Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed higher: Shanghai Composite +0.37%, Hang Seng -0.89%, Nikkei +0.13%

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes GDP 8:30 AM ET, International Trade in Goods 8:30 AM ET, Jobless Claims 8:30 AM ET, Corporate Profits 8:30 AM ET, Retail Inventories 8:30 AM ET, Wholesale Inventories 8:30 AM ET, Robert Kaplan Speaks 9:30 AM ET, James Bullard Speaks 10:00 AM ET, Pending Home Sales Index 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Kansas City Fed Manufacturing Index 11:00 AM ET, Richard Clarida Speaks 11:45 AM ET, Mary Daly Speaks 11:45 AM ET, Neel Kashkari Speaks 2:00 PM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

S&P 500 Futures: New Intraday Low And High

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +5 giving small upside Follow thru to yesterday’s RDR as 2957 got reclaimed. We’ll see if it does a better job holding vs Tuesday. There’s a small DT that will be interesting to see how market handles it in the sessions ahead 2995 area.

Well, the algos knocked the S&P 500 down Tuesday, and then helped rally them yesterday.

The S&P 500 futures (ESZ19:CME) made an early low at 2956.50 Tuesday night, and rallied up to 2979.00 on Globex, before trading 2969.75 on Wednesday’s 8:30 CT futures open.

After the open, the ES rallied up to 2974.00, then took out Tuesday’s double bottom low at 2958.50, and traded down to a new low at 2953.75. From there, the futures rallied up to a lower high at 2970.00, pulled back down to 2964.25, and then made a series of higher highs all the way up to 2991.50 going into the final hour.

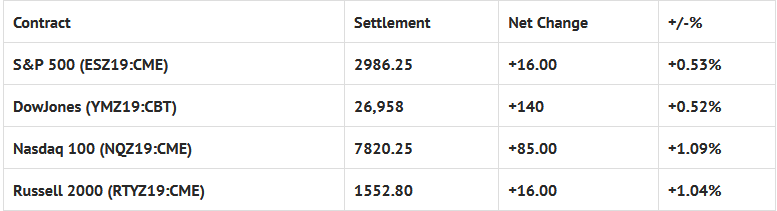

Just after 2:00, the early MiM started to show $710 million to sell, and the ES tapered off a bit. On the 2:45 cash imbalance reveal, the ES traded 2988.75 when the final MiM showed $808 million to sell. The futures then went on to trade 2986.50 on the 3:00 cash close, and settled the day at 2986.75 on the 3:15 futures close, up +14.75 handles, or +0.50%In the end, yesterday’s trade was all about catching people off base, and the lower low caught the shorts with their pants down. In terms of the overall tone, it was like night and day, going from ugly early in the day, and turning around to trade higher for the rest of the day. There was a series of very steady buy programs later in the day, which to me had the looks of an asset allocation; sell bonds (down -1.6%) / buy RTY (up +1.02%) and NQ (up +1.06%) accordingly.