by Pinchas Cohen

Key Events

On Friday, all four main US indices—the S&P 500, Dow, NASDAQ and Russell 2000—rallied after opening higher, forming an upside gap.

The S&P 500 and the Dow Jones Industrial Average each also had record closes. For the S&P 500 it was the 58th record of the year.

Headlines going into, and on Friday likely helped keep market momentum buoyant:

- Earlier in the week the Senate passed its version of a tax reform bill, allowing both houses of Congress to proceed forward toward working out a compromise bill to submit to the President.

- On Friday the US Bureau of Labor Statistics reported better-than-expected Nonfarm Payrolls results; 228,000 new jobs created in November, beating the 200,000 forecast; more important, wage growth, which helps spur inflation, accelerated to 2.5 percent a year, up from 2.4 the month previous.

- The prospect of a looming government shutdown was averted...until December 22.

Global Financial Affairs

To start the trading week, Asian stocks rallied this morning, amid low volumes, providing bulls with little resistance on the combined optimism that lingered from the US close before the weekend—fiscal policy, continued economic growth and the deferral of a US government shutdown.

The Nikkei 225 returned to a 26-year closing high, on volume more than 25-percent lower than the average of the last 30 days. Volume on South Korea’s KOSPI was similar. Both mainland and Hong Kong Chinese shares extended Friday’s bounce after their worst decline since April-May.

European shares followed Asia higher, as investors continued moving into financial shares at the expense of telecom and travel equities which were sold off.

This week, investor focus will shift to central banks with fiscal policy announcements from no less than 13 banks on tap in the week ahead. The Fed is widely expected to increase rates on its Wednesday policy meeting; though no interest rate announcements are expected from the European Central Bank on Thursday, investors will be paying close attention to plans the ECB has for scaling back the balance sheet. That same day the Bank of England and the Swiss National Bank also hold policy meetings.

Investors must realize that the better the economy—under normal circumstances a boon to stock prices—the more bearish it is for historically high equity prices. With the world economy heading into its strongest period since 2011, Wall Street economists are warning investors to brace for the biggest tightening of monetary policy in more than a decade. As such, after a five-day-straight US dollar rally coupled with current high equity valuations, investors might lock in profits ahead of the Fed meeting Wednesday.

The pound resumed a decline on a Brexit breakthrough regarding the Irish border issue falling apart.

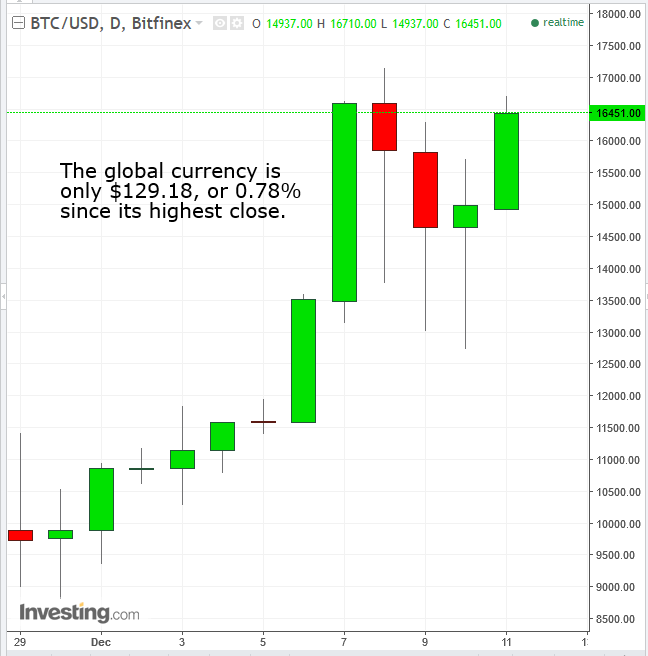

Trading in Bitcoin Futures started on the CBOE Global Markets in Chicago last night, the first major U.S. exchange to offer a product pegged to the volatile cryptocurrency. During the first hours of trade two halts were triggered, aimed at cooling the volatility.

Bitcoin has soared more than 1,500 percent this year and at one point during initial futures trading jumped as much as 25 percent.

The kiwi dollar climbed as expectations of a dovish approach to monetary policy were scaled back with the appointment of Adrian Orr as the Reserve Bank of New Zealand’s new governor. Technically, the pair is bearing down on the neckline of an H&S top, after both the MACD and RSI already provided selling signals. The RSI also formed a negative divergence—another sell signal—after it broke down, in contrast to the rising price.

The price of oil fell to near $57 a barrel as US drillers' rig count increased to a three-month high, confirming our technical view from early November. The price is struggling to remain above its uptrend line since October 9, while it potentially forms a H&S top.

Up Ahead

- Fed policy makers on Wednesday are projected to raise the target range for their benchmark interest rate against a backdrop of continuing robust U.S. economic conditions, a vibrant labor market and forecasts for inflation to pick up.

- The European Central Bank, the Bank of England and the Swiss National Bank set monetary policy at their respective meetings on Thursday.

- Among top U.S. economic reports are consumer inflation on Wednesday and retail sales on Thursday.

- European lawmakers continue to debate Brexit and weigh moves on the next step, while North America Free Trade Agreement negotiators meet again.

Market Moves

Stocks

- The Stoxx Europe 600 Index gained 0.2 percent as of 8:16 a.m. London time, the highest in more than a month.

- The U.K.’s FTSE 100 Index climbed 0.5 percent to the highest in almost two weeks.

- Germany’s DAX Index advanced 0.2 percent to the highest in more than a month.

- Japan’s Nikkei 225 Stock Average jumped 0.6 percent to the highest in about 26 years.

- The MSCI Asia Pacific Index jumped 0.6 percent to the highest in more than a week.

- The MSCI Emerging Markets Index increased 0.6 percent.

- S&P 500 Futures increased 0.2 percent to 2,658.25, the highest on record.

Currencies

- The Dollar Index fell 0.14 percent. It ended last week up 1.1 percent.

- The yen lost less than 0.1 percent to 113.57 per dollar, near the lowest in more than three weeks.

- The euro traded at $1.1783, up 0.1 percent.

- The kiwi jumped 0.8 percent to 69.04 U.S. cents.

- The Philippine peso climbed 0.3 percent to 50.33 per dollar.

- Bitcoin rose 6.2 percent to $16,611, after earlier falling as much as 7.1 percent.

Bonds

- The yield on 10-year Treasuries was unchanged at 2.38 percent, the highest in more than a week.

- Germany’s 10-year yield fell one basis point to 0.30 percent.

- Britain’s 10-year yield decreased two basis points to 1.257 percent.

- Japan’s 10-year yield declined less than one basis point to 0.05 percent.

Commodities