Market Brief

As expected, the Reserve Bank of New Zealand has cut the OCR by 25bps to 2.75% and left the door wide open for further easing as it claimed it will remain data dependent. The Central Bank revised downward its growth projection to around 2% from 3% in its June statement, arguing that “the economy is adjusting to the sharp decline in export prices, and the consequent fall in the exchange rate.” On a more positive note, Graeme Wheeler noted that growth was supported by “robust tourism, strong net immigration, the large pipeline of construction activity in Auckland and other regions.” As a result, the New Zealand dollar dropped 2.30% against the US dollar and is now trading around $0.6270. We were already bearish on the NZD and this dovish statement has only reinforced our view that the RBNZ wants to see a weaker kiwi. On the data front, house sales jump 41.7%y/y in August, according to REINZ, after increasing 37.8% in July.

In a surprise move, Standard & Poor’s lowered Brazil’s long-term credit rating to junk, from BBB- to BB+, while maintaining a negative outlook. The New York based credit-rating agency argued that “the political challenges Brazil faces have continued to mount, weighing on the government's ability and willingness to submit a 2016 budget to Congress consistent with the significant policy correction signaled during the first part of President Dilma Rousseff's second term.” Traders will therefore price in the new information in USD/BRL today and it won’t be pretty as the move wasn’t anticipated so soon (S&P cut the outlook to negative on July 28th). The BRL per dollar is not that far after all.

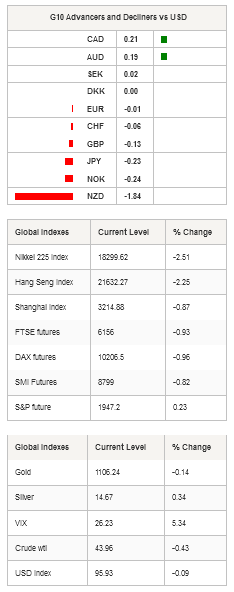

In the Asian session, stocks partially erase yesterday’s strong gains as mounting uncertainties about Fed’s next interest rate decision push traders to take their recent profits. The Shanghai Composite edges lower by 0.87%, while its tech-heavy counterpart, the Shenzhen Composite lost 0.28%. In Japan, the Nikkei 225 lost 2.51% of yesterday’s 7.71% gain while the Topix index falls 1.85%. Only the Kospi index from South Korea manages to stay in positive territory and rises 1.44%. In Australia, the S&P/ASX falls 2.42%, despite an encouraging job report. Unemployment rates fell to 6.2% in August from 6.3% in July as the economy created 17.4k jobs, beating expectations of 5k. The Australian dollar rebounded above the 0.70 threshold against the US dollar, erasing early session losses.

In Europe, equity futures follow the Asian lead with the Euro Stoxx 50 down -1.16%, DAX down -0.96%, CAC 40 down -1.10% and the SMI down -0.82%. In UK, the Footsie is down -0.93% while the sterling proves rather resilient given the disappointing data released yesterday. July’s industrial production contracted -0.4%m/m versus 0.1% median forecast, while manufacturing production printed at -0.8%m/m versus 0.2% consensus. GBP/USD is grinding slower and lost 0.40% from yesterday’s high. The closest support stands at 1.5165 (low from September 4th) while on the upside, a resistance can be found at 1.5413 (high from September 8th).

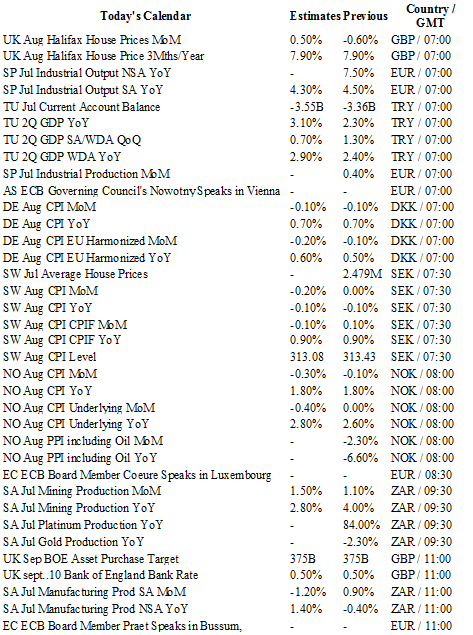

Today, traders will be watching inflation report from Sweden and Norway; an interest rate decision from the BoE in UK; manufacturing production from South Africa; COPOM minutes, IPCA inflation from Brazil; new housing prices from Canada; import price index and initial jobless claims from the US.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1332

CURRENT: 1.1204

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5626

R 1: 1.5443

CURRENT: 1.5355

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.85

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9763

S 1: 0.9513

S 2: 0.9259