by Pinchas Cohen

Key Events

- Equities rise, as investors overcome tech sell-off scare

- Dollar, yields and gold fall on FOMC pessimism

- The pound recovers after post-UK election declines

- Oil falls on API inventories release

Global Affairs

Yesterday, the Dow Jones Industrial Average, the S&P 500 and the Russell 2000—all the major US indices except the NASDAQ—closed at record highs, just two sessions after Friday's market-crash scare. This after US Attorney General Jeff Sessions testified to Congress earlier in the day that he never spoke with Russian officials, or had “any type of interference with the 2016 presidential campaign."

Today, most Asian stocks rose while European stocks opened higher.

The dollar fell for a third straight day yesterday, as Treasuries and gold rose. Ahead of today's Fed policy meeting, markets have already priced in a quarter-percent rate hike. However there's pessimism about future hikes or a balance sheet tapering. Markets don't expect the next full hike till July 2018, because of expectations of future inflation declines.

The pound extended its yesterday's gain, its first since last week's UK elections.

Up Ahead

- Central bank week: Investors are pessimistic on The Fed's plans for guidance; The BoJ is pressured to mention its stimulus policy; The current situation in the UK, Brexit and post-election turmoil means the country is too unstable for a rate change; Switzerland, unlike the Fed, doesn’t care about guidance and instead is more concerned over their over-valued currency. They are still expected to keep their policy unchanged.

- China's retail sales climbed 10.7 percent YoY in May, meeting expectations; industrial production rose 6.5 percent, beating expectations of 6.4 percent. Still, their equities fell in a mostly rising Asia-Pacific equity market, following a crackdown on the country's insurance industry.

- Japanese industrial production climbed 5.7 percent in April YoY and 4 percent MoM, per estimates.

Market Moves

Stocks

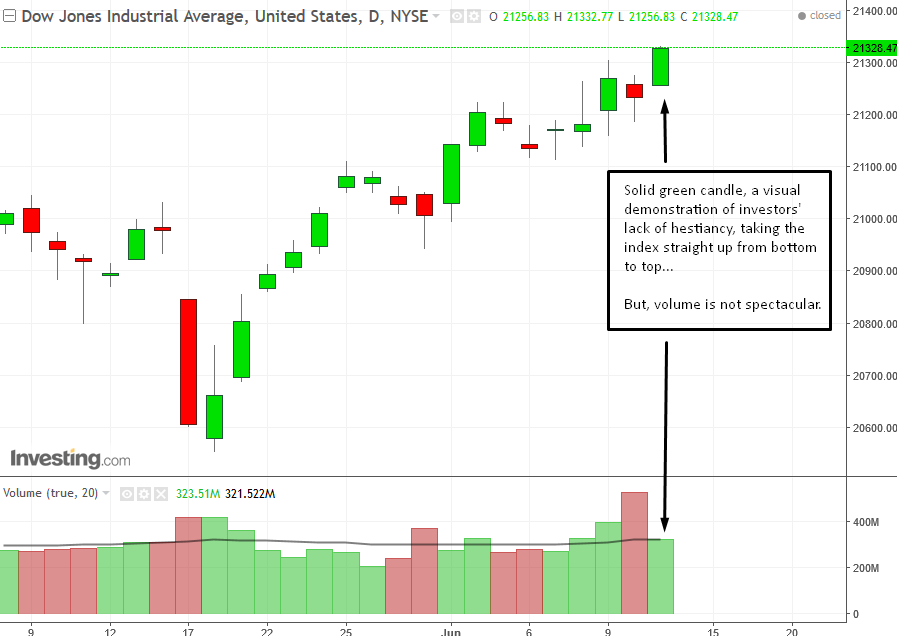

- The Dow Jones Industrial Average gained 0.33%, on a record close of 21328.47. It formed a solid green candle, visually displaying investors' lack of hesitation.

- Yesterday's biggest winner was the NASDAQ 100, which gained 0.8 percent, closing at 5751.82. Ironically it was boosted by its tech sector, climbing 0.85 percent to 3966.33.

- S&P 500 futures traded lower after equity index counterparts achieved record highs, as the tech sector rebounded. Right now SPX Futures are down 0.1%, after rising 0.5 percent to 21328.47 on a record close yesterday.

- The Stoxx Europe 600 Index extended yesterday’s 0.6 percent gain, rising today by 0.3 percent, while the Euro Stoxx 50 also climbed for a second day, by 0.69%.

- The FTSE 100 is up 0.26%. Characteristically UK equity investors disregard political risk at home.

- The Nikkei rose 0.1%.

Currencies

- The Dollar Index declined 0.1 percent to 97.00, rising from its low of 96.86. This could be a sign that of late, pessimism may be dissipating.

- The pound rose 0.4% to 1.2760, down after touching just about the benchmark 1.3 price level, with a high of 1.2797, the result of yesterday's UK's inflation release showing CPI had resumed its uptrend.

- The euro is flat at 1.1210

- The Canadian dollar rose for a fifth day. It's now up 23 percent to 1.3212

- The Aussie rose 0.49 percent to 0.7575

Bonds

- The yield on 10-year Treasuries was down one basis point at 2.20 percent.

Commodities

- West Texas crude futures fell 0.7 percent to $46.14 a barrel. U.S. inventories climbed by 2.75 million barrels last week, according to yesterday's API release. Traders await today's official DOE release.

- Gold rose 0.1 percent to $1,268.02 an ounce.

- Iron ore futures in Dalian—the major city and seaport in the south of Liaoning Province, China—reversed earlier losses to climb 2.2 percent to 427.5 yuan per ton following the release of stable Chinese economic data.