by Pinchas Cohen

Key Events

- US markets have best gain in 2 months as up-moves go global—on central banks

- ECB drives euro to one-year high; BoE helps pound resume rally

- Oil set for sixth daily gain

Global Affairs

Global stocks rose yesterday after US equities registered their biggest gain in the past two months, boosted by an outlook of higher interest rates—which investors interpret as a sign of a growing economy.

Oil is on course for its sixth straight daily gain, after falling into bear market range.

As forecast in yesterday’s Opening Bell, banks led gains in Asia and Europe in a reflationary rotation, after the S&P 500 rebounded from its biggest sell-off in six weeks.

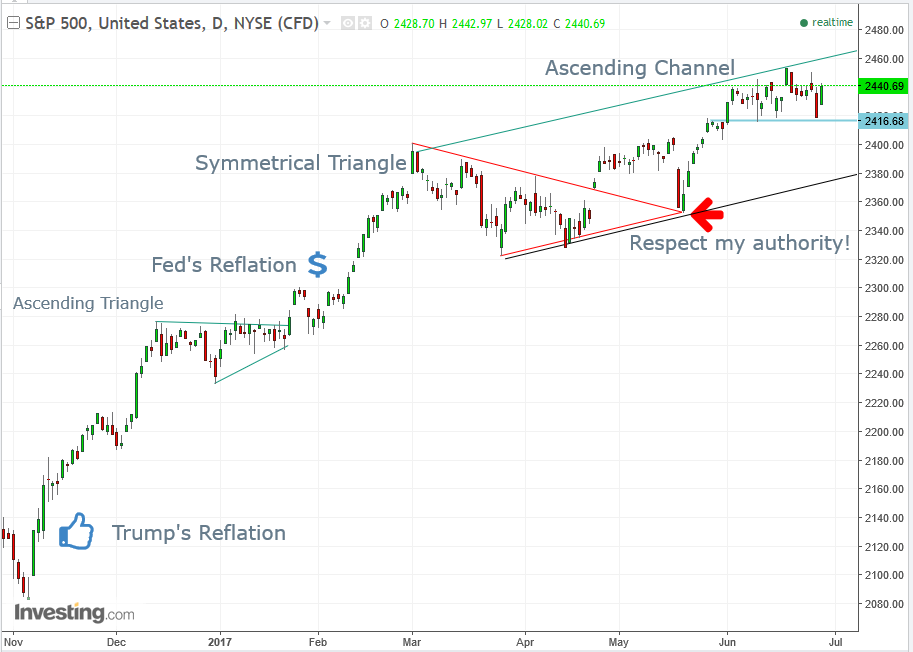

The index is ranging at the top half of an ascending channel. Should the consolidation break down, it would form a small Head & Shoulders (H&S), with a target at the bottom of the rising channel, the 2400 area. If the breakout would be to the upside, it will aim toward 2500.

US banks rallied this week after Fed Chief Janet Yellen stressed that reflation is on track.

The banking sector continued to climb after the close of regular trading Wednesday, following the first time all US banks passed an economic stress test since the 2008 financial crisis. Their plans for massive capital returns were approved as well. Clearly, stock investors are bullish, even after Yellen signaled this week that asset valuations were rich.

Technology shares—the best-performing sector for global equities this year—fell for a second day, while miners jumped along with commodity prices.

The dollar is at its lowest level since May after extending its losses to 1.7-percent, in what may be its third consecutive decline—reaching the USD's lowest level since early October, before the reflation trade was even a gleam in Donald Trump's eye.

The pound extended its rally, after the BoE’s Governor Mark Carney said a hike may be in order

Global stocks are on track for their best January-to-June performance since 1989, with an 11 percent gain, in addition to sitting at all-time highs.

The market is rallying, while President Donald Trump and the GOP are mired in multiple political quagmires—party infighting about the healthcare bill, obstruction of justice suspicions, no movement on tax reform—suggesting this recent uptick is not because of Trump but in spite of him. Investors have redirected their faith toward prosperous earnings, and toward an optimistic unified show of force by central banks.

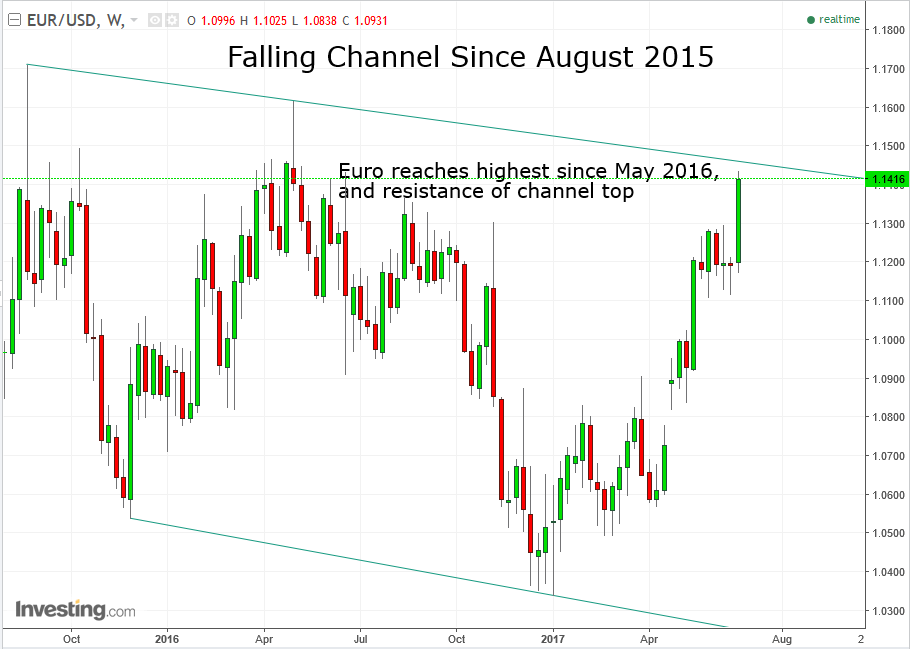

The euro was up 1.4 percent on Tuesday, its highest level in a year, only to soon be sold-off on mixed ECB signals. Between EC President Mario Draghi’s hints of an autumn tightening and his Vice President, Vitor Constancio’s attempt to temper the market reaction by stating the remarks were “totally” in line with existing policies and investor response was hard to understand. Still, Constancio’s statements only hastened the euro down in a correction, but the breakout support held and it continued its advance, per our post yesterday.

Up Ahead

- China’s PMI might have declined in June after unexpectedly remaining unchanged in May, reflecting government efforts to cut overcapacity and leverage. That reading is due Friday.

- Japan’s calendar is even heavier with economic data on Friday, including reports due on inflation, factory output, unemployment, household consumption and housing starts.

Market Moves

Currencies

- China’s yuan strengthened for a third day, with the offshore currency advancing 0.3 percent as President Xi Jinping kicks off a landmark visit to Hong Kong.

- The Dollar Index declined 0.25% to 95.77, dropping for a third day to its lowest level since October.

- The euro increased 0.4 percent to $1.1424, its highest level since last year’s Brexit vote.

- The pound climbed 0.5 percent to $1.2984, heading for a seventh straight day of gains, its longest winning streak since April 2015.

- The Canadian dollar rose 0.1 percent after jumping 1.2 percent on Wednesday as BoC Governor Stephen Poloz reiterated he’s considering tighter monetary policies.

Stocks

-

- The Stoxx Europe 600 opened 0.25% higher, climbed another 0.2%, only to end up slipping 0.1 percent.

- The Hang Seng Index climbed 1.1 percent.

- China's Shanghai Composite added 0.5 percent.

- Singapore’s Straits Times Index rallied 1.4 percent, its most since November.

- Australia’s S&P/ASX 200 Index rose 1.1 percent, with bank and basic materials shares having the biggest impact.

- South Korea’s KOSPI advanced 0.6 percent to a record high.

- S&P 500 Futures added 0.1 percent. The underlying gauge rose 0.9 percent on Wednesday, bouncing back from a loss of 0.8 percent. It’s on pace for a seventh straight quarterly advance.

- The NASDAQ Composite jumped 1.4 percent on Wednesday.

Commodities

- WTI futures advanced 0.8 percent to $45.12 a barrel. Prices gained as government data showed a drop in U.S. gasoline supplies which have remained stubbornly high at the start of the summer driving season.

- Gold fell 0.3 percent to $1,245.82 an ounce.

- Copper futures jumped 0.8 percent, advancing for a seventh day.

Bonds

- The yield on 10-year Treasuries rose two basis points to 2.25 percent, after gaining two basis points on Wednesday, and jumping seven basis points in the previous session.

- The yield on UK gilts advanced four basis points to 1.20 percent. French 10-year yields also added four basis points, as did those on 10-year German bunds.