Market Brief

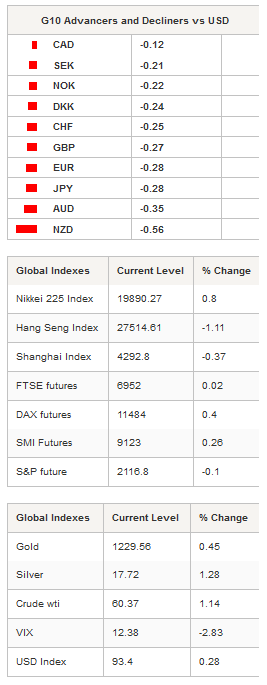

US Industrial Production for April was released on Friday and came in below expectation, at -0.3%m/m verse 0.0% consensus. The University of Michigan’s preliminary sentiment index for May dropped to 88.6 from 95.9 the prior month while the Empire Manufacturing Index came in at 3.09 versus 5 expected. The recent weak data dampen the American’s mood and decrease the odds of a second-quarter rebound, helping the S&P 500 to print a new all-time high at 2,122.73, for the second day in a row, on hopes the Fed will delay rate hike. The Dow Jones gained 0.11%, the NASDAQ retreated by -0.05%. The weak data put the greenback under pressure, the dollar index dropped 0.65% Friday at 93.38. EUR/USD rallied, printing a new 3-month high at 1.1467 in New York. In Tokyo, the single currency moved sideways around 1.1440, consolidating gains.

Asian equity markets are broadly lower this morning with the exception of the Nikkei 225, up 0.80%. Chinese stocks dropped as China’s home prices decline further. Hong Kong’s Hang Seng is down -1.11%, Shanghai Composite retreated -0.37%. In Japan, Machine Orders rose 2.9%m/m in March (1.5% expected, prior revised down to -1.4%) for the first time in 2015. USD/JPY is slightly higher this morning to 199.66. The dollar will find support around 118.50 (previous lows) and resistance at 120.18 (fib 50% on March debasement). Australian shares are blinking red on the screen, down 1.33% to 5,659.20. AUD/USD sits on the 0.8028 support implied by the highs of April 28th and May 6th. The Aussie is still in its uptrend channel since April 14th, up almost 5 figures since then.

In Europe, equity sell-off pauses in pre-session with European futures broadly higher. Euro Stoxx 50 futures are up 0.34%, FTSE is flat, DAX edges higher by 0.40% and Swiss futures rise 0.26%. GBP/USD breathes after a 7-day rally, consolidating between 1.57-1.58. The cable validated the break of the 38.2% Fibonacci level (on July 2014 – April 2015 sell-off) and the 200dma; the pair will need some fresh boost to clear the next resistance standing at 1.5879 (Fib. 50%). EUR/GBP is edging higher and turned the 0.7248 resistance into support (Fib 50% on March-April rally). On the upside, the euro should find some buying interests above 0.73.

USD/CHF found a strong support at 0.9073 as the dollar failed twice at breaking the support. EUR/CHF is currently testing 1.05 and lacks the strength to validate a break. The single currency will find support at 1.04; we expect the pair to remain within the 1 figure range.

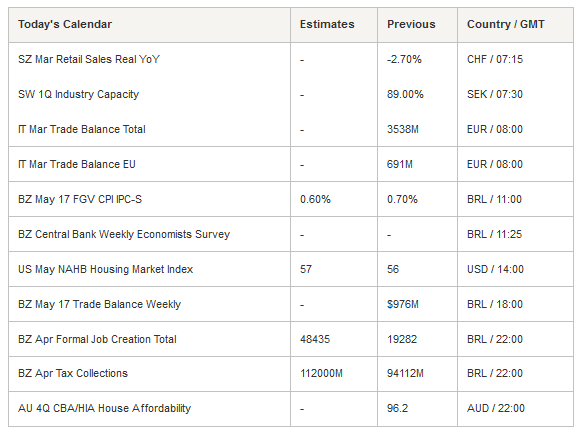

The economic calendar is very light today. However, the remainder of the week will be very busy with the release of the FOMC minutes, CPI and Housing starts from the US; Flash PMIs, final HCPI and German IFO from Eurozone; CPI, retail sales and BoE MPC minutes from UK; RBA minutes; GDP and BoJ from Japan.

Currency Tech

EUR/USD

R 2: 1.1529

R 1: 1.1450

CURRENT: 1.1396

S 1: 1.1111

S 2: 1.1000

GBP/USD

R 2: 1.6189

R 1: 1.5879

CURRENT: 1.5673

S 1: 1.5569

S 2: 1.5156

USD/JPY

R 2: 122.03

R 1: 120.10

CURRENT: 119.67

S 1: 118.91

S 2: 117.94

USD/CHF

R 2: 1.0240

R 1: 0.9571

CURRENT: 0.9204

S 1: 0.8936

S 2: 0.8823