSE:CVX), whose profitability are cushioned by their downstream refining and marketing operations. The oil service and exploration and production companies have no such protection. They are more vulnerable to oil price weakness and therefore further weakness from tax loss selling.

As the year draws to an end, I would expect that these weak sectors and groups, such as small caps, energy and mining stocks, to weaken and then stage a snapback rally in the last week of the year. My inner trader is watching market conditions and preparing for such a possibility. In the meantime, he is nervously long with relatively tight stops.

Next week, I will discuss how my inner investor views the challenges and opportunities for equities in 2015.

Disclosure: Long SPXL, BIB

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.