Tuesday March 21: Five things the markets are talking about

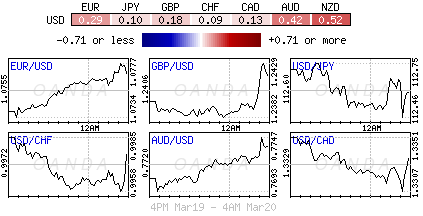

The ‘mighty’ buck remains on the back foot, pressured by concerns that change to U.S trade policy could hamper growth. It has slumped as much as -1.8% since last week’s Fed rate hike now that policy makers did not accelerate the timeline for future tightening.

Market volatility remains low across the different asset classes as investors attempt to assess how sustainable the hopeful global economic recovery is. On the weekend, G20 members struggled to find common ground on trade, however rookie U.S Treasury Secretary Steven Mnuchin did convince finance officials to drop a denial of protectionism from their policy statement.

The group’s communiqué now ensures the U.S can still use sanctions or other policy tools to punish trade partners and stop economic policies that Trump’s administration deems to be unfair.

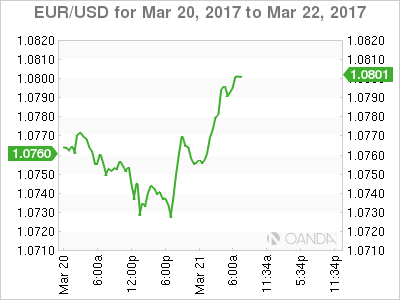

In Europe, the EUR has found support after last nights French Presidential debate. An overnight poll shows independent candidate Emmanuel Macron emerging as the most convincing of the five contenders, ahead of anti-euro candidate Marine Le Pen.

Elsewhere, Fed speakers continue to dominate the airwaves. Yesterday, Fed member Kashkari (dove, dissenting vote) indicated that the job market is showing more signs of slack and remains short on inflation. Fed’s Evans (dove, voter) said that three rate hikes this year are “possible,” while Fed member Harker (hawk, FOMC voter) would not rule out more than three rate hikes this year.

1. Stocks record mixed results

In Japan, the Nikkei share average fell to a two-week low overnight (-0.3%) as financial stocks continue to underperform as U.S. yields fall. The broader Topix dropped -0.2%.

In Hong Kong, equities climbed to a near 20-month high, boosted by continued inflows from Chinese investors. The benchmark Hang Seng index rose for a fourth consecutive day, adding +0.4%.

Note: The index is the world’s best performing in Q1, having gained nearly +12%.

In China, stocks closed slightly higher in thin trading. Investors’ risk appetite remains restrained amid growing signs of tighter liquidity in the banking system. The blue-chip CSI 300 index rallied +0.5%, while the Shanghai Composite Index added +0.3%.

In Europe, equity indices are trading mixed, but generally higher across the board. Financials are supporting the Euro Stoxx 50 while commodity and mining stocks are lower in the FTSE 100.

U.S equities are set to open in the black (+0.2%).

Indices: Stoxx50 +0.2% at 3,447, FTSE -0.2% at 7,413, DAX flat at 12,050, CAC 40 +0.3% at 5,025, IBEX 35 +0.7% at 10,283, FTSE MIB +0.9% at 20,143, SMI -0.1% at 8,684, S&P 500 Futures +0.2%

2. Oil prices rise on talk that OPEC could extend supply cut

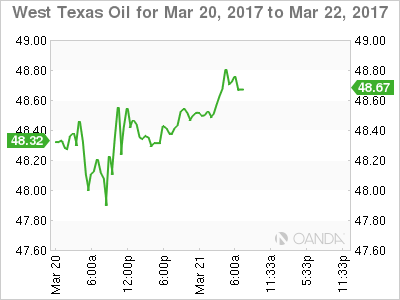

Oil prices are in the black overnight on expectations that an OPEC-led production cut to prop up the market could be extended, while strong demand would also work to slowly erode a global fuel supply overhang.

Brent crude futures is trading atop of +$51.97, up +35c, or +0.68% from Monday’s close. U.S. West Texas Intermediate (WTI) crude futures are up +28c, or +0.58%, at +$48.50 a barrel.

Last November, OPEC together with other producers including Russia pledged to cut output by almost -1.8m bpd between January and June in an effort to support prices and rein in a global supply glut.

To date, the cutback has not had the desired effect as compliance has been patchy (Russia) and other producers (U.S shale) have stepped up to fill the gap, resulting in crude prices falling more than -10% this year.

The market is waiting for today’s API date for price direction guidance.

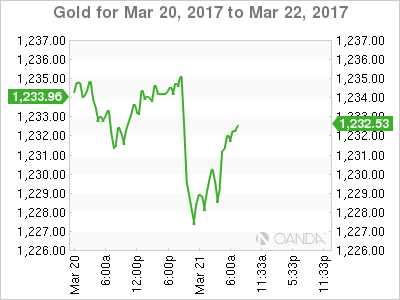

In commodities, gold (-0.4% at +$1,228.61) prices have edged lower overnight, but hover near its two-week high print in yesterday’s session on prospects of a less-hawkish Fed.

3. Yields on the move

The spread between French and German 10-Year bond yields have tightened after last nights live French Presidential debate eases political fears. Current polls indicate that centrist candidate Macron emerged as the winner. The OAT-bund spread has tightened to +65.8 bps from +70 bps yesterday.

In the U.K, yields on 10-Year Gilts have backed up more than +3 bps to +1.294% this morning after CPI data rose more than expected last month (see below). The higher-than-expected inflation print (+2.3% vs. +2.1%) should increase expectations of a “hawkish” drift by the BoE, especially with a dissenter voting for a rate rise.

In the U.S. 10-Year yields rose above +2.6% earlier this month and reached a two-year high as investors anticipated the Fed would raise short-term interest rates. They did last week, but its signal of a “gradual” path of tightening policy has debt product better bid. U.S 10’s are trading at +2.49% after losing -4 bps in each of the previous two sessions.

4. EUR on the move

The “mighty” dollar remains under pressure as the pace of pushing President Trump’s domestic agenda maybe obstructed due to the FBI ‘s investigation into possible administration links with Russia.

The EUR (€1.0800) trades atop a six-week high aided by last nights French Presidential debate, which saw Macron, put in a strong performance. The single unit seems to be little impacted by the current phase of the Greece bailout review – country and lenders remain divided, expect bailout talks to intensify with the real deadline looming a few months down the road.

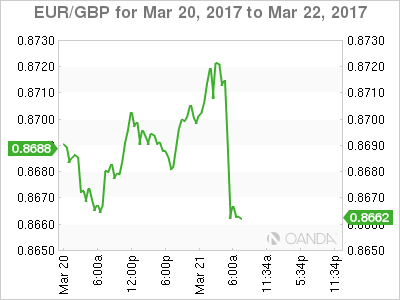

GBP/USD (£1.2465) has jumped to a three-week high following stronger than expected inflation data. Against the EUR, the pound has rallied to €0.8661, up +0.25% ahead of the U.S open.

5. U.K inflation hits three-year high

Data in the U.K shows that the annual rate of inflation in the U.K. rose to +2.3% in Feb. from +1.8% in Jan., reaching its highest level since Sep. 2013. It’s moved above the BoE’s +2% target for the first time in four years. The market was expecting an uptick to +2.1%.

Higher energy prices have been blamed for the pick up in inflation across developed nations. However, the pickup in the U.K has also been supported by the pound’s depreciation since the Brexit vote in June 2016.

The BoE’s Governor Carney has already indicated that he will tolerate a “modest” overshoot of its target for a limited period of time. The BoE expects higher inflation to slow consumer spending and growth, helping bring price rises back to target over the medium term.