Monday March 20: Five things the markets are talking about

Market volatility remains low across markets from equities to currencies and fixed-income as dealers and investors attempt to evaluate how sustainable the hopeful global economic recovery is.

Investor focus turns away from last week’s central bank statements to U.S policy or Trumponomics. The White House is heading for a busy week, with anticipated House health care legislation coming to the floor and the Senate starting hearings on a Supreme Court nominee (Gorsuch).

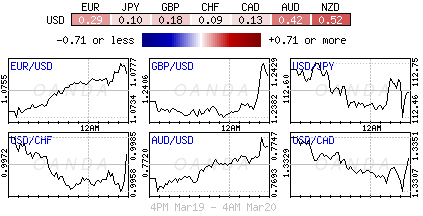

Currently, the ‘mighty’ U.S. dollar is heading for its longest losing streak since last Novembers U.S Presidential election, while most major equity indexes falter near their all-time high, while treasury yields trade atop of the recent lows.

On the weekend, the G20 official communiqué upheld their commitment against competitive “devaluation,” but also omitted language on promoting free trade (see below).

On the data front, investors this week will be kept busy by Euro and Japanese flash PMI’s. In the U.K, price data and retail sales will be released for February. Minutes of the BoJ’s January meeting and the RBA’s March meeting will be published, while the RBNZ will announce its monetary policy decision.

1. Global stocks see mixed results

Last week was the best week since January for global equities.

However overnight, it was a mixed performance. Equities have retreated in Europe, Australia and New Zealand. Japan’s stock market was closed for a holiday, while indexes rose in emerging markets.

The MSCI’s broadest index of Asia-Pacific shares ex-Japan added +0.3%. In Hong Kong, the Hang Seng climbed +0.7%, while Chinese shares were mixed with the CSI 300 down -0.1%, while the Shanghai Composite added +0.1%. Down-under, Aussie shares closed down -0.36%.

Elsewhere, the MSCI’s emerging markets (NYSE:EEM) index added +0.4% to hit its highest level in more than two-years.

In Europe, equity indices are trading lower as market participants digest the weekends G20 communiqué. Banking stocks are putting pressure on the Eurostoxx while energy; commodity and mining stocks trade lower in the FTSE 100.

U.S stocks are set to open in the red (-0.2%).

Indices: Stoxx50 -0.2% at 3,436, FTSE -0.2% at 7,411, DAX -0.3% at 12,055, CAC 40 -0.4% at 5,011, IBEX 35 -0.3% at 10,215, FTSE MIB -0.3% at 20,016, SMI flat at 8,698, S&P 500 Futures -0.2%

2. Higher U.S oil production offsetting OPEC’s supply cuts

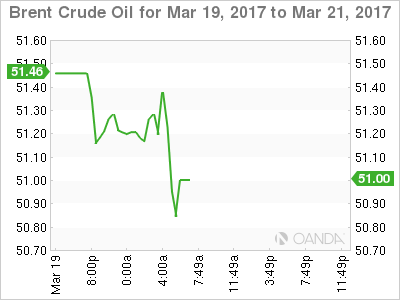

Crude oil prices start the week on the back foot, pressured by rising U.S drilling activity and steady supplies from OPEC countries despite last November’s agreement of production cuts.

Ahead of the U.S open, Brent crude futures are down -34c, or -0.66%, at +$51.42 per barrel. U.S West Texas Intermediate (WTI or light crude) has slipped -48c, or -0.98%, to +$48.30 a barrel.

Friday’s date from Baker Hughes showed that U.S drillers added +14 oil rigs in the week to March 17, bringing the total count up to +631, the most in 18-months, extending a recovery that is expected to boost U.S shale production by the most in six-months in April.

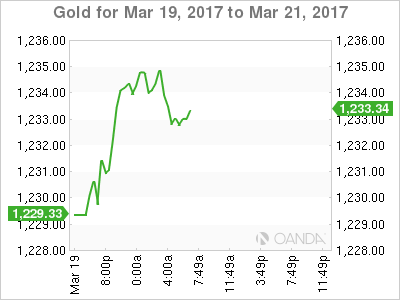

Gold prices have edged up (up +0.2% to +$1,231.05 per ounce) as the ‘mighty’ dollar stays on the defensive after last week’s “less hawkish” tone from the Fed, despite the rate hike. Yellen’s cautious guidance has the market pricing in almost no chance of another rate rise in May, but rises to 50-50 for June.

Note: Markets are bracing for a packed week of Fed messaging – this week there are nine different U.S policy makers set to speak, including Chair Janet Yellen on Thursday.

3. U.S Treasury yields lower, ECB futures tightening

Currently, to many the possibility of the ECB raising interest rates before its QE program ends is a “tail risk.” However, its not stopping the market from pricing in the possibility of incremental “small” hikes.

Looking at the euro curve, FI dealers are pricing in some tightening pressures to the ECB’s deposit rate (-0.4%) over the next 18-months. Dealers see a +10 bps rise by January 2018, a +15 bps rise by May 18 and a +20 bps rise by August 2018. To many, this would still be considered a “dovish” hike.

Elsewhere, U.S 10-year Treasuries are little changed at +2.50% after falling -4 bps on Friday. The yield on Aussie 10’s have dropped -3 bps to +2.82%.

4. EUR to focus on French Presidential Debate

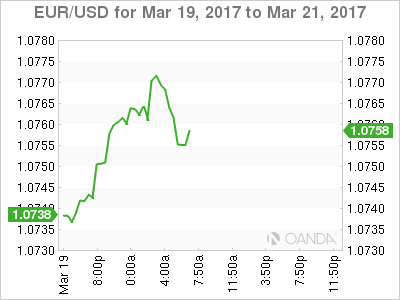

The EUR and GBP have both benefitted from a weaker dollar after the G-20 statement dropped a pledge to promote free trade, reviving concerns about U.S. policy causing disruption to trade. The dollar is also continuing its weakness from a “less hawkish” message from the Fed.

EUR/USD is up +0.2% at €1.0767, while GBP/USD has rallied to a three-week high £1.2436. USD/JPY has dropped to trade atop a three-week low around ¥112.47.

Note: EUR’s gains may be limited as market focus shifts to today’s French Presidential TV debate. Any narrowing of centrist candidate Macron’s lead after the debate could indeed instigate fresh EUR selling.

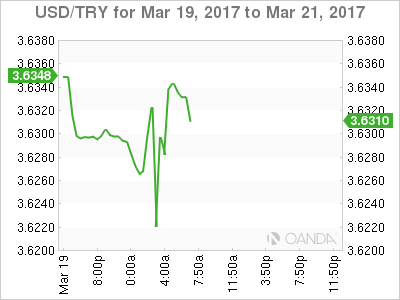

Elsewhere, the KRW (+1.1% to $1,116) trades at a five month high outright amid continued appetite for the currency as the political picture becomes somewhat clearer. TRY ($3.6338) is recovering some of the falls prompted by Moody’s downgrading Turkey’s sovereign rating outlook to negative from stable late Friday.

5. G20’s communiqué

The weekend's post-meeting communiqué retained language on avoiding currency manipulation – previously aimed chiefly at Japan and China – but it omitted a call for ‘free trade.’ This may be considered a win for the U.S as it opens the door to more overt efforts by the Trump administration to shift the balance of its international relationships.

U.S Treasury Sec Mnuchin: U.S wants free, but fair and balanced trade. NAFTA would have to be reviewed, some WTO rules needed to be better enforced and older agreements may have to be renegotiated.

German Fin Min Schaeuble: G20 communiqué was adopted unanimously. G20 trade discussions were complicated; there was broad consensus that ‘open trade’ is necessary to strengthen global growth.

Bundesbank President Weidmann: Meeting was marked by intense struggle for a common position, still much to discuss on trade. Agreed now is the time to implement structural reforms.

Japan Fin Min Aso: No one at the meeting remarked that they were against free trade and confirmed importance of free trade despite language in communiqué.

China Fin Min Xiao Jie: Unwaveringly supports free trade and investment, opposes protectionism.

IMF’s Lagarde: Global cooperation and pursuing the right policies can help achieve “strong, sustained, balanced, and inclusive growth, while the wrong ones could stop the new momentum in its tracks.”