Slowing Services Sector In UK Bearish For GBP/USD

UK’s service sector expansion slowed in June. Will the GBP/USD continue declining?

Economic data from UK were negative after the unrevised final reading of Q1 GDP confirmed economic growth was at the strongest pace since the third quarter of 2017. Purchasing managers index data released on Tuesday showed that UK construction activity suffered its sharpest downturn in over a decade in June. And a speech by Bank of England Chairman Mark Carney late Tuesday suggested that the bank might loosen the tightening bias of its monetary policy. At the same time Markit’s Service PMI index declined to 50.2 from 51 in May, showing a slowing of expansion in services sector. Readings above 50.0 indicate expansion. Weaker UK data are bearish for GBP/USD.

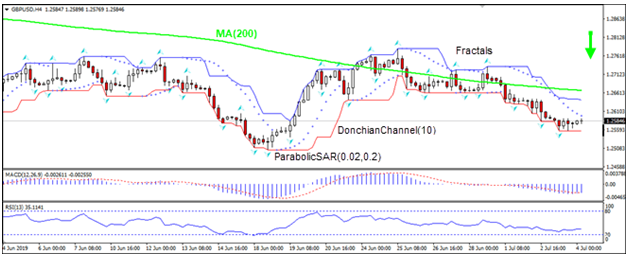

On the 4-hour timeframe the GBP/USD: H4 is retracing after hitting two-week low in mid-June.

- The Parabolic indicator gives a sell signal.

- The Donchian channel indicates downtrend: it is narrowing down.

- The MACD indicator gives a bullish signal: it is below the signal line and the gap is narrowing.

- The RSI oscillator is below the 50 level and has not breached into oversold zone yet.

We believe the bearish momentum will continue after the price breaches below lower boundary of Donchian channel at 1.2556. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper Donchian boundary at 1.2640. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (1.2640) without reaching the order (1.2556), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

| Order | Sell |

| Sell stop | Below 1.2556 |

| Stop loss | Above 1.2640 |

Market Overview

- All three major benchmarks close at records

- DJI and Nasdaq join SP500’s record spree

US stock market closed at record on Wednesday in a short session ahead of July 4 holiday. The S&P 500 rose 0.8% to record 2995.82. The Dow Jones industrial average gained 0.7% to record high 26966. Nasdaq composite index advanced 0.8% to record 8170.23. The dollar strengthening resumed as the Automatic Data Processing Inc (NASDAQ:ADP). reported the US private sector added 102,000 new jobs in June, below the 140,000 expected, but above the 41,000 jobs created in May. The live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up less than 0.01% to 96.75 and is higher currently. US financial markets will be closed today for the Independence Day holiday.

CAC 40 Paces European Indexes Gains

European stocks rose sixth straight session on Wednesday as EU leaders agreed to nominate IMF chief Christine Lagarde as the new head of the ECB. EUR/USD joined GBP/USD’s continuing slide yesterday with Pound lower still currently while euro is higher. The Stoxx Europe 600 rose 0.8% led by travel and leisure shares. Germany’s DAX 30 added 0.7% to 12616.24. France’s CAC 40 advanced 0.8% and UK’s FTSE 100 gained 0.7% to 7609.32.

Australia’s All Ordinaries Still Ahead Of Asian Indexes

Asian stock indices are mixed today. Nikkei rose 0.3% to 21702.45 with yen flat against the dollar. Chinese stocks are falling despite White House economic adviser Larry Kudlow’s comment U.S. and Chinese negotiators would talk on the phone next week to set up a new round of meetings: the Shanghai Composite Index is down 0.3% and Hong Kong’s Hang Seng Index is 0.03% higher. Australia’s All Ordinaries Index extended gains 0.5% despite Australian dollar continuing climb against the greenback after report retail sales rose 0.1% in May.

Brent Rose After Third Weekly Decline Is US Inventories

Brent futures prices are inching lower today. Prices rebounded yesterday after the Energy Information Administration report US crude inventories declined by 1.1 million barrels last week while gasoline inventories dropped by 1.6 million. September Brent crude rose 2.3% to $63.82 a barrel on Wednesday.