Market Brief

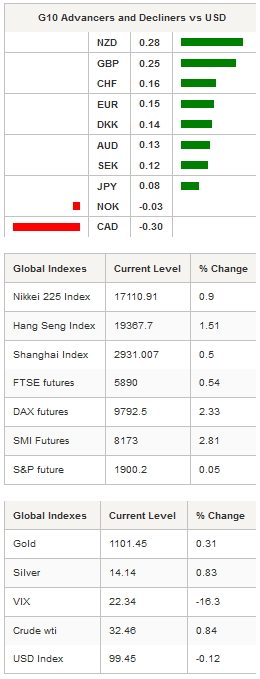

The greenback traded broadly lower throughout the Asian session as risk-off sentiment improved across financial markets. After surging more than 20% from Wednesday’s low, buying interests in crude remained solid on Tuesday. Futures on West Texas Intermediate were up 0.80% after surging more than 20% from Wednesday’s low, while futures on the Brent, gained 0.75% in overnight trading. However, WTI is currently testing the previous support, now resistance that lies at $32.40 (low from December 2008). A period of stabilisation is more than necessary to validate the rebound and to prevent prices from collapsing again.

In Asia, regional equity markets paired gains for a second straight day and validated Friday’s gains. The Japanese Nikkei 225 edged up 0.90%, while the broader TOPIX index gained 1.34%. In Hong Kong, the Hang Seng climbed 1.51%, while in mainland China, the Shenzhen and the Shanghai Composite rose 0.50% and 0.86% respectively. Finally, in Australia, the S&P/ASX 200 was up 1.84% as commodity stocks recovered.

The New Zealand dollar surged the most in Tokyo, reaching $0.6533. In the context of the rate cut by the RBNZ, we expect that the Kiwi won’t go much higher. Even though most market participants do not expect Governor Wheeler to further ease the Bank’s monetary policy stance, the odds of a rate hike have increased substantially due to the lack of inflationary pressure. NZD/USD will find a first support at around 0.6450; however the real test stands at 0.6348 (low from January 20th). On the upside, the 0.69 remains the strongest resistance.

In Europe, futures equity indices are blinking green across the screen, taking the Asian lead. The FTSE 100 edged up 0.54%, the German DAX surged 2.33%, the CAC 40 climbed 3.10%, while the SMI rose 2.81%. EUR/CHF is holding ground above the 1.09 threshold is about to test the 1.10 level. USD/CHF managed to stay above parity and is currently trading at around 1.0150 as the bias remains on the upside. Overall, we believe that the Swiss franc will be under pressure as investors return to riskier assets. However, on the medium-term, one should keep an eye on the ECB as an increase/extension of the quantitative easing programme appears to be increasingly on the cards. However, on the short-term, there is upside potential in both USD/CHF and EUR/CHF.

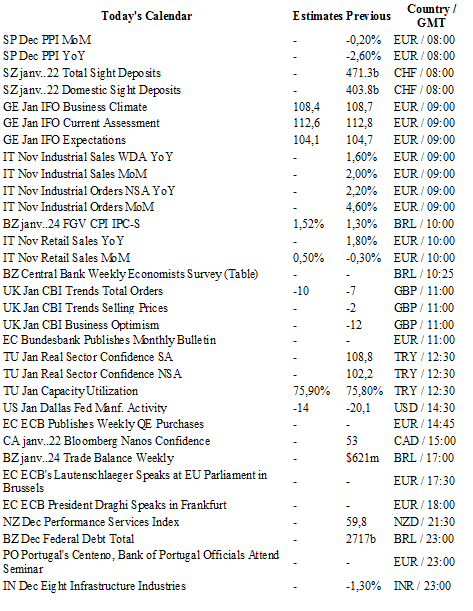

Today traders will be watching SNB’s sight deposits; IFO survey from Germany; industrial orders and retail sales from Italy; capacity utilization from Turkey; Dallas Fed. Manufacturing Activity from the US; weekly trade balance from Brazil. ECB’s Draghi and Lautenschläger will also give a speech later today.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0827

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4260

S 1: 1.3657

S 2: 1.3503

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 118.32

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0142

S 1: 0.9786

S 2: 0.9476