Market Brief

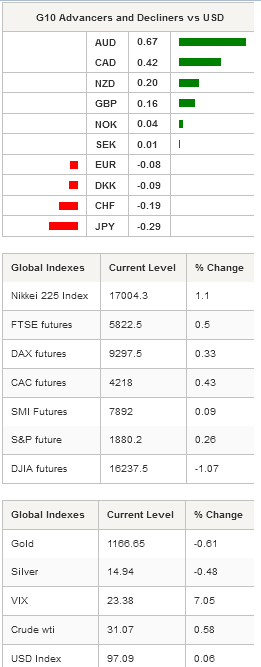

After Friday’s market turmoil, we are looking at a quiet start to the week with most Asian markets closed for holidays. Japanese equities traded higher for the second consecutive day as the JPY paired losses. The Nikkei was up 1.10%, while the broader Topix index edged up 0.84%.

US futures were trading mostly higher in Asia after the S&P 500, the Nasdaq and the Dow Jones fell 1.85%, 3.25% and 1.30% on Friday amid mixed jobs report. As usual, the report contained both good and bad signals. The US economy generated only 151k private jobs in January (versus 190k median forecast), while December’s reading was downwardly revised to 262k from 292k.

On the bright side, the unemployment rate fell below the 5% threshold to 4.9%. Finally, wage pressure continued to build up in January as earnings per hour rose 0.5% m/m (vs 2.2% consensus) or 2.5% on the year-over-year basis (versus 2.2% expected).

In our opinion, the uptick in wage growth is definitely more than welcomed by the Fed, as sustainable wage inflation was the missing ingredient that could help the central bank to reach its inflation target and therefore to resume its rate tightening process.

After Friday’s sharp gains, the greenback consolidated during the Asian session. EUR/USD traded range-bound between 1.1128 and 1.1151.

On Sunday, China released a snapshot of its foreign exchange reserves. The market was expecting a decrease of $120bn as the PBoC fought to support a weakening yuan. However, data showed that the reserves contracted by only $90bn to $3.23tn. China’s war chest has been shrinking consistently since June 2014, when it reached $3.99bn.

Chinese markets will be closed the entire week as the country celebrates the New Year.

European futures are pointing to a higher open, with the German DAX up 0.33%, the CAC 40 +0.43% and the SMI +0.09 as investors still try to determine whether Friday’s job report was a good or a bad thing.

On the FX side, EUR/CHF gave up earlier gains as it returned below the 1.11 threshold. However, the single currency found a strong support at around 1.1050.

Commodity currencies were the biggest winners of the session as crude oil prices stabilized above $30 a barrel. The Australian dollar soared 0.67% against the greenback, erasing partially last week’s sharp losses. AUS/USD is about to test the 0.7136 resistance implied by its 50dma; on the downside hourly support can be found at around 0.70 (psychological level).

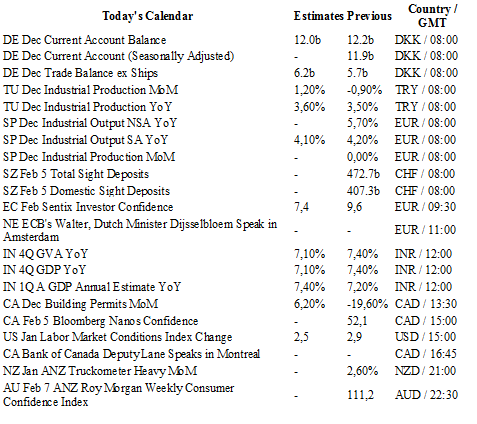

Today traders will be watching the current account balance from Denmark; industrial production from Turkey and Spain; building permits from Canada; sight deposits from Switzerland.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1158

S 1: 1.0711

S 2: 1.0524

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4541

S 1: 1.4081

S 2: 1.3657

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 117.11

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9920

S 1: 0.9786

S 2: 0.9476