Well, it had to happen eventually, and it occurred on the perfect day for it. After the Nasdaq 100 futures (NQU17:CME) closed higher 10 days in a row, and the S&P 500 futures (ESU17:CME) closed up 9 out of the last 10 sessions, the markets sold off and the bears went nuts. To say it was long overdue is an understatement, but after the ES traded down to 2462.74, and the NQ went down to 6896.50, both markets rallied going into the NY lunch time.

At 12:30 CT, the ES traded up to 2470.00, then reversed lower to 2467.25, down 5.50 handles. The NQ made its way up to 5921.55, before trading back down 5909.50, down ?? points. Not much of a kill job. After the inital sell off things went quiet and while there was a small rally there was a total lack of trade. Much of this has to do with the summer trade but the other part is that expirations tend to see some action in the first 45 minutes and the final 45 and little in between and that how the days trade went.

The PitBull commented that ‘they had them for sale early, and maybe they will they have them for sale late.’

Late the MiM started to show over $ 300 mil for sale. The ES sold off down to 2466.00 and then rallied up to 2469.50 when it ‘flipped’ to the buyside. I put this out at 2:25; Dboy: MiM flips the ES will trade 2471. It didnt quiet make it to 2471 but overall it was not a bad close.

In the end the S&P 500 futures (ESU17:CME) settled at 2469.50, down -1.75 handles, or -0.07%, the Dow Jones futures (YMU17:CBT) settled at 21518, down -63 points, or -0.29%, and the Nasdaq 100 futures (NQU17:CME) settled at 5918.75, down -6.50 points, or -0.11%… Like I said above; not much of a kill job.

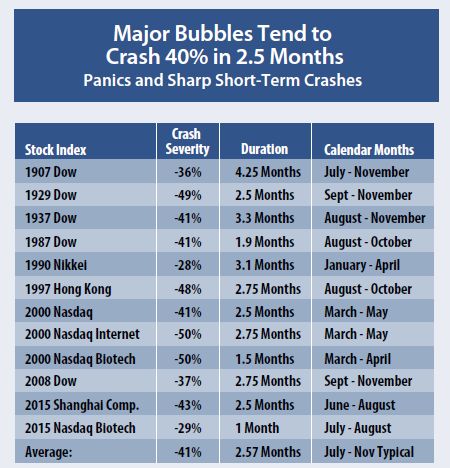

There’s a lot of talk about a stock market bubble going around, and there are also tons of historical stats that say the stock market should correct, but I go back to one thing… What’s changed?

FYI…don’t shoot the messenger…

Achtung! Before you all head to the beach/break…13 trading days left!!!

While You Were Sleeping

Overnight, equity markets in Asia traded mostly higher, led by the JSX Composite, which closed up +0.63%. Meanwhile, in Europe, stocks are trading lower this morning, as investors await the next round of earnings releases.

In the U.S., the S&P 500 futures opened last nights globex session at 2469.75, and printed the high of 2470.50 within the first few minutes of trading. From there, the ES began a move down 2463.50, which would be the overnight low, and then traded in a sideways in a 4 handle range for the rest of the night. As of 6:30am CT, the last print in the ESU is 2467.00, down -2.50 handles, with 122k contracts traded.

In Asia, 8 out of 11 markets closed higher (Shanghai +0.39%), and in Europe 11 out of 12 markets are trading lower this morning (FTSE -0.99%). This week’s economic calendar consists of 27 reports, 10 U.S. Treasury auctions and announcements, 1 Fed speaker, and the FOMC meeting. Today’s economic calendar includes the PMI Composite Flash, Existing Home Sales, a 4-Week Bill Announcement, a 3-Month Bill Auction, and a 6-Month Bill Auction.

Our View

It’s Monday morning, less than two hours before the regular session open, and the S&P’s are trading at 2467.25, just 9.00 handles from last Thursday’s all time high print. Monday’s have been strong since mid spring, and this entire year has shown that it’s hard to go wrong when buying pullbacks.

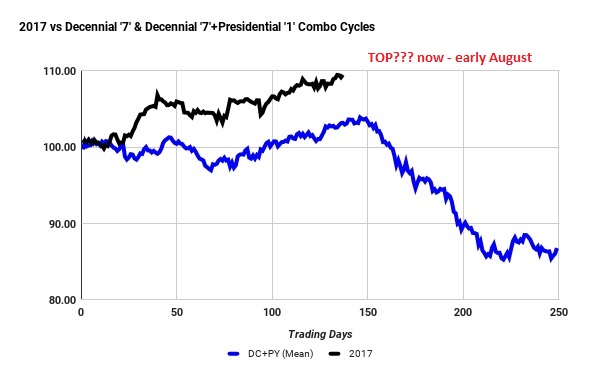

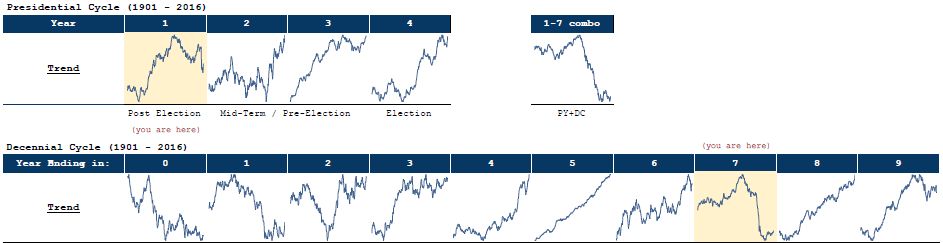

This week is the last full week of the month, and T+3 will come into play. The PitBull also mentions that there have been major turning points in the equity markets at the end of July, going into August. Given the end of the month trade, we could see some weakness this week, but we expect for the S&P 500 futures to hold above last weeks low at 2448.

Our view remains the same; look to buy the early dips, realizing that if you wait for 10 handle pullbacks, you may miss the boat. If you feel like you have to short, then do so with smaller size, and do it midday after a morning rally.