Investing.com-- Most Asian stocks kept to a tight range on Tuesday as investors digested a mixed batch of Chinese business activity readings, while Japanese markets rose sharply in catch-up trade after a long weekend.

Broader Asian markets were mildly positive after a small overnight gains on Wall Street. But U.S. stock futures tread water in Asian trade as anticipation of a Federal Reserve meeting this week kept investors cautious.

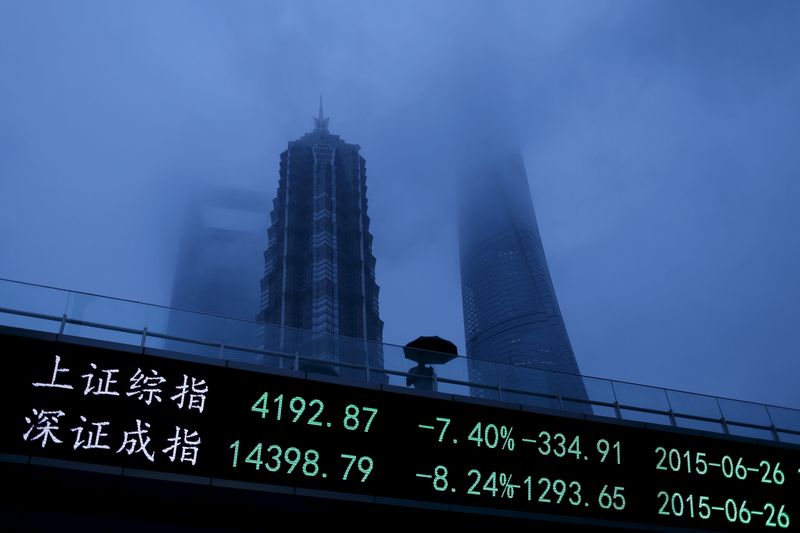

Chinese stocks stall after mixed PMIs

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes rose slightly on Tuesday as investors digested a batch of mixed purchasing managers index (PMI) readings for April. Official data showed growth in manufacturing activity slowed slightly less than expected in April from March, while growth in non-manufacturing activity slowed substantially more than expected.

While a private survey painted a rosier picture of the manufacturing sector, the overall PMI data showed some cooling in activity after a strong first quarter.

Still, a rebound in Chinese markets largely persisted in April, with local stock indexes set to outperform their regional peers for the month. The CSI300 was up 2.5% in April, while the Shanghai Composite was trading up 2.6%.

Hong Kong’s Hang Seng index rose 0.6% on Tuesday and was by far the best-performing Asian index in April. The Hang Seng was trading up about 7.6% in April, after racing to a five-month high on bargain buying and optimism over more stimulus measures in the mainland.

Gains in Hong Kong also reflected improved sentiment towards China.

Asian markets ex-China set for April losses

Most other Asian stocks outside China were set to clock losses in April, as they grappled with profit-taking in technology and as traders largely priced out expectations for early interest rate cuts by the Fed.

Japan’s Nikkei 225 jumped 1.3% on Tuesday, while the TOPIX added 2.1% in catch-up trade after a market holiday on Monday.

But the Nikkei was by far the worst performer in Asia through April, as it was slapped with a heavy dose of profit-taking, while uncertainty over the Bank of Japan’s policies also weighed. The Nikkei was down nearly 5% in April, while the TOPIX shed 0.9%.

South Korea’s KOSPI rose 0.6% on Tuesday, but was trading down 1.5% for April on losses in technology stocks.

Australia’s ASX 200 rose 0.2% after data showed an unexpected drop in retail sales in March, which could herald a lower inflation outlook. Weak commodity prices and concerns over China put the ASX on course for a 3.2% drop in April.

Futures for India’s Nifty 50 index pointed to a muted open after the index added 1% in the prior session. Sustained optimism over India’s economy put the Nifty on course for a 1.5% gain in April.

But investors were wary of any near-term volatility in the index, with the start of the 2024 general elections.