Market Brief

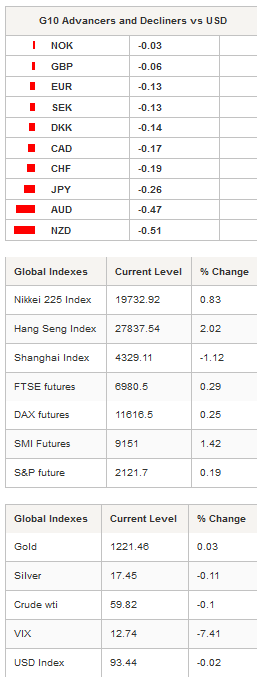

It was a quiet FX session in Asia. The US dollar extended gains against G10. The Aussie and the Kiwi were the biggest losers, down 0.47% and 0.51% respectively. In the stock market, equity returns are mixed this morning, unable to follow Wall Street’s pace. Yesterday in New York, the S&P 500 gained 1.07% to 2,121 points, closing at record high; US 30 and NASDAQ Composite were up 1.06% and 1.38% respectively. S&P 500 futures are down -0.03%. Across the Pacific, Shanghai Composite retreats -1.12% while Nikkei 225, Hang Seng, S&P/ASX and BSE Sensex 30 gained 0.80%, 2.02%, 0.43% and 0.68% respectively.

USD/JPY showed little price action overnight and was range bound between 118.90 and 119.50. AUD/USD extended losses for the second day in a row, erasing partially early week’s gains. The Aussie remains in a hourly uptrend channel and will find support at the bottom of the latter around 0.80. On the upside, a key resistance stands at 0.8295 (high from January 15th and 200dma). Elsewhere, THB retreated -0.40%, KRW is up 0.44% while MYR appreciated 0.29%.

EUR/USD moved sideways in Tokyo after yesterday’s sharp moves. EUR/USD printed an 11-week high in the European session at 1.1445. The euro is currently in the middle of a key resistance area between 1.1380 and 1.1535 which corresponds to February’s highs. Despite initial jobless claims released better-than-expected at 264k verse 273k expected (265k prior read), the dollar had a tough week so far, losing ground against all G10. The top winners are the NOK up 2.58%, CHF up 2.17%, AUD up 2.07% and the single currency up 2.01%. The recovery in the US economy appears to be less temporary than expected. We expect US growth to accelerate in Q3, resuming the dollar rally. Meanwhile, we do not rule out a weaker dollar in the short/medium-term, especially if disappointing economic data keep coming out of the world’s biggest economy.

In Europe, equity futures are green this morning, with the SMI up more than 1.42%. DAX is up 0.25% and Euro Stoxx +0.25%. GBP/USD treads water in Asia, marking a pause in the 1-month rally. The sterling validated successively the break of the 50dma and the 200dma and is now on its way to test the next resistance standing a 1.5879 (Fib 50% on July 2014 – April 2015 debasement). Further, the next resistance lies at 1.6189 (Fibo 61.8%) while on the downside a support stands at 1.5569 (Fib 38.2%).

The economic calendar is light today, again. However, traders will be watching March manufacturing sales in Canada (1%m/m exp, -1.7% prior), May Empire manufacturing index and April industrial production (0% exp, -0.6% prior) and May Michigan sentiment index (exp flat) in the US.

Today's CalendarEstimatesPreviousCountry / GMT TU Feb Unemployment Rate 11.40% 11.30% TRY / 07:00 SZ Apr Producer & Import Prices MoM -0.10% 0.20% CHF / 07:15 SZ Apr Producer & Import Prices YoY -3.40% -3.40% CHF / 07:15 NO Apr Trade Balance NOK - 20.7B NOK / 08:00 UK Mar Construction Output SA MoM 4.00% -0.90% GBP / 08:30 UK Mar Construction Output SA YoY 1.10% -1.30% GBP / 08:30 BZ May FGV Inflation IGP-10 MoM 0.73% 1.27% BRL / 11:00 TU TCMB Turkey Survey of Expectations - - TRY / 11:30 CA Mar Manufacturing Sales MoM 1.00% -1.70% CAD / 12:30 US May Empire Manufacturing 5 -1.19 USD / 12:30 CA Mar Int'l Securities Transactions - 9.27B CAD / 12:30 CA Apr Existing Home Sales MoM - 4.10% CAD / 13:00 CA Bloomberg May Canada Economic Survey - - CAD / 13:00 US Apr Industrial Production MoM 0.00% -0.60% USD / 13:15 US Apr Capacity Utilization 78.30% 78.40% USD / 13:15 US Apr Manufacturing (SIC) Production 0.20% 0.10% USD / 13:15 US May P U. of Mich. Sentiment 95.9 95.9 USD / 14:00 US May P U. of Mich. Current Conditions - 107 USD / 14:00 US May P U. of Mich. Expectations - 88.8 USD / 14:00 US May P U. of Mich. 1 Yr Inflation - 2.60% USD / 14:00 US May P U. of Mich. 5-10 Yr Inflation - 2.60% USD / 14:00 US Mar Net Long-term TIC Flows - $9.8B USD / 20:00 US Mar Total Net TIC Flows - $4.1B USD / 20:00 IN Apr Exports YoY - -21.10% INR / 22:00 IN Apr Imports YoY - -13.40% INR / 22:00 IN Apr Trade Balance -$10.5B -$11.8B INR / 22:00

Currency Tech

EUR/USD

R 2: 1.1529

R 1: 1.1450

CURRENT: 1.1412

S 1: 1.1111

S 2: 1.1000

GBP/USD

R 2: 1.6189

R 1: 1.5879

CURRENT: 1.5776

S 1: 1.5569

S 2: 1.5156

USD/JPY

R 2: 122.03

R 1: 120.10

CURRENT: 119.45

S 1: 118.91

S 2: 117.94

USD/CHF

R 2: 1.0240

R 1: 0.9571

CURRENT: 0.9121

S 1: 0.8936

S 2: 0.8823