Here are the latest developments in global markets:

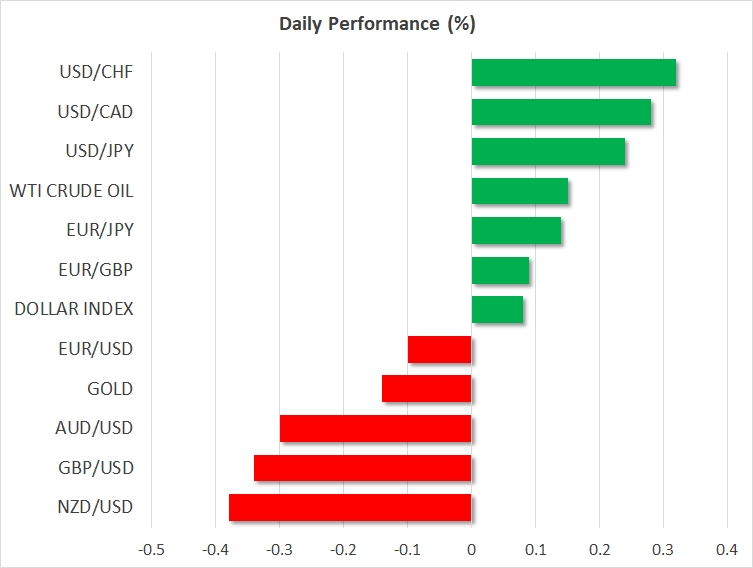

· FOREX: The dollar index traded marginally higher on Monday, recouping some of the losses it posted on Friday. Meanwhile, the yen remained relatively elevated after shooting up on Friday, following some remarks from BoJ Governor Kuroda.

· STOCKS: Asian markets were mixed. In Japan, the Nikkei 225 closed marginally lower, while the Topix was less than 0.1% higher. In Hong Kong, the Hang Seng declined 0.3%, though the index still lies very close to all-time high levels. In Europe, futures tracking the Euro STOXX 50 were 0.3% up, suggesting the index could open higher. Over in the US, Friday marked another spectacular day for the major indices, with the S&P 500, Dow Jones and Nasdaq Composite all closing at record highs. The Nasdaq led the charge, gaining an astonishing 1.3%, while the S&P tracked closely behind that, up by almost 1.2%. Futures tracking the S&P, Dow and Nasdaq 100 are all currently very close to neutral territory, thus providing no clear indication of how these indices might open today.

· COMMODITIES: Oil prices did not give a clear direction on Monday, with WTI trading slightly higher, but Brent crude being somewhat lower. Both benchmarks continue to hover near multi-year highs, buoyed by the broader plunge in the US dollar, as well as optimism that the market is rapidly rebalancing itself. That said, the sentiment surrounding the energy market may be on thin ice right now, amid tentative signs that US production has begun to rise again, following the surge in the US Baker Hughes oil rig count released on Friday. In precious metals, gold corrected a little lower on Monday, last trading near the $1347/ounce level.

Major movers: Yen spikes up on “optimistic” BoJ remarks

The Japanese yen gained ground on Friday, following some comments from Bank of Japan (BoJ) Governor Haruhiko Kuroda at Davos. In an uncharacteristically optimistic tone, he said there are some indications that Japanese wages are rising, and that the BoJ is finally close to achieving its 2% inflation target. Even though these comments are far from ground breaking, they come from a notorious policy dove, and amidst heightened speculation that the BoJ may be setting up to scale back its massive stimulus program.

That said though, one has to reiterate that any change in the BoJ’s language will likely be motivated by a substantial pick-up in wages and inflation, something that is not evident in the data yet. Indeed, the BoJ quickly backpedaled on these remarks, with a spokesperson for the Bank clarifying a few hours later that the Governor did not signal any change to the inflation outlook, causing the JPY to give back some of its Kuroda-induced gains.

GBP/USD corrected lower 0.3% today, perhaps due to some profit-taking ahead of a meeting in Brussels between EU27 ministers. The officials are expected to approve a set of directives that will allow their chief negotiator to broker a transitional agreement with the UK.

As for the commodity-linked currencies, USD/CAD was up nearly 0.3%. In the near-term, the pair will likely continue to respond to any moves in oil prices, as well as any developments in the ongoing NAFTA negotiations. In this respect, the sixth round of talks (out of seven) is scheduled to conclude today, amid no signs of material progress. Any comments from the senior negotiators will be closely watched. Elsewhere, USD/NZD was down almost 0.4%, while AUD/USD fell 0.3%.

Day ahead: US consumption and core PCE due; New Zealand trade data could also attract attention

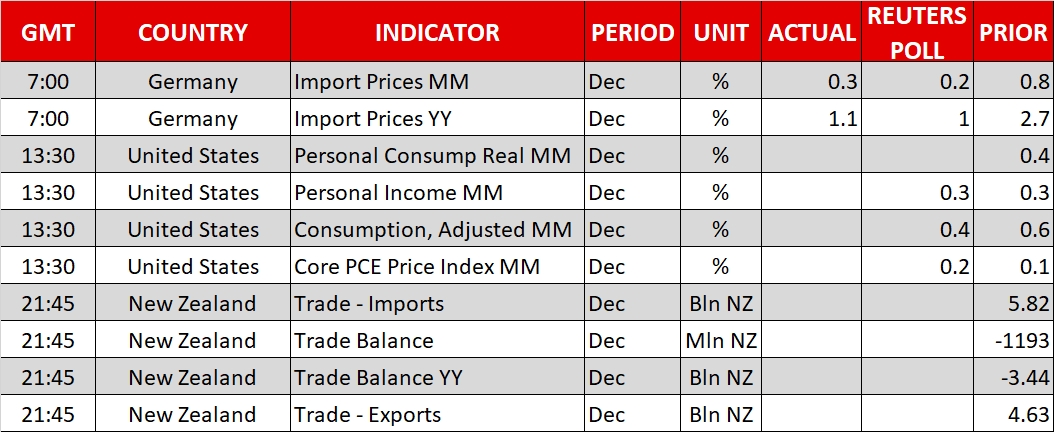

Market participants will be paying close attention to US consumption data for the month of December due at 1330 GMT. Consumer spending during the month is expected to ease after growing beyond forecasts in November, overall giving signs of positive momentum in the economy. The December core personal consumption expenditures (PCE) price index – the Federal Reserve's preferred inflation measure – will be made public at the same time. It is expected to grow by 0.2% m/m in December, up from November’s 0.1%, while year-on-year growth for the measure is expected to remain at 1.5%; this compares to the Fed's target for inflation of 2%. Following the surprising uptick in the core CPI rate for the month, market participants may be looking for a similar reaction in the core PCE print as well. An upside surprise could lead markets to price in a more aggressive tightening cycle by the US central bank, thus lending support to the greenback. Data on personal consumption and income will also be released at 1330 GMT.

Beyond the above releases, the economic calendar is relatively light today with New Zealand’s trade data for December gaining some interest. Those are scheduled for release at 2145 GMT.

European Central Bank board member Sabine Lautenschläger will be speaking at a Frankfurt conference on banking reforms at 1045 GMT.

In equity markets, corporate earnings releases will continue to keep investors busy.

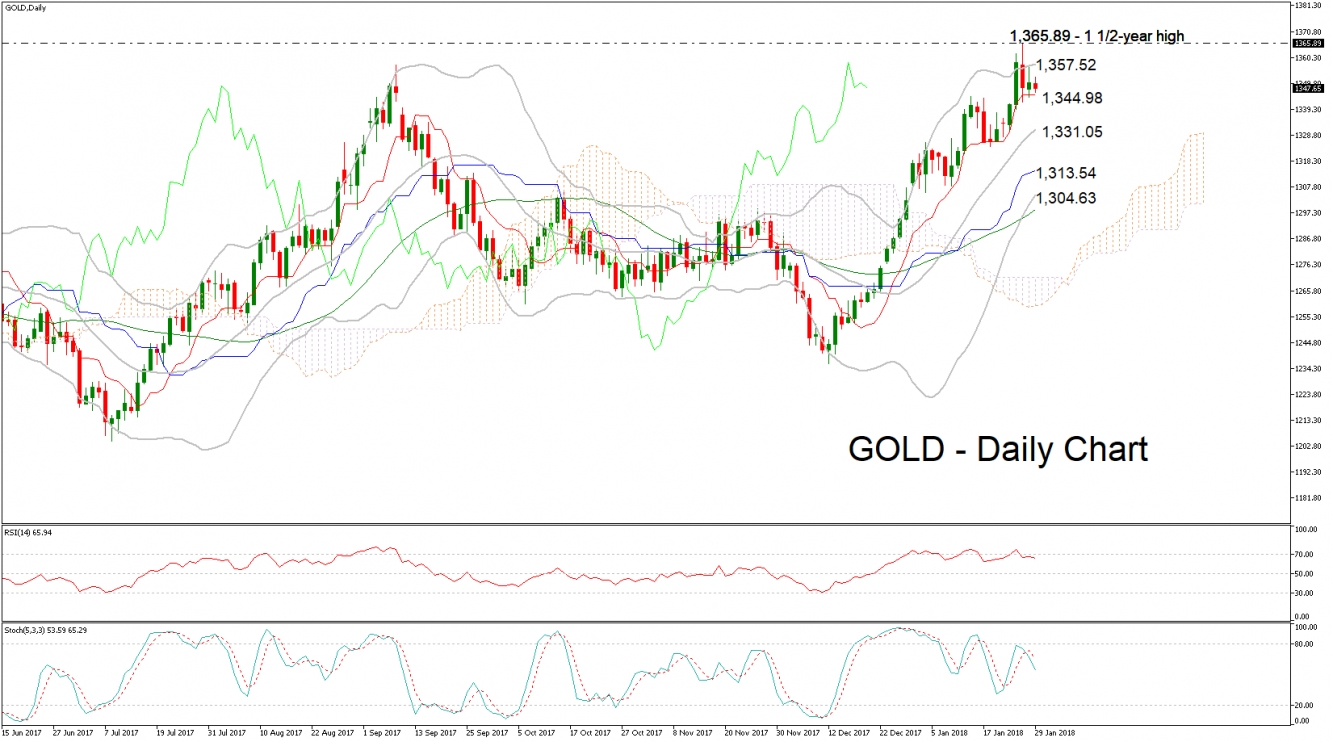

Technical Analysis: Gold bullish bias potentially loses steam

Gold has eased a bit after hitting a one-and-a-half year high of 1,365.89 last week. The Tenkan- and Kijun-sen lines remain positively aligned and the RSI indicator is in bullish territory above 50. However, the RSI moving sideways might be an indication of the bullish short-term momentum losing steam. Also, the stochastics are giving a bearish signal in the very-short-term: the %K line has moved below the slow %D one and both lines are heading lower.

The dollar-denominated precious metal tends to lose ground when the greenback strengthens. Stronger-than-anticipated US data on consumption and PCE later on Monday are expected to boost the dollar and likely push gold lower. In this case, gold might find support around the Tenkan-sen at 1,344.98, with steeper declines shifting the focus to the current level of the middle Bollinger line – a 20-day moving average line – at 1,331.05.

A US data miss that weakens the dollar could see the yellow metal advancing. In such a scenario, resistance could be met around the upper Bollinger band® at 1,357.52 and further above at around last week’s high of 1,365.89.