Market Brief

On Wednesday, the release of poor trade data from China heavily affected the European and US markets. The sell-off in equity was led by commodity and energy shares, which fell the most on the back of plummeting commodities. The West Texas Intermediate fell sharply yesterday, dropping as much as 5.90% amid renewed concerns about global growth. In Europe, the Euro Stoxx 600 fell the most amongst regional indices, falling 1.01%, while in the United Kingdom the Footsie 100 was down 0.92%.

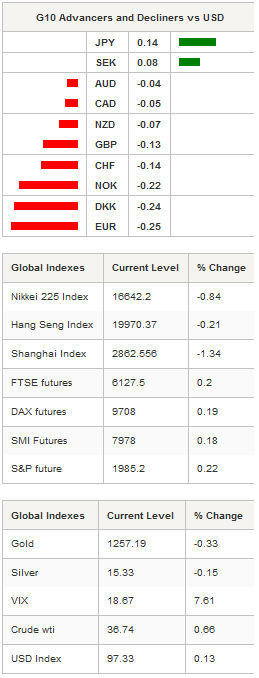

Across the Atlantic, shares have not been spared by the spreading risk-off sentiment: the S&P 500 was down 1.12%, while the Nasdaq fell 1.26%. It worth noticing that small capitalizations have paid the heaviest tribute as the Russell 2000 was down 2.40%. Unsurprisingly, most Asian regional equity indices were trading lower overnight, following the rest of the world. The Nikkei settles down 0.84%,. While the broader Topix was down 1.14%. In China, the Shanghai Composite slid 1.34%, while in Hong Kong the Hang Seng fell 0.21%.

On the FX market, the single currency lost ground against all G10 currencies, in anticipation of the ECB’s decision to further ease its monetary policy. The Japanese yen was the biggest winner, up 0.31% against the EUR. EUR/JPY is down 1.70% from a week ago as traders take shelter in the yen. On the downside, the low from February 29th at 122.09 remains the closest support, while on the upside the high from March 4th will act as resistance.

The single currency was also trading lower against the US dollar, but the fall was less pronounced as investors became increasingly worried about the US economy’s ability to weather the current market turmoil, and more specifically, the ability of the Federal Reserve to deliver what it promised. EUR/USD lost momentum ahead of the ECB meeting and fell 0.25% overnight. Until the meeting we expect the pair to trade sideways but maintain our positive bias on the basis that Mario Draghi will deliver what the market has already priced in.

EUR/CHF returned above the 1.0950 threshold as traders realized that the upside surprise in inflation was a once-off. However, on the medium-term, the risk remains on the downside as traders adjust their positions ahead of Thursday’s ECB meeting.

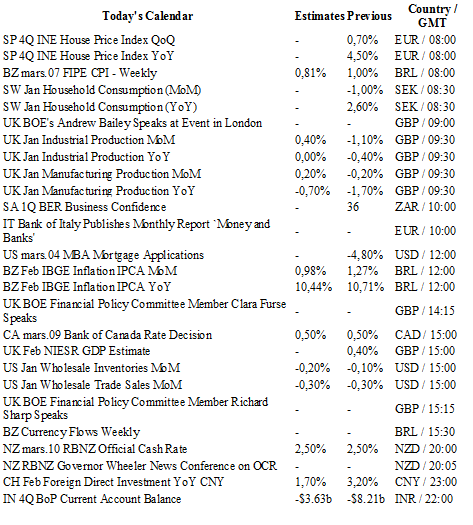

Today traders will be watching industrial and manufacturing production from UK; MBA mortgage application and wholesale inventories from the US; inflation report from Brazil; interest rate decision from the BoC; RBNZ governor Wheeler press conference on OCR.

Currency Tech

EUR/USD

R 2: 1.1193

R 1: 1.1068

CURRENT: 1.0966

S 1: 1.0810

S 2: 1.0711

GBP/USD

R 2: 1.4591

R 1: 1.4409

CURRENT: 1.4190

S 1: 1.3836

S 2: 1.3657

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 112.67

S 1: 110.99

S 2: 105.23

USD/CHF

R 2: 1.0257

R 1: 1.0074

CURRENT: 0.9996

S 1: 0.9847

S 2: 0.9660