Dow logs another record

US broad stock market edged lower on Wednesday as Federal Reserve hiked interest rates 0.25 percentage points. The dollar weakened after Fed left 2018 forecast unchanged. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, dropped 0.7% to 93.433. The S&P 500 slipped less than 0.1% to 2662.85 dragged by financial shares down 1.3%. The Dow Jones industrial average gained 0.3% to record high 24585.43. Nasdaq composite index meanwhile rebounded 0.2% to 6875.8.

ECB, Bank of England meet today

European markets pulled back on Wednesday led by Italian stocks. The euro and British Pound climbed against the dollar. The Stoxx Europe 600 closed 0.2% lower. Germany’s DAX 30 fell 0.4% settling at 13125.64. France’s CAC 40 dropped 0.5% and UK’s FTSE 100 slipped 0.1% to 7496.51. Indices opened lower today.

Australian dollar jumps on strong jobs data

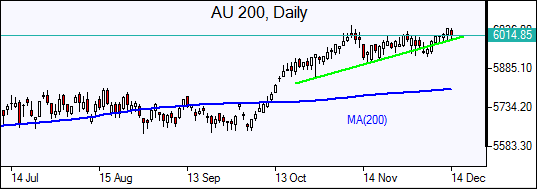

Asian stock indices are mostly lower today. Nikkei fell 0.1% to 22726.76 as yen extended gains against the dollar. Chinese stocks are up as economic indicators suggested little change in economic growth in November and China’s central bank hiked short-term interest rates five basis points: the Shanghai Composite Index is 0.5% higher while Hong Kong’s Hang Seng Index is 0.5% lower. Australia’s ASX All Ordinaries slipped 0.1% as Australian dollar hit a five-week high against the greenback after better than expected jobs report.

Oil up on US crude stock draw

Oil futures prices are edging lower today after the US Energy Information Administration report of more than expected drop in domestic crude supplies of 5.1 million barrels. Prices ended lower yesterday on higher US gasoline stockpiles. February Brent crude fell 1.4% to $62.44 a barrel on Wednesday.