by Eli Wright

Markets continue to move sideways on tepid volume and the lowest volatility levels since 2014—the VIX briefly fell below 11 yesterday, before closing at 11.25. It appears that many traders have already stepped away from their terminals for the holiday. “There is very little driving sentiment,” said Alex Furber, a sales trader at CMC Markets. “The story in the run-up to Christmas is just going to be that trading volumes are thin.”

Similar patterns were seen In Asia overnight, where the Nikkei closed 0.09% lower, at 19,427.67 while the Hang Seng dropped 0.88%, to 21,617.00. The Shanghai Composite edged up 0.03% to 3,138.51.

In Europe this morning the price action is mixed: the FTSE is down 0.07%, at 7,036.50; the DAX is flat at 11,470.50. And the Stoxx 50 is up 0.19% at 3,276.00.

On Wall Street, yesterday profit-takers were in charge albeit on light volume . The Dow retreated 0.16% to close at 19,941.96; the S&P 500 fell 0.25%, to 2,265.18; and the NASDAQ lost 0.23%, to end the day at 5,471.43.

The mood hasn’t really shifted in pre-market trading and markets appear to be primed to continue to scale back risk ahead of the bell today: the Dow and S&P are down 0.12% while the NASDAQ is 0.14% lower.

As equities fell yesterday, US bond prices were driven up with yields down across the board. The yield on the 2-year note is now at 1.196%; the 10-year yield is at 2.539; and the 30-year yield is at 3.109%.

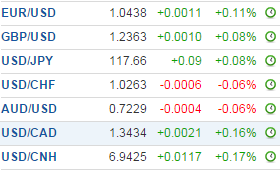

Forex

The US Dollar Index fell from its 14-year high; it’s currently at 103.01.

The euro and cable both edged slightly higher this morning, but the Japanese yen is still struggling to find any sort of foothold.

As oil prices retreated yesterday, commodity currencies, including the loonie, ruble, and Australian dollar, all lost ground.

Though the overall economic calendar is light, the U.S. will release Q3 GDP information, Initial Jobless Claims, and Core Durable Goods Orders today – taken together they could influence the short-term trajectory of the US dollar.

As we head into 2017, dollar strength will be dependent on the efficacy of any direction Trump provides regarding policies and the likelihood of potential Fed action, in particular whether the planned three hikes next year will materialize. Of concern as well will be corporate earnings, which could suffer due to disadvantageous exchange rates.

Commodities

Oil prices snapped a three-day winning streak yesterday and fell approximately 1.5% after the EIA's Crude Oil Inventories report came in contrary to forecasts which expected stockpiles to drop by 2.515 million barrel; instead supplies had grown by 2.25 million barrels. That was in stark contrast to Tuesday’s API report indicating weekly crude supplies fell by 4.15 million barrels. Crude is currently trading at $52.52 while Brent is at $54.53.

Natural gas on the other hand, has surged more than 8.5% to $3.614, as a cold snap in the United States pushed demand higher. According to the EIA, total natural gas in storage currently stands at 3.806 trillion cubic feet, 4.9% above the five-year average for this time of year, but weekly supply data, due out today, is expected to show a decline of about 201 billion cubic feet.

In precious metals, gold is down 0.13% as of this writing, to $1,131.75. It could push lower, to $1,120. However, looking further ahead, many analysts expect the Trump Rally in equity markets to break in January, which could mean a bullish return for the yellow metal could be just around the corner.

Silver has dropped 0.45%, to $15.907. Copper is lower as well, down one percent to $2.472.

Stocks

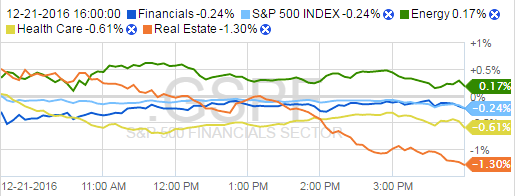

The S&P 500 lost 0.25% yesterday, but energy companies outperformed, due to the increase in natural gas prices.

Source: Fidelity.com

The Energy index gained 0.17%, boosted by Southwestern Energy (NYSE:SWN), which gained 5.8% and Cabot Oil & Gas (NYSE:COG), which rose 2.8%.

Elsewhere in the energy sector, Petrobras (NYSE:PBR), Brazil’s state-run oil company, agreed to sell $2.2 billion worth of assets to France’s Total SA (NYSE:TOT). The deal is expected to inject $1.6 billion into the Petrobras coffers in the next two months.

Yesterday's lagging sectors included Financials, Health Care, and Real Estate.

Financial sector stock losses were headlined by ICE (NYSE:ICE), and BlackRock (NYSE:BLK).

In Health Care, Vertex Pharmaceuticals (NASDAQ:VRTX) fell 5%, cancer drug maker Celgene (NASDAQ:CELG) dipped 2.3%, and Merck (NYSE:MRK) dropped 1.77%. Health insurance company Anthem (NYSE:ANTM) experienced a decline as well, down 1.81%.

Big Pharma's day in the spotlight has arrived, as yesterday, a senate investigative report came out on the predatory practices of some drug companies acquiring decades-old crucial medicines and jacking up prices. How the Trump administration handles this phenomenon remains to be seen.

The Real Estate sector saw the biggest losses, lagging the overall S&P by approximately 1.05%, even though US existing home sales rose to near 10-year highs as buyers rushed into the market in November, in order to lock in low interest rates before the Fed rate hike when borrowing costs would predictably rise.

Among the losing REITs: Washington Real Estate Investment (NYSE:WRE) dropped 2%; Whitestone REIT (NYSE:WSR) fell 1.78%; PS Business Parks Inc (NYSE:PSB) declined 1.73%, and Liberty Property Trust (NYSE:LPT) fell 1.16%.