by Pinchas Cohen

Key Events

- Euro at one-year high after Draghi turnaround

- Tech sell-off resumes, with global traction

Global Affairs

The euro reached a one-year high, and government bonds were sold off, on anticipation of higher interest rates. The second leg of the tech sector sell-off has now gained traction globally, spreading from the US to Asia, and now Europe.

The euro bolstered its position as one of the best performing currencies this quarter, after ECB President Mario Draghi's remarks proved he has influence not only in Europe, but the US as well.

Draghi has consistently taken a dovish stance on the European economic outlook, including in front of European Parliament on May 29 when he said the ECB is convinced “…an extraordinary amount of monetary policy support…is still necessary.” Yesterday however, Draghi reversed course, delivering a surprising upbeat message, even hinting at starting to unwind the ECB's $4.69 trillion balance sheet—larger than the Fed’s $4.4 trillion—as early as Q3 2017. This sudden and sharp reversal sent the Dollar Index down a full percent, while the euro exploded higher, moving up 1.4 percent at the greenback's expense.

In stark contrast, Fed Chairwoman Janet Yellen had no effect on the dollar, signaling yesterday that the US economy can withstand higher interest rates although she did state that asset valuations were rich. However, after it became clear Yellen would not be changing the Fed's outlook, Treasury yields rose to their highest levels since the end of the Trump reflation in January.

To be fair, Draghi has two advantages over Yellen: The European economy is growing while the US is in a slump; additionally, considerable Fedspeak on tightening economic policies has already been priced in, though it's Draghi’s first time mentioning the subject.

The yuan—both domestic and off shore—extended its surge for a second-day on speculation of intervention by the PBoC in local markets.

Oil has risen four percent in four days—its longest run of gains in a month—but fell 1.3 percent when API's nationwide inventory data showed a boost of 851,000 barrels last week, signifying a glut in crude.

Central banks remain the key drivers for markets this week. Draghi said he sees room for paring back stimulus, while Yellen concurred with Fed deputies by saying some asset valuations are frothy. Those comments come ahead of additional appearances by policy makers, at a conference in Portugal that concludes today.

Upcoming Events

- The Federal Reserve is set to announce the results of the second part of its annual bank stress test, which will determine whether lenders can increase dividends and share repurchases.

- China’s PMI release this Friday might show a decline in June after unexpectedly remaining unchanged in May, reflecting government efforts to cut overcapacity and leverage.

- Also slated for release this week: Japanese inflation, factory output, unemployment, household consumption and housing starts.

Market Moves

Currencies

- The euro rose 0.2 percent to $1.1359 as of 8:19 a.m. in London, after briefly touching $1.1379, its highest level since June 2016. The single currency surged 1.4 percent on Tuesday.

- The Dollar Index declined 0.25 percent after falling 1-percent in the previous session.

- The yen was flat at 112.35 per dollar after weakening 1-percent over the past two sessions.

- The South Korean won dropped 0.6 percent.

- The offshore yuan climbed 0.1 percent after surging 0.6 percent on Tuesday. The onshore currency rose 0.2 percent.

- The Canadian dollar jumped 0.3 percent, adding to a 0.4 percent gain on Tuesday. Bank of Canada Governor Stephen Poloz said in a CNBC interview that interest rate cuts “have done their job” and that levels are now “extraordinarily low.”

Stocks

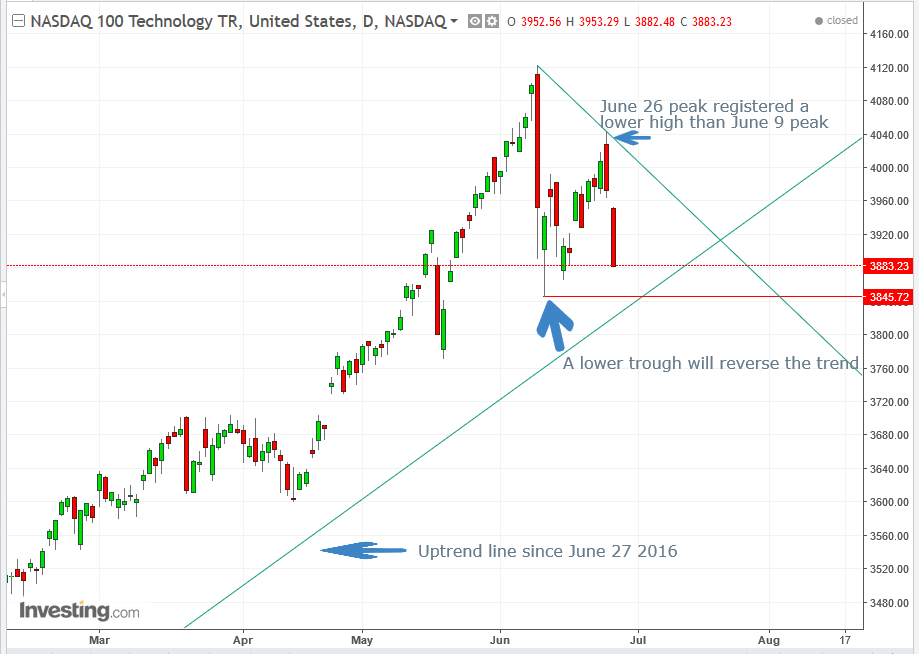

The second leg of the tech sell-off which began Monday extended into its third day in Asia. The first leg started on June 9.

As is evident from the NASDAQ 100 chart above, US (and European counterpart) tech stocks hit a lower peak before the current sell-off. If this is followed by a lower trough, it will signal a reversal.

Financial shares are rallying on the prospects of a reflation in the near-term, while moving sideways in the mid-term, outperforming tech.

South Korean Samsung Electronics (KS:005930) and German software company SAP (DE:SAPG) resumed their US sell-off in Asia and Europe.

- The Stoxx Europe 600 fell 0.7 percent, with technology shares tumbling 1.2 percent. SAP retreated 1.7 percent.

- S&P 500 Futures dropped 0.1 percent. The underlying gauge lost 0.8 percent Tuesday, its most since May 17, as technology and health-care shares declined.

- Australia’s S&P/ASX 200 index rose 0.7 percent as basic materials shares rallied.

- Japan’s TOPIX slipped 0.3 percent, with a rally in banks overshadowed by declines in technology companies.

- South Korea’s KOSPI lost 0.4 percent, with Samsung down 1.2 percent. The TAIEX tumbled 1.2 percent as Taiwan Semiconductor (TWO:5425) dropped 1.4 percent.

- The Hang Seng retreated 0.6 percent, with Tencent Holdings (HK:0700) off 1.7 percent. Investors watched the Hong Kong market closely after a string of small-cap stocks suddenly plunged Tuesday, with traders pointing to links between some of the companies and Lerado Financial Group Co., a brokerage that’s under regulatory investigation.

- The Shanghai Composite lost 0.6 percent.

Bonds

- The yield on 10-year Treasuries added three basis points to 2.24 percent, after jumping seven basis points Tuesday.

- The yield on German bunds climbed three basis points, after rising 13 basis points in the previous session for their biggest surge since December 2015. French yields rose three basis points.

- Australian 10-year government bond yields rose 10 basis points to 2.46 percent.

Commodities

- WTI futures fell 0.9 percent to $43.85 after climbing 4 percent in the previous four sessions. Oil tumbled into a bear market last week on concerns that expanding global supply will counter output cuts from OPEC and its partners, including Russia.

- Gold rose 0.3 percent to $1,250.33 an ounce, climbing for a second day.