Technical AnalsysLower sales expectations bearish for Nvidia price

Nvidia corporation is forecast to report first quarter revenue drop of over 30%. Will the Nvidia price continue declining?

NVIDIA Corporation (NASDAQ:NVDA) is expected to report first quarter revenue drop - more than 31% year over year to $2.2 billion. Among the reasons for the expected drop are weak graphics processing unit (GPU) demand and loss of Tesla (NASDAQ:TSLA) business. NVIDIA's gaming business is its biggest source of revenue, accounting for about 43% of total sales. As a result, the company's earnings are expected to drop to $0.79 per share in the first quarter, down from $2.05 per share a year ago. Lower revenue forecast is bearish for Nvidia stock price. On the other hand, a surprise in the form of not such a sharp decline in revenue is an upside risk which might boost the stock price.

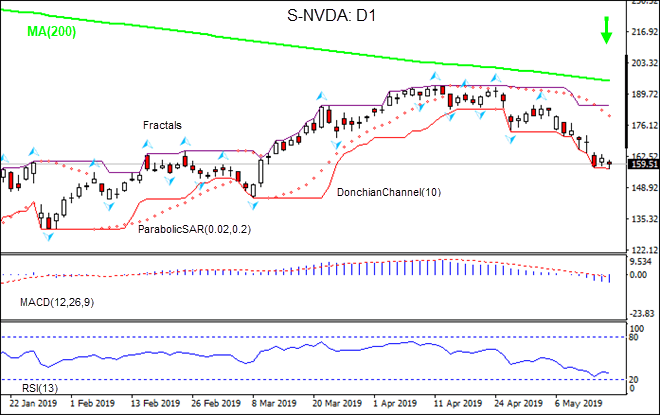

On the daily timeframe the S-NVDA: D1 is below the 200-day moving average MA(200) which is falling. This is bearish.

-

The Parabolic indicator gives a sell signal.

-

The Donchian channel indicates downtrend: it is tilted lower.

-

The MACD indicator gives a bearish signal: it is below the signal line and the gap is widening.

-

The RSI oscillator is falling but has not breached into the oversold zone yet.

We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 157.4. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the fractal high at 184.8. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (184.8) without reaching the order (157.4), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

- Position Sell

- Sell stop Below 157.4

- Stop loss Above 184.8

Market Overview

US stocks extend gains on growing trade optimism

Dollar strengthened despite downtick in sales

US stock market added to previous session gains on Wednesday despite soft data. The S&P 500 gained 0.6% to 2850.96. The Dow Jones industrial average added 0.5% to 25648.02. Nasdaq composite index rose 1.1% to 7822.15. The dollar strengthening continued despite data showing retail sales declined 0.2% last month after strong 1.7% growth in March: the live dollar index data show the ICE (NYSE:ICE) US Dollar Index, a measure of the dollar’s strength against a basket of six rival currencies, added 0.04% to 97.56 but is lower currently. Futures on US stock indexes point to lower openings today.

DAX 30 outperforms European indexes while Germany returned to economic growth

European stocks extended gains on Wednesday on news that President Donald Trump plans to delay the implementation of auto tariffs on European car imports by up to six months. Both the EUR/USD and GBP/USD continued sliding with euro higher currently while Pound falls against the dollar. The Stoxx Europe 600 added 0.4% led by auto shares. Germany’s DAX 30 rose 0.9% to 12099.57 as German economy recorded 0.4% growth in the first quarter following stagnant fourth quarter in 2018. France’s CAC 40 gained 0.6%. UK’s FTSE 100 advanced 0.8% to 7296.95.

Shanghai Composite still ahead of Asian Indexes

Asian stock indices are mostly rising today. Nikkei turned 0.6% lower to 21062.98 as yen climb against the dollar accelerated. Chinese stocks are gaining despite reports President Trump signed an order that would ban telecom equipment from countries considered “foreign adversaries” which will apply to China’s Huawei Technologies too: the Shanghai Composite Index is up 1% and Hong Kong’s Hang Seng index is 0.2% higher. Australia’s All Ordinaries Iindex extended gains 0.7% as Australian dollar continued sliding against the greenback at a previous session’s pace.

Brent rises despite US crude inventories build

Brent futures prices are extending gains today. Prices rose yesterday despite the report US crude stockpiles rose 5.4 million barrels while gasoline stocks declined by 1.1 million last week. July Brent crude added 0.7% to $71.77 a barrel on Wednesday.