Further to my recent post on how USD strength was retarding EPS growth, Ed Yardeni wrote a timely piece on how forward net profit margins appeared to be declining. As the chart shows, net margins appear to be peaking for large caps (blue line) and they seem to be definitely rolling over in mid and small cap stocks.

Yardeni went on to say that if margins are peaking, then the heavy lifting in profit growth will have to come from sales growth:

[P]rofit margins may be peaking across the board, though they aren’t likely to tumble until the next recession. If they have peaked, then profits growth will be determined mostly by revenues growth, which is likely to be below 5% this year and next year.

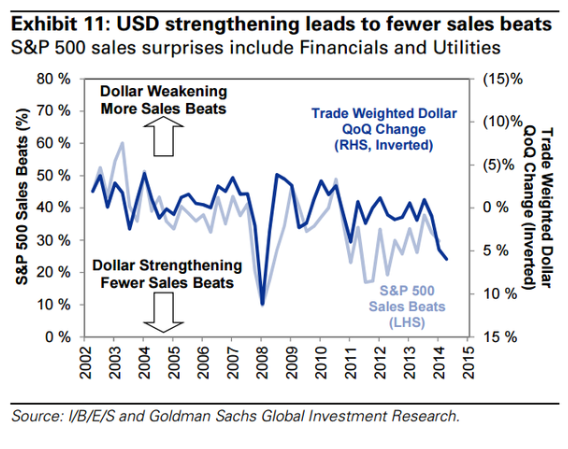

At this point, I got worried. As I pointed out in my previous post, the USD strength seems to be having a negative effect on report sales when compared to expectations. As USD strength continues, how will expectations be for revenue and EPS evolve over the year?

Here is the key question: Supposing that margins are flat to down for 2015 (as per Yardeni) and therefore earnings growth will depend increasingly on sales growth (Yardeni), but the relentless strength of the USD is proving to a headwind for sales growth, unless the American consumer steps up and spends wildly (which hasn't happened so far), what will drive earnings growth in 2015?

As Earnings Season progresses, here is what I will be watching:

- The body language of management when discussing currency effects on sales and earnings

- The trajectory of the USD

Appendix: Geek note on Yardeni vs. Butters

Eagle eyed readers will also note that apparently contradictory analysis from John Butters of Factset shows that net margins are expected to increase, compared to Yardeni`s analysis that they appear to be peaking. Here is Butters:

Higher Margins Projected for Remainder of 2015

Analysts are also expecting profit margins to continue to expand in 2015. Using the bottom-up sales-per share (SPS) and earnings-per-share (EPS) estimates for the S+P 500 as proxies for expected sales and earnings for the index over the next few quarters, profit margin estimates can be calculated by dividing the expected EPS by the expected SPS for each quarter. Using this methodology, the estimated net profit margins for Q1 2015 through Q4 2015 are 9.8%, 10.4%, 10.7%, and 10.7%. These numbers (starting in Q2 2015) are above the net profit margin for Q4 2014 (10.1%), and are also well above the average net profit margin of 9.4% recorded over the past five years.

Both Yardeni and Butters are correct, the difference can be explained by a difference in calculation (and interpretation). John Butters takes a snapshot of current EPS and sales projections and divide earnings by sales to arrive at quarterly margin projections by quarter. He finds that net margins are expected to rise on a quarterly basis.

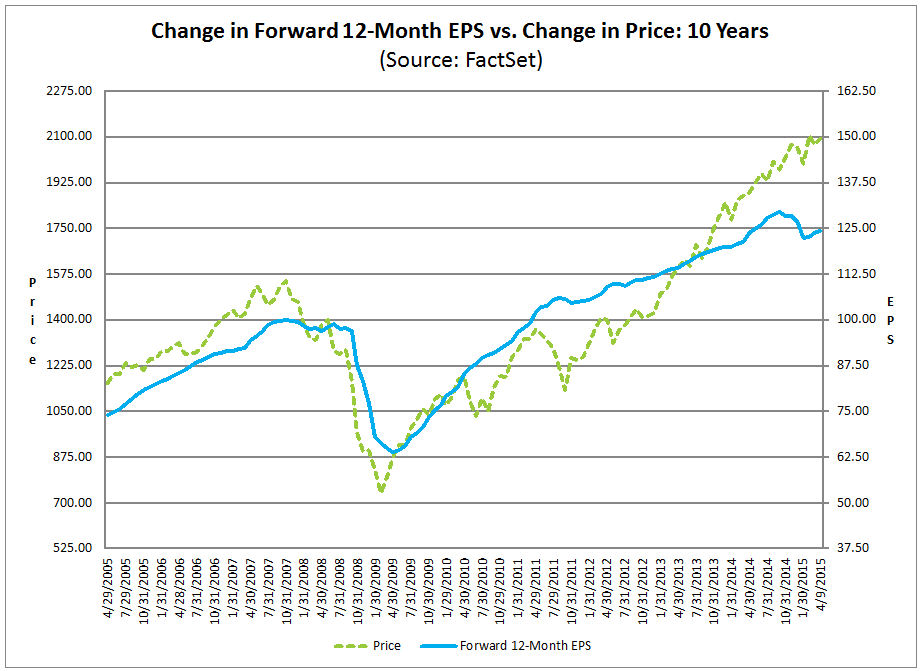

Ed Yardeni calculates the evolution of the forward net margin. For each data point, he divides the forward estimate earnings by forward estimated sales to arrive at a forward net margin for each point in time. This technique is stylistically similar to how John Butters comes up with his forward EPS line (shown in blue) in the chart below.

For the purposes of analyzing the expected change in net margins and how they are likely to affect EPS expectations, I believe that Ed Yardeni has the better approach.

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.