Market Brief

Yesterday, better-than-expected US CPI figures put an end to the commodity currency rally. The core gauge indicated that when food and energy are excluded, consumer prices grew 0.2%m/m during the month of September, while economists were expecting an increase of 0.1%. On a year-over-year basis, core CPI rose 1.9%, beating market expectations and previous reading of 1.8%. Even with the most volatile components factored in, consumer prices remained stable compared to September 2014, above consensus of -0.1%y/y. In spite of this good news from the core gauge, we do not see any trend reversal in inflation levels for the moment. Recent dollar gains aside, we think the greenback is lacking the strong catalyst it needs to reverse the ongoing negative trend. Even though the market is highly data-sensitive, just like the Fed, even this recent string of good news is not enough -- we need to see a real, concrete trend reversal in economic indicators.

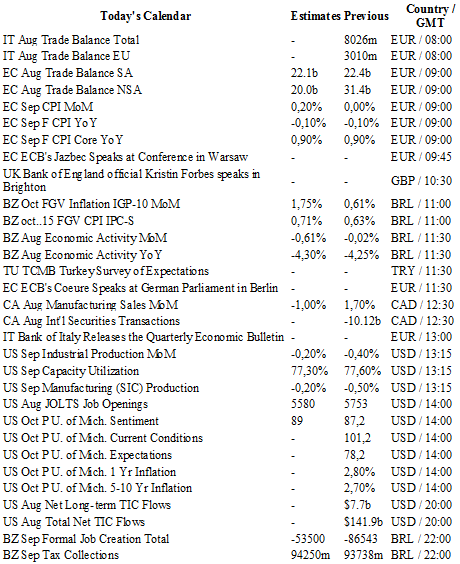

Economists expect industrial production, due later today, to have contracted -0.2%m/m in September after a decrease of -0.4% in the previous month. Aside from this, the preliminary Michigan Sentiment is expected to rise from 87.2 to 89 in October. EUR/USD dropped 1.15% yesterday amid dovish comments from Benoît Cœuré, ECB board member, and US CPI figures.

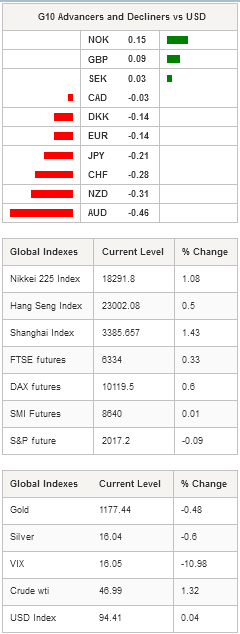

Commodity currencies stabilised against the greenback. The Aussie is trading around $0.73 and has been unable to break the resistance lying at around $0.74 (psychological level and previous high). The Kiwi is holding ground above $0.68 on better-than-expected third quarter CPI figures; inflation rose 0.3%q/q versus 0.2% consensus, but below the previous reading of 0.4%. The loonie keeps printing new highs against the greenback, reaching levels last seen in July 2015. Finally, USD/NOK has been unable to break the strong support standing at 8.0464 (low from September 18th) and is currently trading slightly above.

On the equity front, shares are trading higher across the board on positive from Wall Street. The Japanese Nikkei 225 is 1.08%, the TOPIX index 1.01%, in Singapore shares rose 0.40%, in mainland China the Shanghai Composite climbed 1.43%, while its tech-heavy counterpart were up 1.08%. In Hong Kong the Hang Seng edged up 0.50%. In Europe, futures are also trading higher with the DAX gaining 0.60%, the FTSE 250 0.33%, the SMI 0.01%, the CAC 40 0.51% and the Euro STOXX 600 0.50%.

Today traders will be watching final September CPI from the Euro Zone; manufacturing sales from Canada; industrial production, capacity utilization, Michigan sentiment and JOLTS opening from the US.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1561

CURRENT: 1.1372

S 1: 1.1106

S 2: 1.1017

GBP/USD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5480

S 1: 1.5202

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.17

S 1: 118.07

S 2: 116.18

USD/CHF

R 2: 0.9844

R 1: 0.9741

CURRENT: 0.9534

S 1: 0.9384

S 2: 0.9259