Here are the latest developments in global markets:

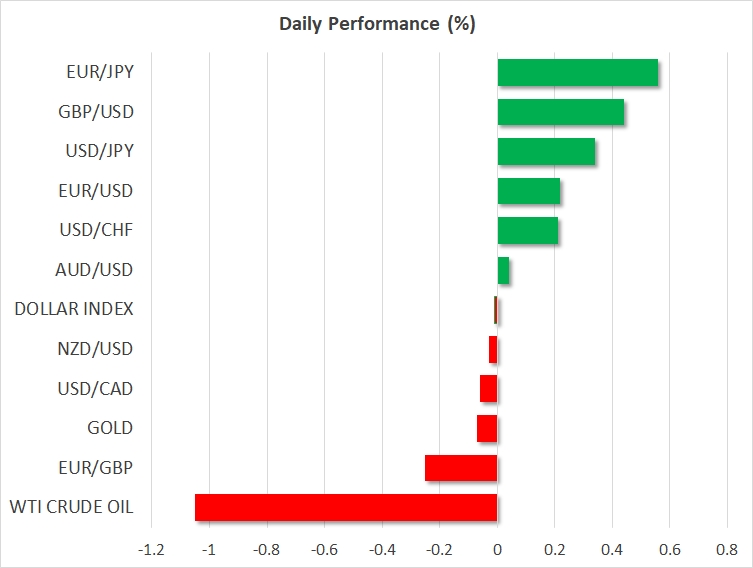

· FOREX: The dollar index was practically unchanged on Friday, remaining unfazed by the shutdown of the US government. Meanwhile, the sterling gave back all of the gains it posted after the Bank of England appeared more hawkish yesterday.

· STOCKS: The turmoil in global equity markets got a second wind on Thursday, with US stock indices collapsing once more. The Dow Jones led the way lower, shedding 4.1% of its value, while the NASDAQ Composite and S&P 500 followed in its tracks, closing lower by 3.9% and 3.8% respectively. It is worth noting that all three indices closed below their respective 100-day moving averages.

According to futures though, the Dow, S&P, and NASDAQ 100 are all anticipated to open in positive territory today.

The negative sentiment rolled over into Asian trading as well, with Japan’s Nikkei 225 and TOPIX falling by 2.3% and 1.9% accordingly. In Hong Kong, the Hang Seng was down by 3.3%. As for Europe, futures tracking the Euro Stoxx 50 are very close to neutral territory.

· COMMODITIES: Oil prices drifted lower alongside energy stocks yesterday, and extended their losses on Friday, with WTI and Brent crude trading lower by 1.0% and 0.7% respectively. Besides risk sentiment, the other potential driver of prices today may be the release of the US Baker Hughes oil rig count, due at 1800 GMT.

Following the latest EIA data showing that US oil output soared to record highs, any further increase in rigs could signal that production may have risen even further, and thereby keep prices under pressure.

Gold traded fractionally lower, last seen near the $1,317 level. It is quite puzzling that the safe-haven metal has not responded to the turbulence in equity markets lately, drifting lower in recent days even despite the broader risk-off sentiment.

Major movers: Sterling surrenders BoE-related gains; US government shuts down; equity volatility remains in the spotlight

The Bank of England (BoE) kept its policy unchanged yesterday via a unanimous vote, as was widely anticipated. The central bank appeared quite optimistic on the economy’s outlook, noting that GDP growth is expected to be faster moving forward even despite the higher market-implied path for interest rates and the stronger exchange rate. On the inflation front, the BoE now anticipates the CPI rate to fall to 2.16% in two years’ time, just shy of its 2% target.

Moreover, the BoE vindicated those looking for faster rate hikes in the future. It noted that according to its new projections, monetary policy may now need to be tightened somewhat earlier and to a greater extent than anticipated back in November.

The British pound surged on these hawkish signals, as the implied probability for a rate hike in May rose to 70%, from roughly 50% prior to the meeting. Nonetheless, sterling was unable to hold onto its BoE-related gains, retreating in the following hours to trade virtually unchanged against most of its major counterparts, and even lower against the yen.

In the US, the government has now officially shut down, as Congress missed a deadline to approve the bill that would raise spending limits over the next two years. The Senate did approve the bill, but the House still has to vote on it in order to end the shutdown, something very likely to happen today.

Importantly, if approved, this bill would balloon the US deficit by another $300 billions, making the US debt outlook even more unsustainable. These concerns have begun to show up in the bond market, where yields on 10-year Treasuries rose to 2.85%. This surge in yields may be another factor weighing on US and global equities. As Treasury yields rise, bonds begin to offer a better and “safer” return, curbing demand for equities.

The volatility in equity markets is likely to remain at the forefront of attention for a while more, as investors try to gauge whether the correction is over or whether it still has more legs to run.

US equity indices closed below their 100-day moving averages yesterday, with the S&P 500 now being roughly 10% lower than its peaks. The lower these indices go, the more attractive they become from a valuation perspective for investors looking to “buy the dip”, a factor that could help to stem the decline.

Elsewhere, the Australian dollar remained under pressure yesterday. Besides the broader risk-averse sentiment, the tumble may have been owed to some dovish comments from RBA Governor Philip Lowe, who noted that he doesn’t “see a strong case” for a near-term rate hike.

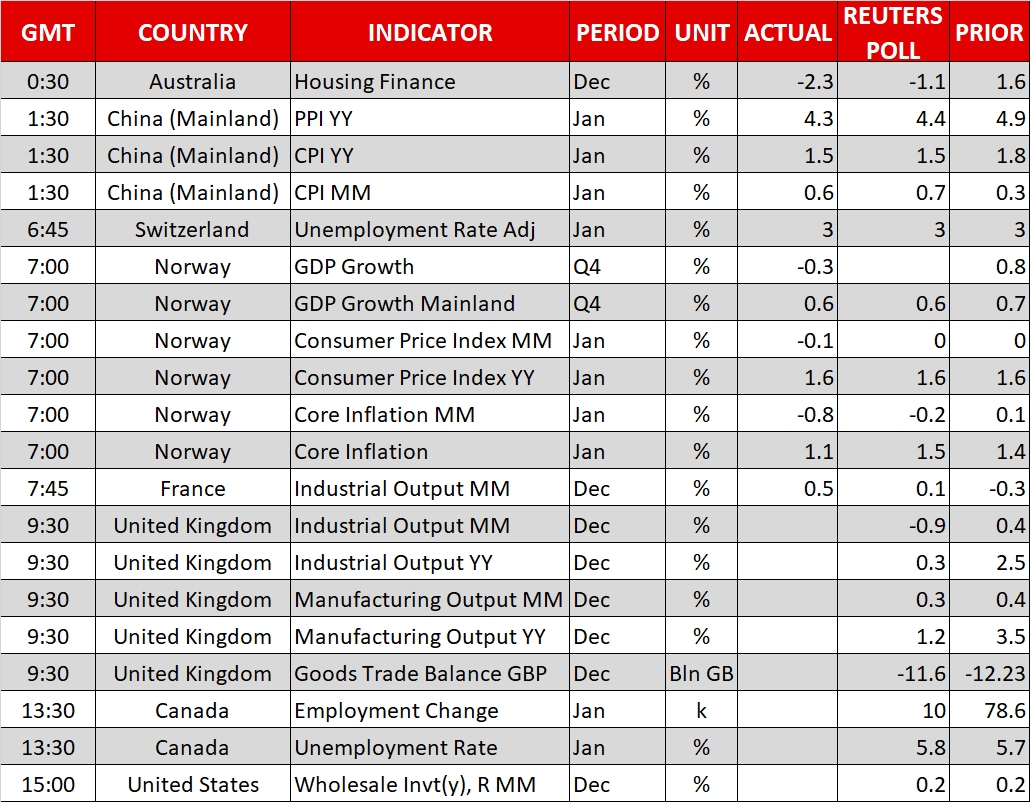

Day ahead: UK industrial & manufacturing output and Canadian jobs report on the agenda

Industrial and manufacturing output figures for December out of the UK are due at 0930 GMT. After the upbeat releases of previous months, the numbers are expected to ease on an annual and monthly basis, with industrial production even forecasted to contract in December relative to the month that preceded.

UK data on the goods trade balance are also scheduled for release at the same time.

Canada’s jobs report for the month of January will be made public at 1330 GMT. Projections point to a “soft” report relative to the preceding month, though it could be argued that a “soft” report was forecasted in December as well, and the actual figures ended up storming past expectations.

Specifically, the economy is expected to have added 10k positions (versus 78.6k in December) and the unemployment rate is expected to have risen to 5.8% from 5.7% in December, though that would be linked to more individuals entering the labor force – being optimistic that they could find a job – rather than to weakness in the jobs market.

It would be interesting to see if the release alters the market’s perception as regards the speed with which the Bank of Canada will deliver additional interest rate rises moving forward.

Data on US wholesale inventories for the month of December are due at 1500 GMT.

Jon Cunliffe, the Bank of England’s Deputy Governor for Financial Stability will be speaking at 1645 GMT.

Corporations continue to release quarterly results as the equity market turmoil continues.

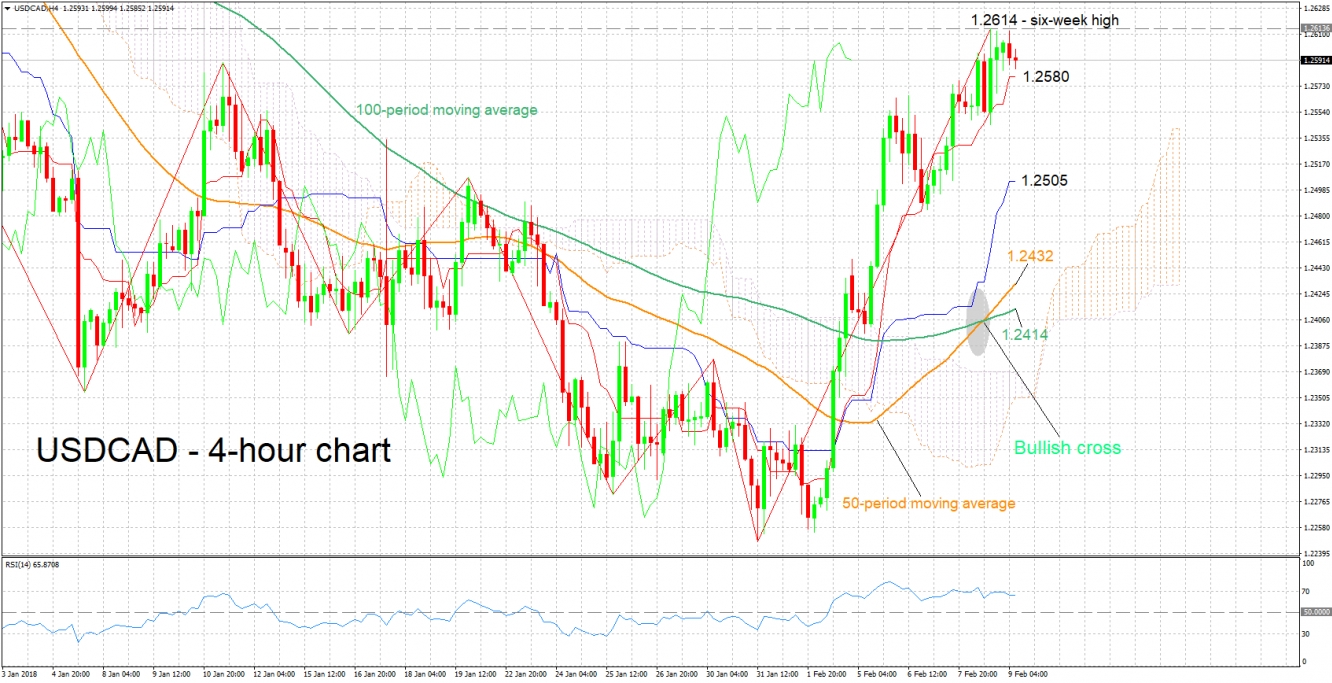

Technical Analysis: USD/CAD close to 6-week high; Tenkan- and Kijun-sen positively aligned

USD/CAD has posted considerable gains in recent days, reaching a six-week high of 1.2614 during Thursday’s trading. The pair is currently trading not far below this level.

The Tenkan- and Kijun-sen lines are positively aligned, pointing to bullish short-term momentum. The RSI is in bullish territory above 50, supporting the case for a positive bias, though notice that it is moving sideways. This is perhaps an indication that positive momentum is losing steam. Also, the indicator is relatively close to the 70 overbought level.

A strong jobs report out of Canada is anticipated to lead to weakness in USD/CAD, with the range around the Tenkan-sen at 1.2580 – including the 1.26 handle, a level that may be of psychological importance – potentially offering support. A violation of this area would turn the attention to the one around the Kijun-sen at 1.2505.

Weaker Canadian data, on the other hand, are expected to see the pair advancing. Thursday’s high of 1.2614 could provide resistance in this case, with 1.27 being eyed next in case of an upside break from 1.2614. The area around the 1.27 handle was relatively congested in the past.