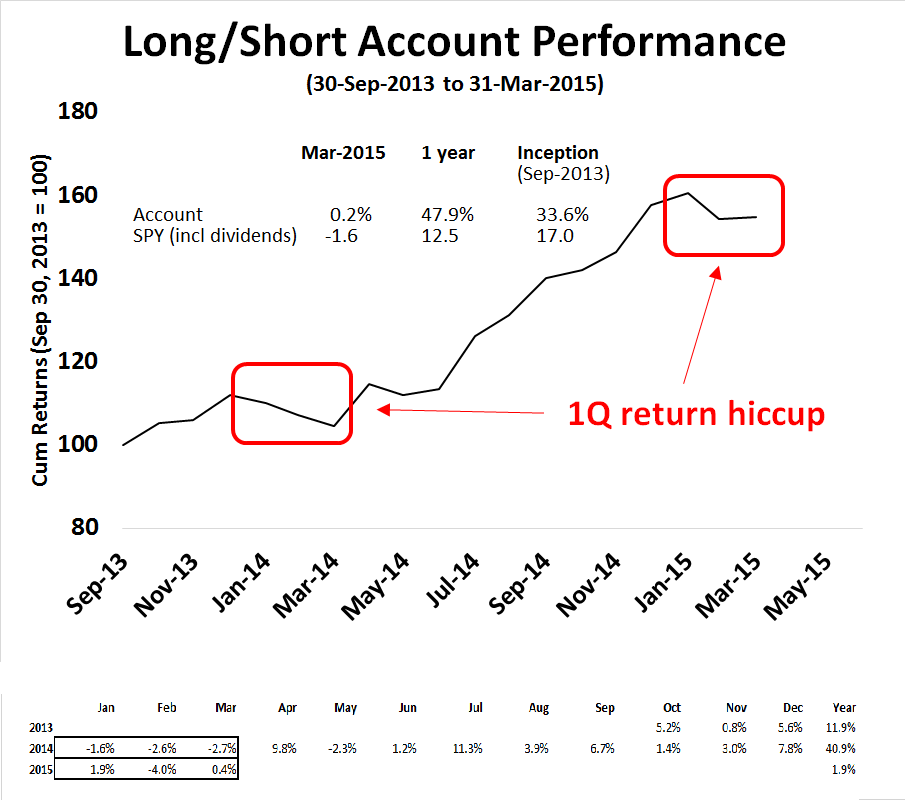

This is the latest performance update on my long-short account based on my Trend Model signals (see An intriguing Trend Model interim report card). The Trend Model account eked out a 0.2% in March; the one-year return was 47.9%; and the return from inception of September 30, 2013 was 33.6%. The 0.2% return followed a -4.0% drawdown in February, which is somewhat reminiscent of the hiccup seen in 1Q 2014.

I reiterate my disclaimer that I have nothing to sell anyone right now. I am not currently in a position to manage anyone`s money based on the investment strategy that I am describing.

Trend Model description

For readers who are unfamiliar with my Trend Model, it is a market timing, or asset allocation, model which uses trend following techniques as applied to commodity and global stock market prices to generates a composite Risk-On/Risk-Off signal (risk-on, risk-off or neutral). I have begun updating readers on the Trend Model signals on a weekly basis and via Twitter @humblestudent as new developments occur.

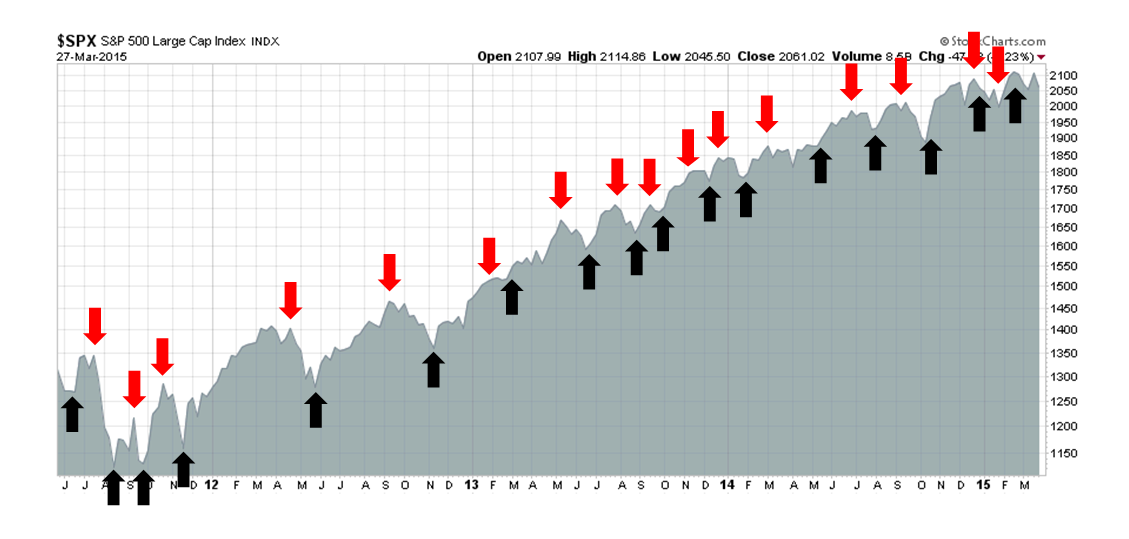

The chart below shows the actual (not back-tested) changes in the direction of the signal, which are indicated by the arrows, overlaid on top of a chart of the SP 500. You can think of the blue up arrows, which occurred when the trend signal changed from negative to positive, as buy signals and the red down arrows, which occurred when the trend signal changed from positive to negative, as sell signals.

Trend Model Signal History

A proof of concept

While the results from the above chart representing paper trading is always interesting, there is no substitute for actual performance. As a proof of concept, I started to manage a small account that traded long, inverse and leveraged ETFs on the major US market averages and, on occasion, sector and industry ETFs. Trading decisions were based on Trend Model signals combined with some short-term sentiment indicators. The inception date of the account was September 30, 2013 and the chart below represents an interim report card of that account. (For more details on how the Trend Model or how the account is managed, see my post here).

When evaluating the performance of this trading account, keep in mind that this is intended to be an absolute return vehicle. While I do show the SPDR S&P 500 (ARCA:SPY) total return, which includes re-invested dividends, for illustrative purposes, the S&P 500 is not an appropriate benchmark for measuring the performance of this modeling technique.

A challenging 1Q

The account was up 0.2% in March, 47.9% for one year and 33.6% from inception (September 2013). However, I would also like to point out that turnover averaged about 200% per month, so this strategy is not for everyone.

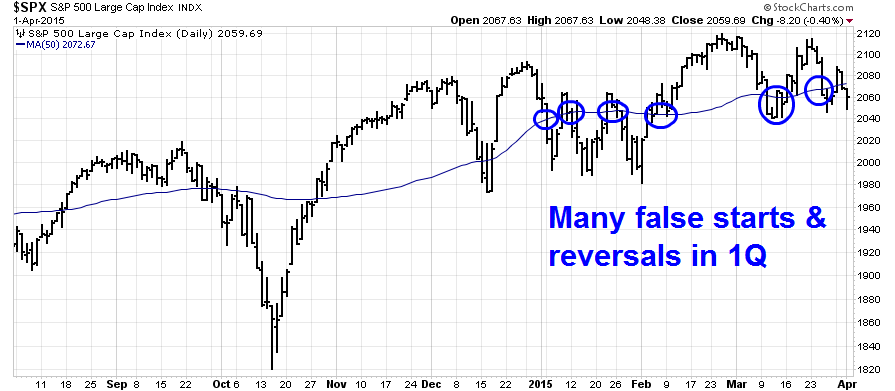

Despite the positive returns shown by the account, the market environment was especially challenging for this kind of trading system. The Trend Model signals are primarily based on the application of trend following principles to global stock and commodity markets. Trend following systems simply do not perform well in either sideways markets that are subject to whipsaw, or markets that experience sharp reversals.

As shown by the chart of the SPX below, the first quarter was marked by an up-and-down whipsaw market. As the chart below shows, the stock market was largely trend-less and moved up and down through the 50-day moving average, which is a proxy of the price trend, many times during this period. The account managed to achieve positive returns in January and March, largely through the use of short-term sentiment trading models that are used to supplement the main Trend Model signals, but these short-term models were caught offside when the market briefly trended in February.

Despite the challenging environment, this strategy continue to be promising:

- Returns are strong and the Trend Model is performing as expected.

- Returns are highly diversifying compared to major asset classes. They are uncorrelated with equities (correlation of -0.26 with SPY) and bonds (-0.10 with AGG).

- Returns are consistently positive, with a 72% batting average.

I expect that the strong 30%+ performance of this strategy will start to normalize towards a 20% average, especially if the stock market continue to be choppy in the months ahead.

2015: An acid test year I continue to believe that the market environment is likely to be challenging for both stocks and the Trend Model trading strategy in 2015. In a year-end 2014 review, I postulated a positive year for US stock prices but with a much higher (see 2015: Bullish skies with scattered periods of volatility). Trend following models do not perform well in choppy markets.

The stock market does see increased volatility, then the choppiness will indeed be an acid test for this trend following strategy. Positive returns during these volatile periods will lean more on the short-term sentiment models that I use to better assist the main trend following model to calibrate both entry and exits as well as the magnitude of position commitment.

To summarize, results continue to be promising for this model.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.