Market Brief

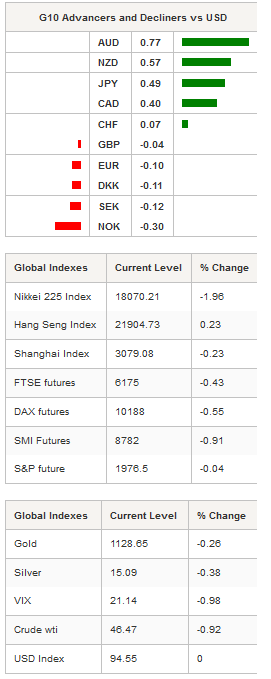

As expected, the Fed left its monetary policy unchanged and reaffirmed the current federal funds rate target range of 0% to 0.25%. The biggest surprise however, came from the tone of the statement. Market participants had already priced in this event but they were not prepared for such a dovish statement. As a result, the US dollar got immediately hammered, with the dollar index dropping 1.20% as the greenback lost ground against almost every single currency. However, commodity currencies such as the AUD, NZD and CAD were unable to hold ground as the dollar bounced back to its initial levels. US treasury yields dropped substantially amid the decision; the 10-year fell 11bps to 2.1830%, the 5-year dropped 14bps to 1.4710%, while the more sensitive 2-year sank to 0.67%, down more than 14bps.

EUR/USD is now trading above the 1.14 threshold and remains firmly set in the uptrend channel. The single currency validated a break of the 1.1368 resistance and is now heading for the following, standing at 1.1561 (high from August 26).

In the Asian session, regional equity markets across the board are trading in positive territory ahead of closing with the exception of Japanese shares which dropped at the opening. Both the Nikkei 225 and the broader TOPIX index were unable to move into territory during the session; they closed down 1.96% and 1.98%, respectively. Elsewhere in Asia, Hong Kong’s Hang Seng edged higher by 0.23% while Chinese mainland shares were trading without clear direction. The Shanghai Composite is down -0.23% and the Shenzhen Composite edges lower by -0.06%. In Australia, the S&P/ASX 200 index is up 0.46%. AUD/USD is on the rise this morning as the Fed’s decision still weighes on the greenback. The closest resistance, implied by yesterday high and 50dma, stands around 0.7250-76, while the next one can be found around the $0.74 psychological threshold. On the downside, a support lies at 0.7138 (yesterday’s low). NZD/USD is also moving higher this morning. Yesterday’s high at 0.6446 will act as resistance, while on the downside, the low standing at 0.6312 will act as support.

In Europe, equity futures point toward a lower open despite strong gains in Asian markets. The German DAX is down 0.55%, the CAC 40 -0.57%, the FTSE 250 -0.43% and the SMI -0.91%. EUR/CHF is still stuck below the 1.10 threshold, while USD/CHF took a hit yesterday evening dropping 1.25%. The dollar is currently testing the strong support standing at 0.96 as sellers cannot move the price lower.

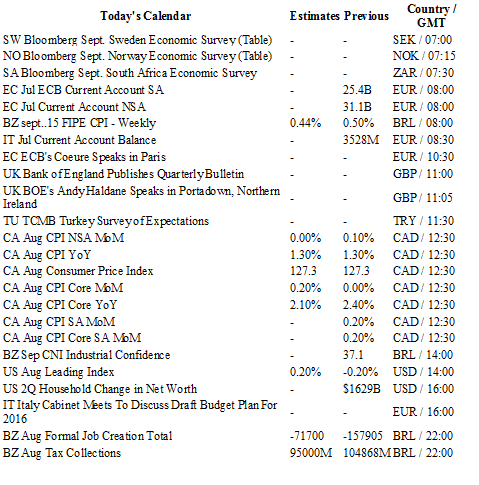

Today is a slow day for economic news. However, August inflation reports from Canada will be released this afternoon. Core CPI is expected at 2.1%y/y and headline CPI at 1.3%y/y. Despite recent correction in USD/CAD, we remain bullish on the pair as we believe that the Fed’s inaction will encourage the BoC to cut its benchmark rate before the end of the year.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1561

CURRENT: 1.1417

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5819

R 1: 1.5628

CURRENT: 1.5579

S 1: 1.5165

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.46

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9592

S 1: 0.9513

S 2: 0.9259