Trend Model signal summary

Trend Model signal: Neutral

Trading model: Bearish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

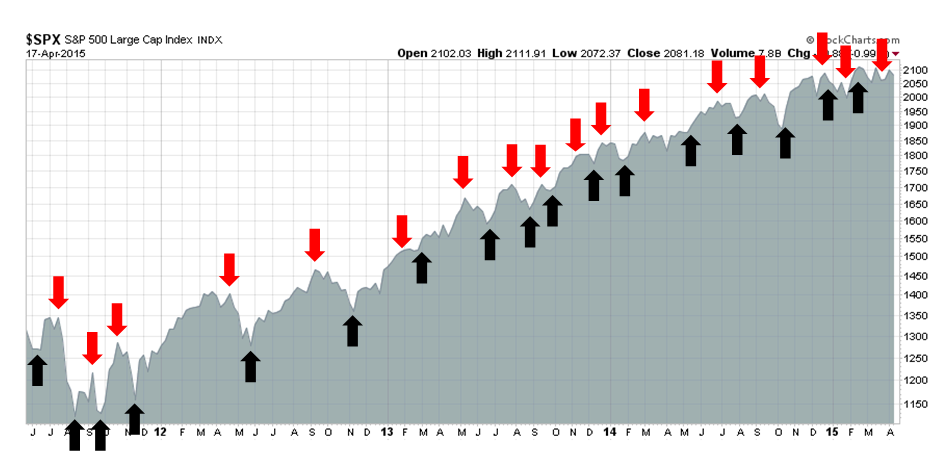

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual (not backtested) signals of the trading model are shown by the arrows in the chart below. In addition, I have a trading account which uses the signals of the Trend Model. The last report card of that account can be found here.

Update schedule: I generally update Trend Model readings on weekends and tweet any changes during the week at @humblestudent.

The bulls had their chance...

Last week, I wrote that I expected that the US equity market would have difficulty making gains because we have seen a pattern of choppiness for 2015 (see Calling an audible (for more choppiness)). On the surface, there were plenty of reasons to be bullish. The earnings outlook appeared positive as consensus estimates were rising again; overseas markets were strong, which indicated global reflation; and last week was option expiry week, which was a historically bullish period.

So what happened? The bulls turned out to be utter wimps. The SPX pushed up to a minor resistance level at 2112, only to see the gains evaporate and ended the week in the red.

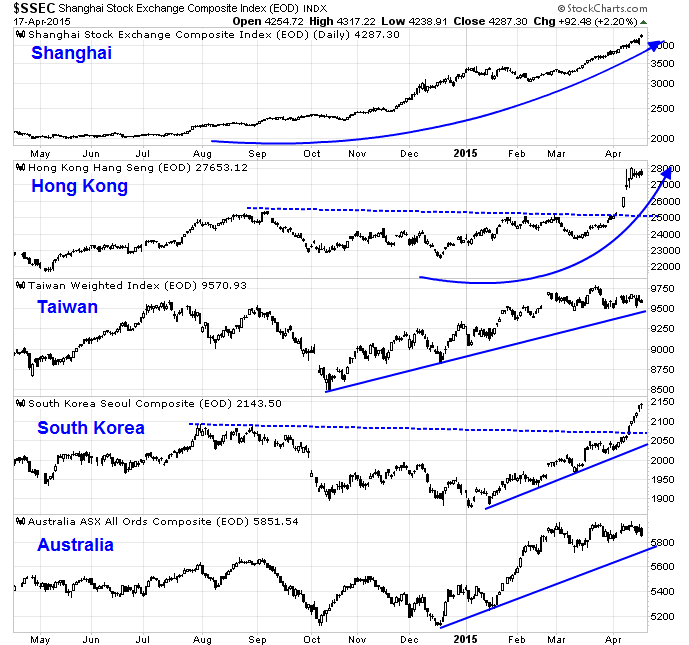

Nevertheless, the preliminary conclusion of a quick tour around the world is supportive of further gains. Non-US markets are rising. In Asia, stock markets are all in up-trends. While the Chinese market (via the Shanghai Composite) is a casino and somewhat divorced from China's economic outlook, the bourses of China's major trading partners (via the Hong Kong's Hang Seng, the Taiwan Weighted Index, South Korea's Seoul KOSPI, and Australia's ALL ORDINARIES) are signaling reflation, or at least the expectation of reflation. (Note that these charts do not reflect the announcement to put limits on margin trading and short selling, which cratered the China H-Shares futures by about 5% after the close).

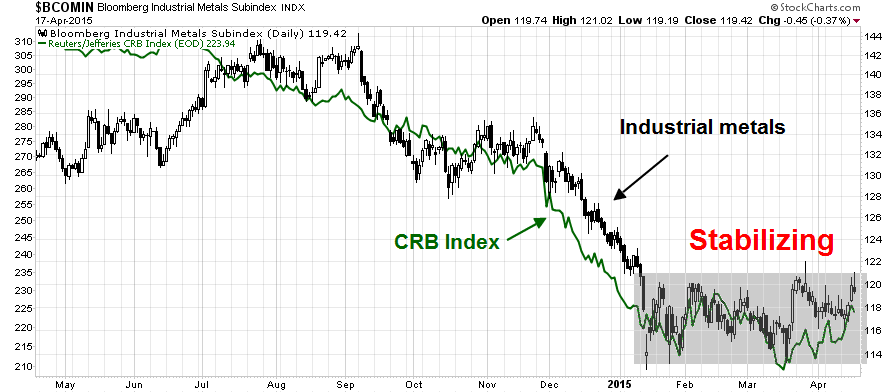

Commodity prices (via the CRB Index among others) appear to have stabilized, which is another indication that global deflationary fears (particularly in China) may be overblown.

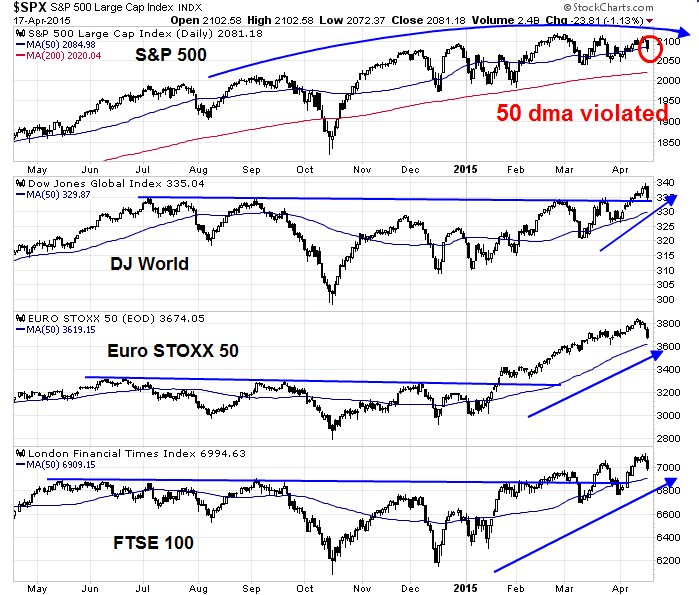

European markets (via the Dow Jones Global Index, DJ Euro Stoxx 50, FTSE 100), though weighed down by the never-ending Greek drama and dinged by Friday's weakness, are trending up.

The relative weakness of US stocks among the major markets is standing out like a sore thumb in my global review. Despite all these bullish tailwinds the SPX appears to be carving a broad top and violated its 50 day moving average on Friday.

What`s going on?

Signs of an intermediate term top

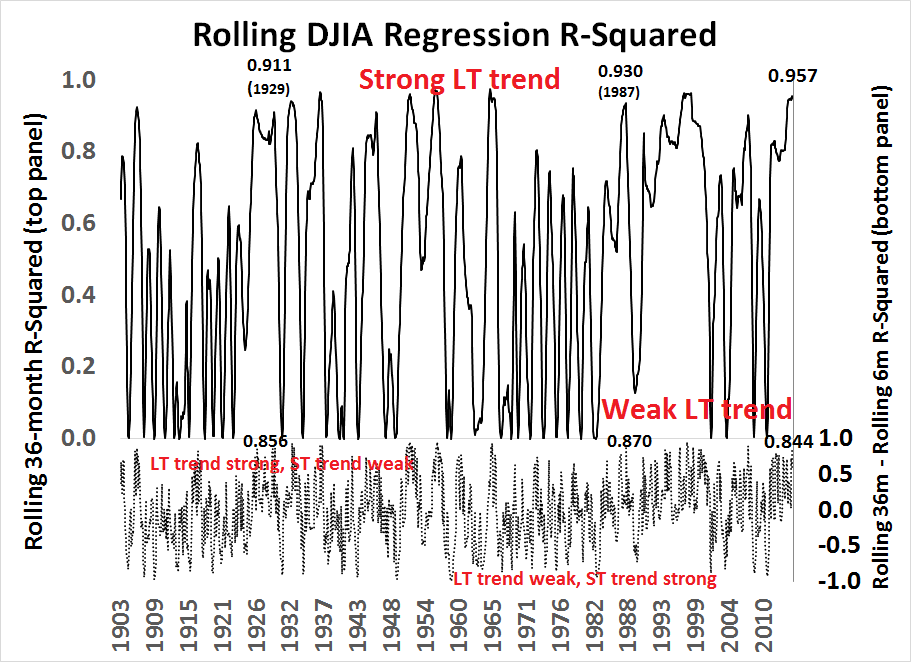

The best explanation I can offer, from a technician`s viewpoint, is that we are seeing the early signs of disappointment of investor complacency spawned by the steadily rising stock prices experienced in the past few years. I had previously highlighted a Wells Capital Management study showing how trended stock prices have become and how the trend appears to be overdone. I further extended the results of that study by comparing the long-term (36-month) trend and the short-term (6 month) trend (for more details see How to make your first loss your best loss).

The top panel of the chart below shows the rolling 36-month R-squared of stock prices, which shows that the trend in stock prices has been very good - too good. The bottom panel shows the difference between the 36-month R-squared and the 6-month R-squared shows that while the long-term trend is positive, the short-term trend is choppy. These conditions have historically led to market reversals in the past and readings are at levels similar to the ones seen before the market crashes of 1929 and 1987 (though with the caveat that this model is more predictive of future direction, not the magnitude of the move).

Catalysts for a correction

With that technical backdrop in mind, I have been seeking the fundamental catalysts for a correction for the past few weeks. I have a few candidates in mind.

- Fed tightening creates havoc in the HY and EM bond markets

- The mini-mania in Chinese stocks comes to a grinding halt and the risk-off contagion spreads

- The combination of a strong USD and pause in US economic growth spooks the earnings outlook

Taper Tantrum 2.0

Let's go through each of these scenarios, one by one. The IMF recently outlined its global economic outlook and the risks to financial stability in a report. A note from the Brookings Institute summarized how risks have changed:

* Risks are shifting from advanced economies, which are gradually healing, to emerging markets, where the variety of ailments include falling commodity prices and side effects of a slowdown in China and internal political tensions. This is, of course, a switch from the Great Recession, when emerging markets were a source of strength amid a financial crisis emanating from the U.S. and (later) Europe.

* Financial risks are shifting away from banks, which have strengthened substantially since the crisis, to non-bank financial institutions such as insurance companies and pension funds struggling to get high enough returns to meet their obligations and the rapidly growing portfolios of mutual funds and asset managers.

* The big questions about financial stability are shifting a bit from the solvency of big banks to the liquidity of markets: the signs, for instance, that market-making dealers are holding smaller inventories of bonds and have less capacity to dampen volatility or the concerns that investors in emerging-market and junk-bond mutual funds may underestimate the difficulty of getting out of those positions in a crisis. As Ms. Lagarde put it: “Liquidity can evaporate quickly if everyone rushes for the exit at the same time—which could, for example, make for a bumpy ride when the Federal Reserve begins to raise short-term rates.”

These risks lay out a scenario where Fed tightening could cause havoc in the credit markets, which could cascade into a risk-off rush in all asset classes. Business Insider highlighted the fact that HY default rates are at the lowest levels in history, which can create complacency. There is also the issue of the USD 9 trillion in offshore loans sloshing around the global financial system that is outside the reach of the Fed (see The key tail risk that the FOMC missed (and you should pay attention to)). A Fed tightening could conceivably put HY and EM borrowers at risk. With diminished liquidity in the bond markets, a rush for the exits could cascade into a sudden market crash in the credit markets.

Alas, I am sorry to disappoint permabears as this blog is not Zero Hedge. There are no signs of stress from the credit markets at the moment, but I will be monitoring them carefully for signs of rising risk aversion.

Stock market stir fry: Easy come, easy go

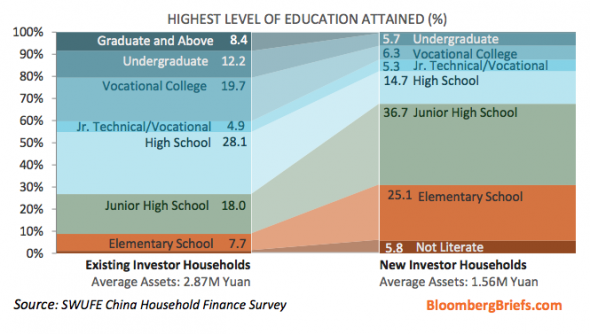

The second bearish scenario is based on China's stock market speculative frenzy coming to a screeching halt. We have all heard the stories. The number of new trading accounts have gone parabolic and about two-thirds of new stock traders in China haven't even graduated from high school (FT Alphaville), valuations look extended (FT Alphaville) and the level of turnover is frantic (CNN Money).

You have to understand that the Chinese stock market is not a traditional equity market in the western sense. It`s a casino. There is a Chinese expression describing a stock speculator as someone who "stir fries stocks". Think of the imagery of what happens to the ingredients when you stir fry in a wok and apply it to stock trading. Players care about fundamentals as much as horse players care about the ponies they bet on.

Remember the stir fry. Easy come, easy go - and lots of turnover.

For now, the Chinese enthusiasm for equities seems to have spilled over from the Mainland to the Hong Kong market. I have been monitoring the charts of the other "Greater China" markets, namely Taiwan, South Korea, Hong Kong and Australia, for Mr. Market's views of the Chinese economy (see chart above). As well, China surprised the market with a 1% RRR cut over the weekend, which is larger than the usual 0.5% cut, which may be a sign of panic. At the same time, a SCMP article entitled "Premier Li Keqiang makes case for deeper economic reforms over stimulus" signaled Beijing's reluctance to embrace more "stimulus", which I read to mean fiscal stimulus and infrastructure spending.

Reflecting on the steps the government had taken to cope with a slowing economy last year, Li said it was crucial it had launched reforms to decentralise decision-making and allow the market to play a bigger role.

Li attributed last year's successes to this "proactive and creative way to macro-manage".

"In a complicated economic environment, we acted calmly, neither tightening up nor easing monetary policies," he wrote. "If we had instead resorted to stimulus measures, not only would things have turned out very differently last year, we would end up having a harder time in the coming years, too.

"This is the most fundamental lesson last year's experience has taught us."

Li said the government must facilitate more reforms by giving more power to the market. He reiterated his administration's promise to cut the number of permits and initiatives that need government-approval by a third.

How will the markets react to the news? Will it focus on the regulatory changes to cool the mania in stocks, or will it focus on the stimulative effects of the RRR cut? Or will it interpret the RRR cut as a technical change to offset the effects of capital outflows, as this comment in a Bloomberg story indicates?

“The PBOC’s easing remains ’defensive’ in nature,” said Stephen Jen, co-founder of hedge fund SLJ Macro Partners LLP in London and former head of currency research at Morgan Stanley). “Capital outflows have continued, and this has led to a contraction in China’s base money. To offset this, the PBOC needed to take actions to increase the money multiplier.”

Stay tuned. Just one word of advice: Don't just watch what happens to the stock markets in China, but the peripheral "Greater China" markets too.

Earnings headwinds in the US

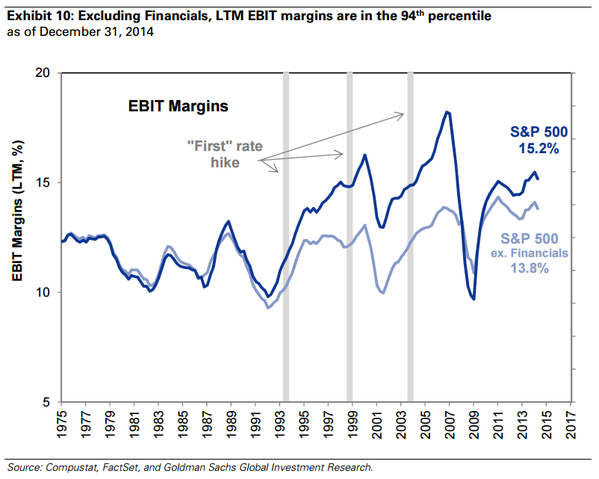

In a recent post, I wrote about how the strength of the USD was posing problems for the EPS growth outlook (see 2015 earnings headwinds in 3 charts). To recap, Ed Yardeni observed that net margin estimates seemed to be peaking for large, medium and small cap stocks. Indeed, this independent analysis from Goldman Sachs shows that EBIT margins are already elevated.

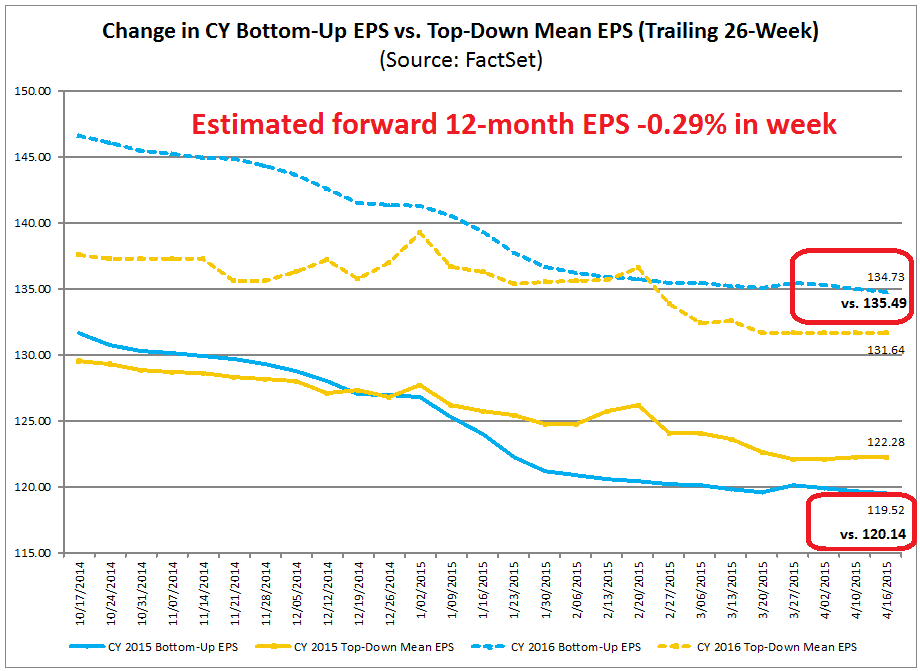

If margins do not expand, then sales growth will have to do the heavy lifting if earnings are to grow. But the strength of the USD is proving to be a headwind for sales growth. The latest update from John Butters of Factset indicates that while the earning beat rate for the young Earning Season was 77%, the sales beat rate was a disappointing 46%. By far, the most cited negative factor in earnings calls has been USD strength.

Consequently, EPS estimates ticked down this week. The chart below from Factset depicts the evolution of FY 2015 and FY 2016 estimates (annotations are mine). As EPS estimates have a tendency to fall over time, I calculated a forward 12 month EPS estimate by blending FY 2015 and FY 2016 estimates - and that figure fell by 0.29% in the week.

The EPS growth outlook has not been helped by the recent softness in the macro economic data. Industrial production was negative and came in below expectations last week. Retail sales, though positive, missed expectations. Doug Short`s Big 4 Recession Indicators are now looking a little wobbly.

In his latest comment, Short sounds a lot less certain that the expansion is likely to continue (emphasis added):

The overall picture of the US economy had been one of slow recovery from the Great Recession with a clearly documented contraction during the winter, as reflected in Q1 GDP. Data for Q2 supported the consensus view that severe winter weather was responsible for the Q1 contraction -- that it was not the beginnings of a business cycle decline. However, the average of these indicators in recent months suggests that the economy is at risk of outright contraction. Retail Sales and Industrial Production have been the source of weakness. We must see these improve in the months ahead to avoid an outright recession.

New Deal democrat, who has done an excellent job of monitoring macro data in real-time, seems to shading his previously bullish tone of a strong 2015 a little bit too much (emphasis added):

This week modulated what has been the dominant theme of the last several months: poor coincident indicators with positive long and short leading indicators. The big positive change was Gallup consumer spending. This measure has consistently earned its bones ever since it correctly showed that consumers were not pulling in their horns during the "debt ceiling debacle" of 2011. Hopefully the improvement is not a one-week wonder. On the other hand, there was a significant new negative in short leading indicators, as temporary staffing unexpectedly declined, which may mean that current industrial weakness is showing up in employment, remembering that hiring leads firing.

In summary, there is a shallow industrial recession, but a resilient consumer economy.

Could that "shallow industrial recession" be the catalyst for a market correction?

The week ahead: Wimpy bears?

In trying to forecast what might happen in the week ahead, here is the technical framework I am operating under. I have written about how the long-term trend remains strong, but the short-term trend is faltering. These conditions are highly suggestive of an intermediate term top.

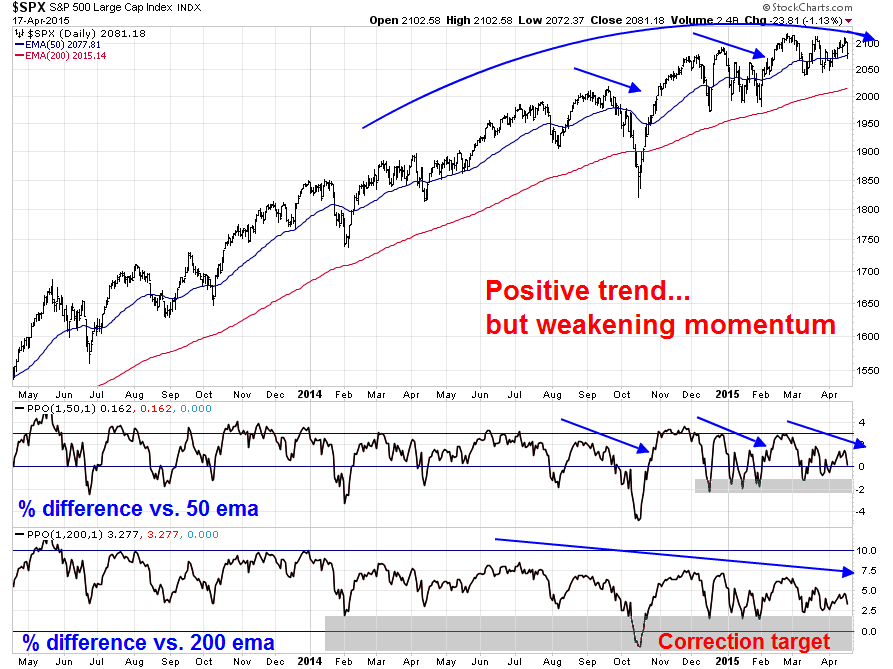

The bottom two panels of the below chart show the % difference between the SPX and the 50 or 200 day exponential moving average (ema). SPX price momentum is fading against the 200 ema and weakness against the 50 ema, which seems to be happening now, has resulted in minor pullbacks in the past few months.

The big question is "Will the latest round of stock market weakness be consistent with the usual, wimpy, 2-3% pullback or will it be the start of a major correction?"

I have three scenarios in mind, starting from the most likely to the least. My base case scenario (code name "wimpy bear") calls for further weakness into the coming week, with the decline ending at the SPX support at the 2035-2050 zone, followed by a rally to test the old highs.

After such a selloff, it isn't unusual for the market to bounce for the next day or two. However, neither the 5-day RSI nor the 14-day RSI are oversold, which suggests further weakness for the rest of the week. Recent declines have been arrested at the 150 day moving average, which should rise into the 2035-2050 zone next week. The magnitude of such a pullback is consistent with the experience seen in the above chart, where the market has bottomed out at between 1% and 2% below the 50 ema.

Since this market has seen more than its share of whipsaws, another possibility is Friday may have marked the bottom and a rally would ensue (code name "koala bear"). Dana Lyons showed that when the market trades in a tight range as it has in the recent past, it has had a tendency to make a marginal new high before correcting.

The third and IMHO least likely scenario, is that this is the start of a deeper correction (code name "Ursa Minor"). Certainly, the fundamental triggers of a growth scare and possible contagion from Chinese market weakness are there. Brett Steenbarger observed that while current conditions have been marked by the lack of buying, deeper corrections need rising selling pressure, which has been missing. In other words, we need more bearish momentum if the market were to correct further.

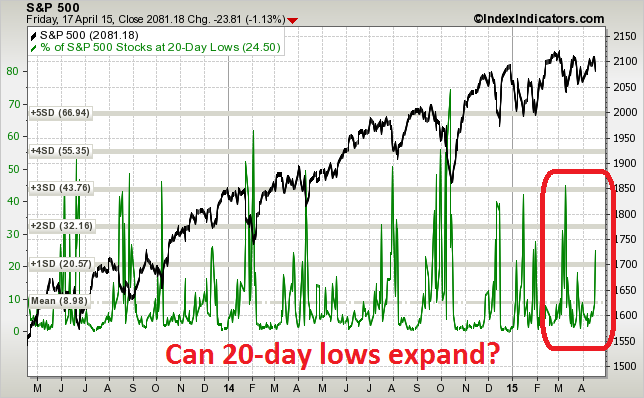

Here are some of the tripwires that I am watching. Can bearish momentum assert itself, as measured by an expansion of new lows?

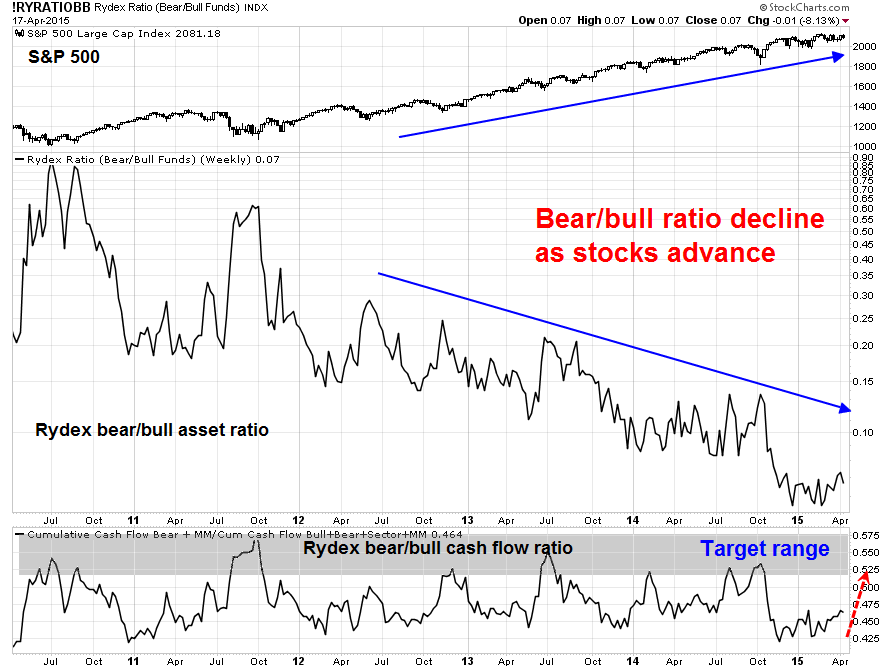

In a nutshell, a pre-condition for the onset of Ursa Minor is for the bearish bandwagon to get rolling. While most people monitor sentiment data from a contrarian perspective, in this case I am watching Rydex data for signs of a surge in bearish sentiment. The middle panel of the chart below shows the Rydex bear-bull asset ratio, which naturally declines as stock prices rise and the bottom panel shows the bear-bull cash flow ratio, which is nowhere near a crowded short reading. For a correction to get its spark, we need those lines to start rising.

In conclusion, my inner investor remains cautious but not panicked. He is holding his asset allocation at his policy weight as he believes that any correction should be mild, say a 10% stock market hiccup which is the kind of risk that you should accept when you invest in equities.

My inner trader flattened his short last Tuesday but re-established his short positions at the open on Friday. He has a stop loss at about Thursday`s close. Should the SPX fall to the 2035-2050 support zone, he will be watching for an expansion of bearish momentum as factors in his decision process on whether to cover and take profits.

Disclosure: Long SPXU, SQQQ

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.